DXY is now an unstoppable rocket as EUR is blasted to bits:

The Australian dollar was slain:

Commodities will struggle with the return of the King:

EM stocks held on but the King is not kind to them either:

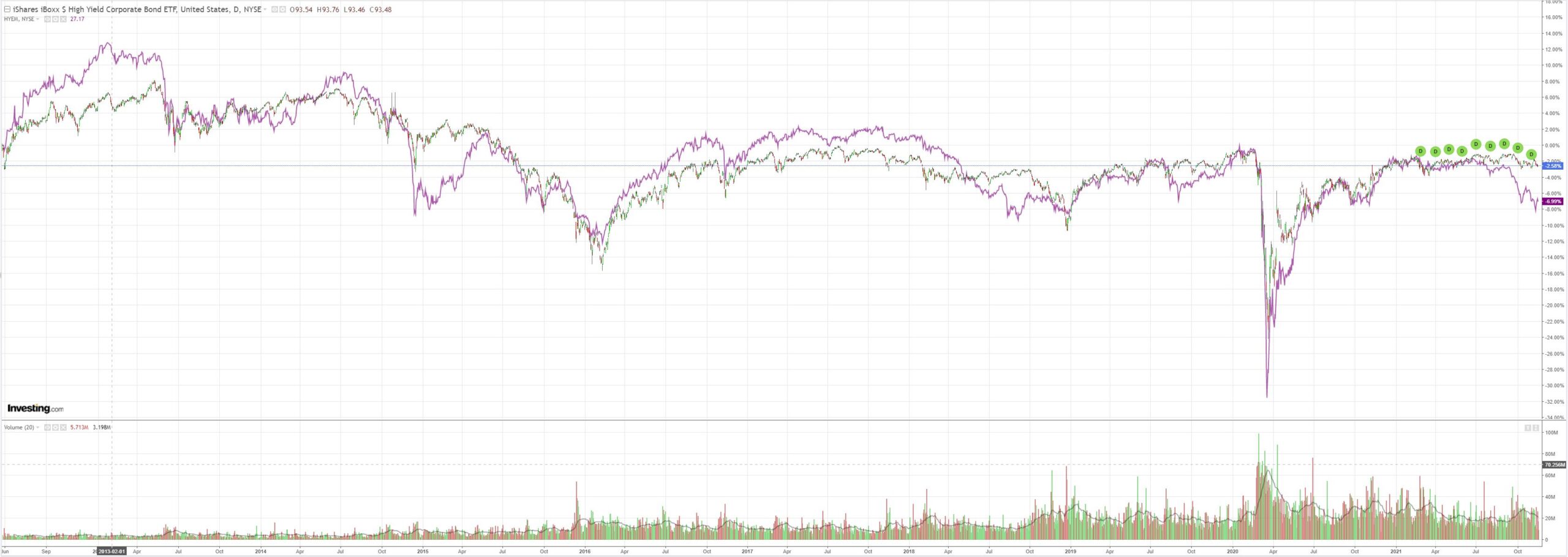

Nor EM junk:

The US curve steepened on red hot data:

Stocks ignored it:

Westpac has the data:

Event Wrap

US retail sales in October rose 1.7%, beating expectations (est. 1.4%, prior 0.8%), with the largest monthly gain since March. At play was a combination of rising prices and increased demand, and possibly a shift in holiday sales.

Industrial production in October rose 1.6%, beating expectations (est. 0.9%, prior -1.3%), with the largest monthly gain since March. All the major components beat estimates, and the rise takes production back above pre-pandemic levels.

The NAHB homebuilder confidence survey rose from 80 to 83 (vs. est. 80) – the highest since 1984. Builder sentiment continues to be underpinned by strong demand amid still low mortgage rates and ongoing pandemic shifts, that are dominating the negative effects from rising building costs, labour shortages, and supply chain disruptions.

Event Outlook

Aust: The Westpac-MI Leading Index likely remained weak in October as the six-month annualised measure continued to cycle through delta’s effects. The Q3 wage price index is anticipated to report gradual gains for wages despite a robust labour market and strong recovery.

Eur/UK: The final release of the Euro Area’s CPI for October will highlight the significant contribution from energy prices. Meanwhile, strength in recovery and supply chain constraints are expected to be the key drivers for the UK’s October CPI (market f/c: 0.8%).

US: In October, housing starts and building permits are expected to reverse some of September’s losses given robust underlying demand (market f/c: 1.3% and 2.8% respectively). The FOMC’s Bowman, Mester, Waller, Daly, Evans and Bostic are all due to speak at different events.

Red hot US data is now reflected in a booming Q4 Fed GDPNow at 9%!

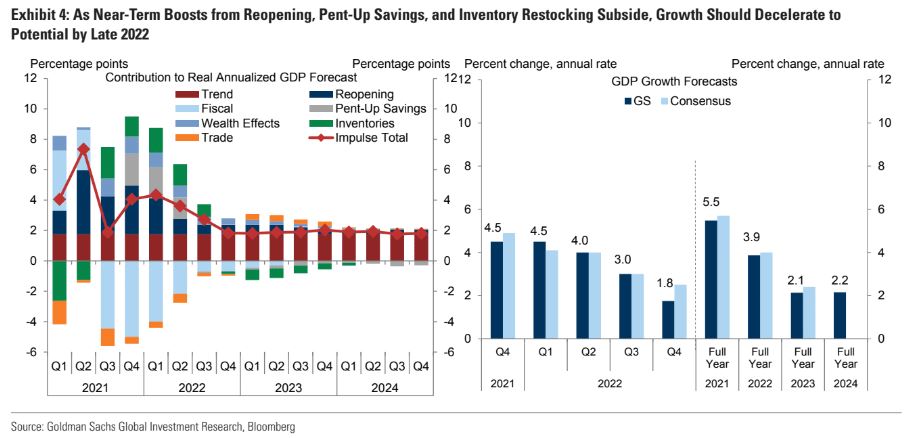

That will come down a lot but, even so, it would be curmudgeonly to deny that US consumption is doing anything other than booming. I maintain the slowdown is ahead for goods but so far the stimulus tail is wagging despite the fiscal thumping. Goldman sees it taking another six months to calm the runaway US consumer:

Then beyond 2022 comes the Biden stimulus advantage. Meaning this:

The U.S. Federal Reserve should “tack in a more hawkish direction” over its next couple of meetings to prepare in case inflation does not begin to ease, St. Louis Federal Reserve bank president James Bullard said on Tuesday.

“If inflation happens to go away we are in great shape for that. If inflation doesn’t go away as quickly as many are currently anticipating it is going to be up to the (Federal Open Market Committee) to keep inflation under control,” Bullard said on Bloomberg Television.

US exceptionalism is back and so is King dollar delivering a steamroller to crush EMs, commodity prices and the AUD across 2022 and beyond.