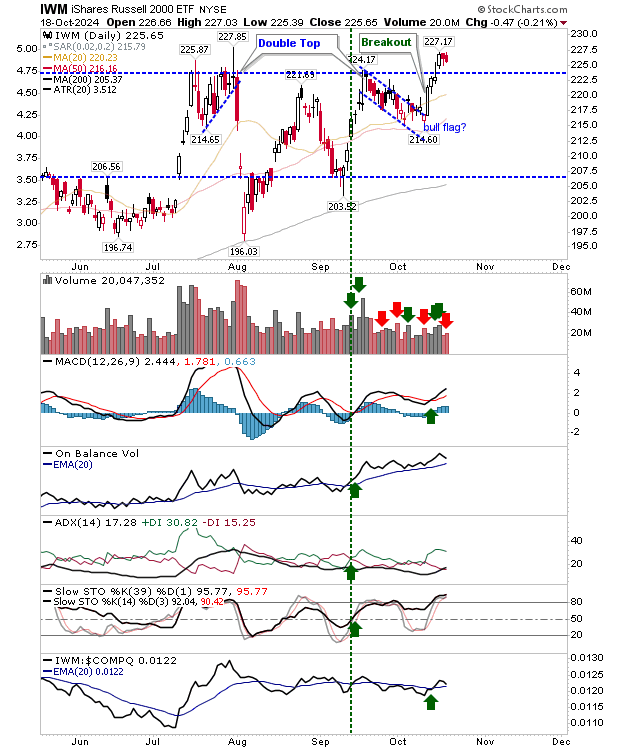

Wednesday delivered the long awaited breakout in the Russell 2000 (IWM), and while we didn't get the follow through higher, we did see buyers maintain breakout support.

Friday's selling volume ranked as distribution, but it was not particularly heavy volume overall. Technicals didn't lose much ground over the two days of selling and remained net bullish.

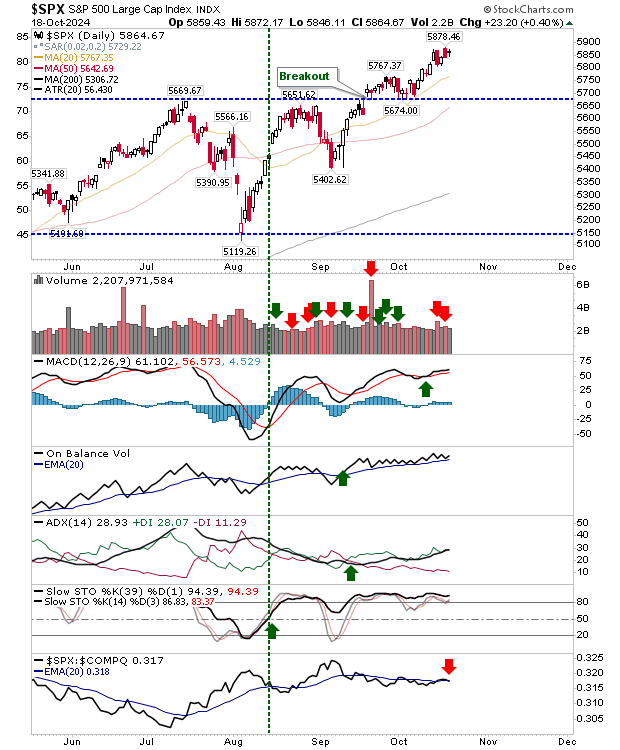

The S&P 500 is looking a little vulnerable with Friday's doji forming a bearish 'harami cross' against Thursday's broad candle - a reliable reversal candlestick pattern.

Adding to this is an overbought market condition alongside a new relative reversal against the Nasdaq. Look to premarket for leads; a gap down at the open would effectively set up a short play.

