A short week for the markets has opened with some modest selling, hardest felt in the Russell 2000 (IWM), but common across all lead indexes.

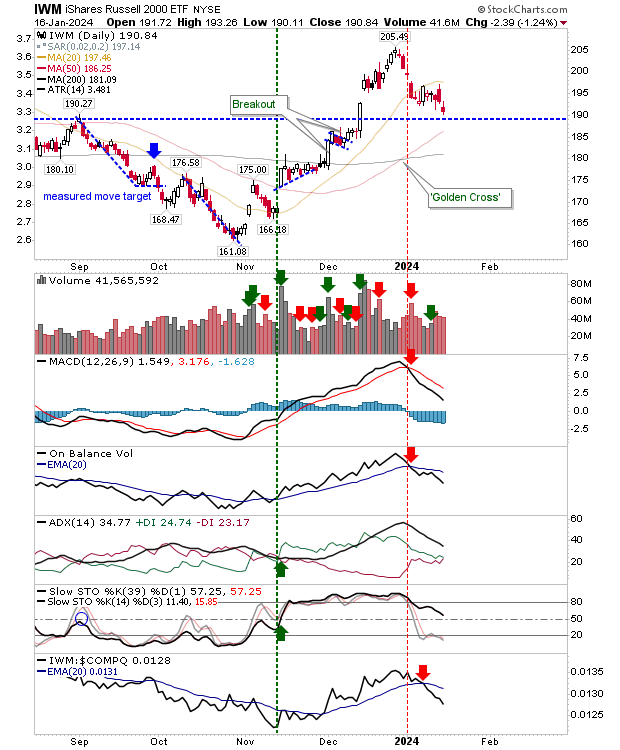

The Russell 2000 ($IWM) gapped down but hasn't yet tagged support marked by the September swing high.

There is the current 'sell' trigger in the MACD and On-Balance-Volume offset by the bullish momentum for intermediate-term stochastics.

Given yesterday's action I would be looking for a likely intraday move down to the 50-day MA, although it may be late this week or early next week before this happens.

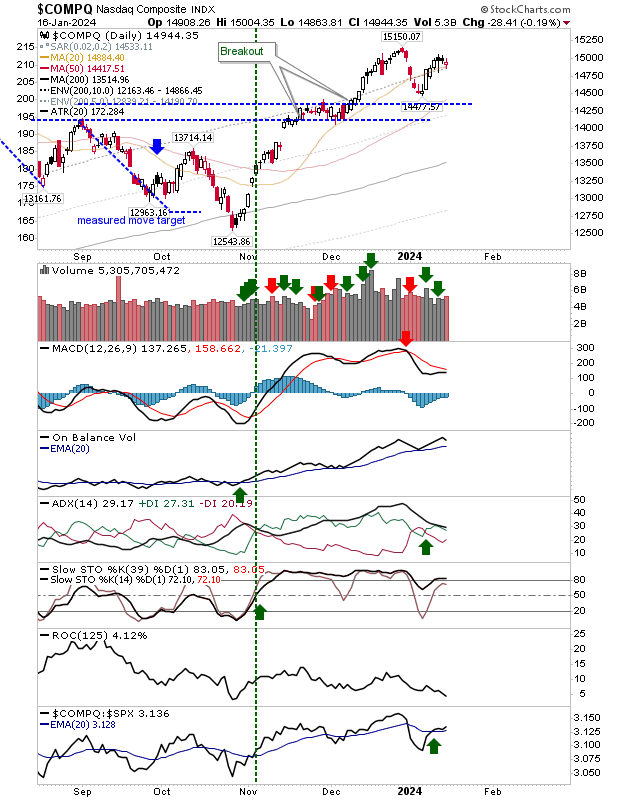

The Nasdaq stayed close to last week's highs, but the "spinning top" followed on from the doji point to continued indecision and this still could go either way.

It appears to be shaping a lower high, and the likelihood for a lower low looks more probable. Adding to the bearish outlook, yesterday's volume ranked as distribution.

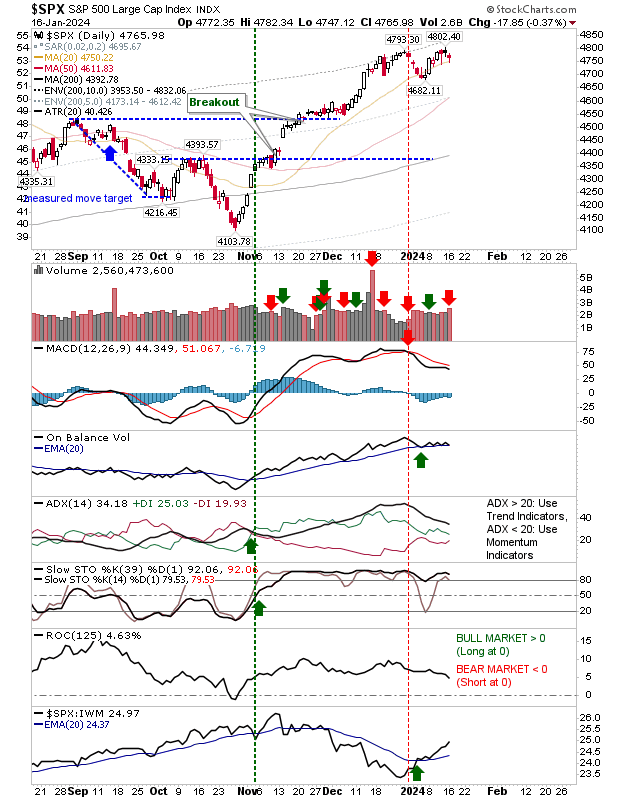

The S&P 500 came back to tag its 20-day MA but is best positioned to push to new highs.

Unlike, the Nasdaq, it hasn't formed a lower high sequence and it's the index outperforming peer indexes. So if there is an index that's going to attract buyers it's going to be this one.

If indexes are to finish strong on weekly time frames, then I would want to see intraweek lows formed today (if not already in place).

If we see a close below 20-day MAs in the Nasdaq and S&P 500 today, then it may be too late to save the bullish weekly outlook.