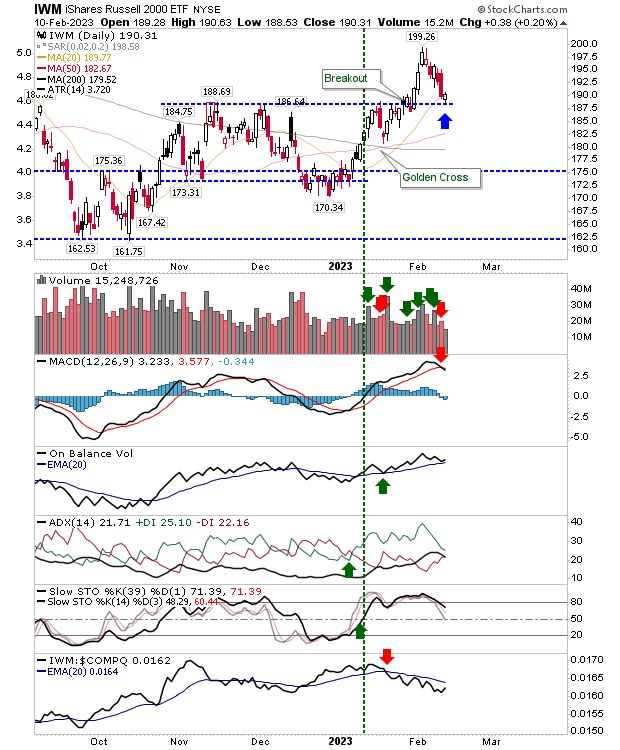

A good end-of-week finish for markets offered positive tests of support to head into next week with. The Russell 2000 (IWM) tagged breakout support is defined by November's swing high and 20-day MA. Volume steadily declined off the reversal from the $199 high - another positive - although the MCD trigger 'sell' was a little disappointing.

The S&P 500 had a smaller distance to travel to test support but managed to repeat the action, including a positive test of its 20-day MA. Also, like the Russell 2000, it finished the week with a MACD trigger 'sell.'

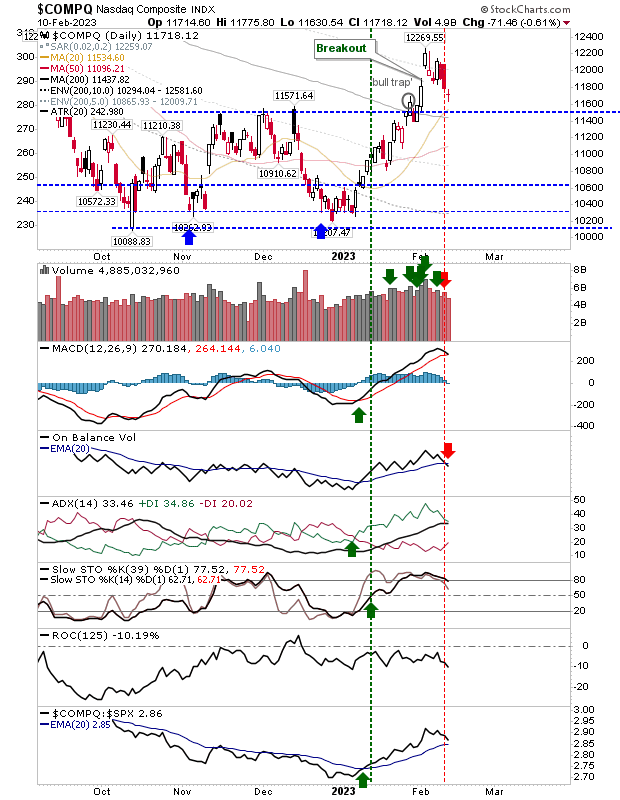

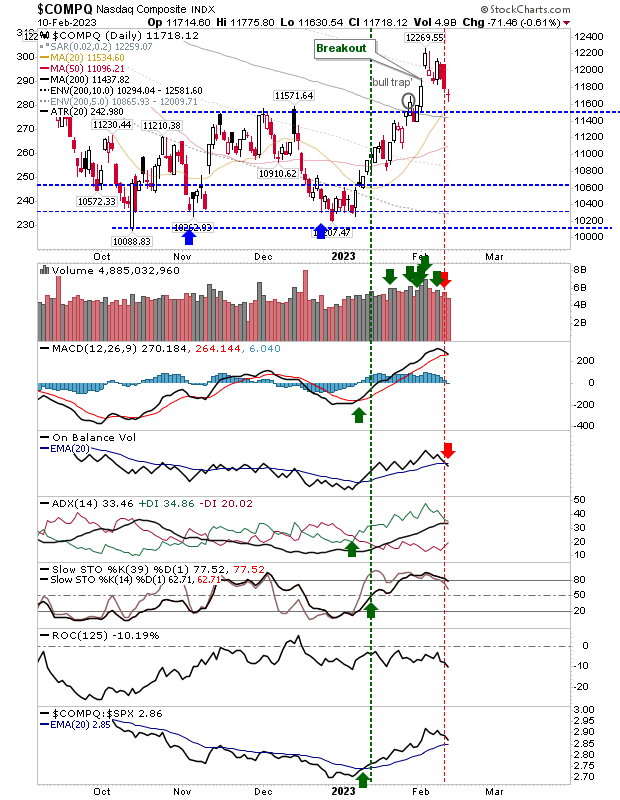

The Nasdaq hasn't retreated as far as the Russell 2000 or S&P 500 and has yet to engage in a test of support. Because of this, it hasn't yet turned in a 'sell' trigger for its MACD but has for On-Balance-Volume. Friday's finish for the index was a neutral Doji, a potential turning point to end the 6-day decline; if not the Doji, then moving averages are there to lend support.

All Indexes are working towards right-hand bases, with current action early steps in the bullish reversal. December rallies haven't consolidated as they continue to push higher, so until this happens, we won't know we have a true bottom in place. However, I believe that the June low was the low of the decline, with a successful retest in October leading into the current rally.