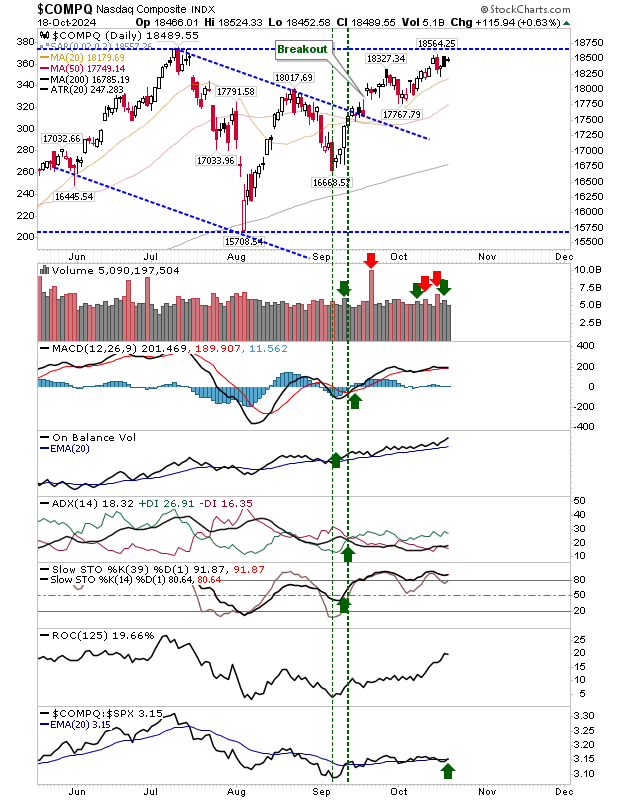

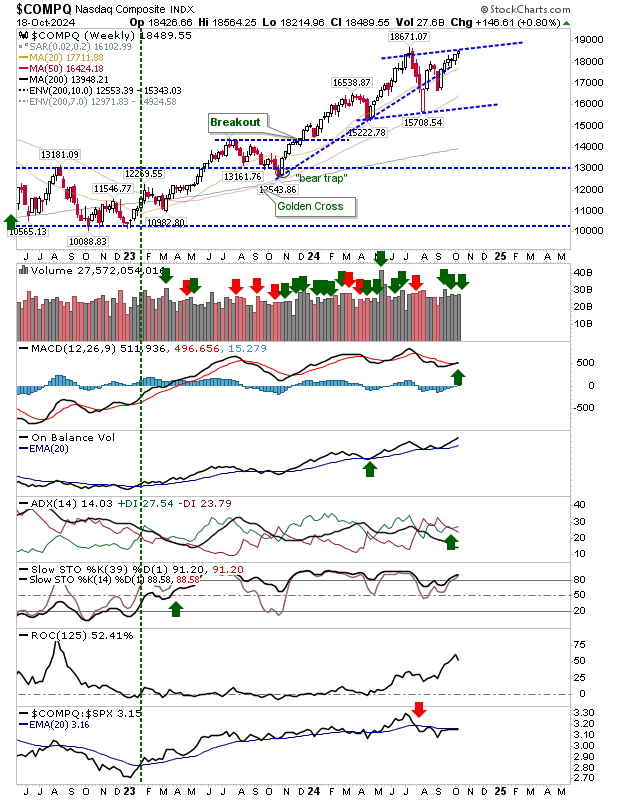

The Nasdaq also closed with a bearish harami cross just below resistance. Like the S&P, it will be vulnerable to a gap down. Needless to say, look to the premarket for guidance.

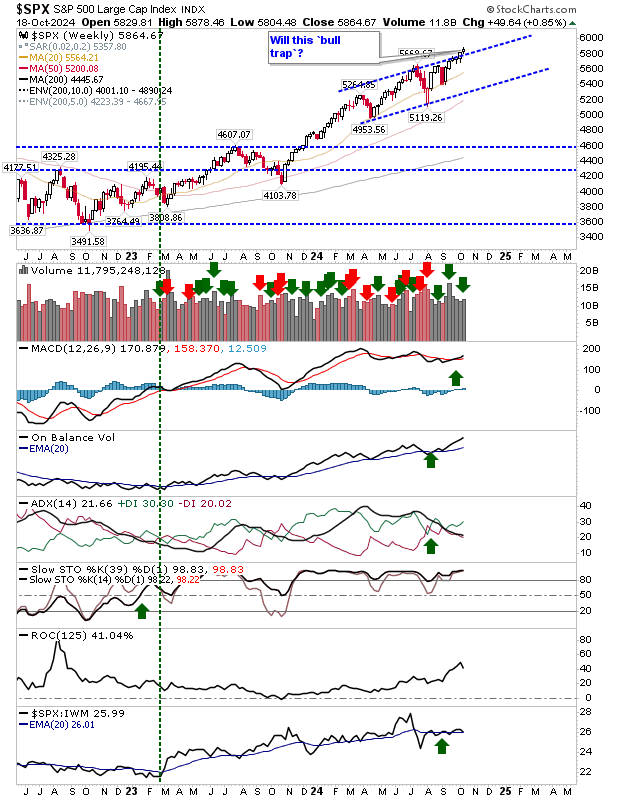

Another chart to watch is the weekly S&P. We won't have confirmation until Friday's close, but if we start the week poorly there is a risk for a "bull trap" that could deliver weeks of underperformance.

While the weekly Nasdaq pegged channel resistance, and is at a position where sellers naturally find a point of attack.

So, I would be expecting a gap down in the Nasdaq and S&P, but if this fails to materialize, then the conditions are there for a big gain that delivers a breakout in the Nasdaq, a confirmation of the Russell 2000 ($IWM) breakout, and a continuation of the S&P rally.