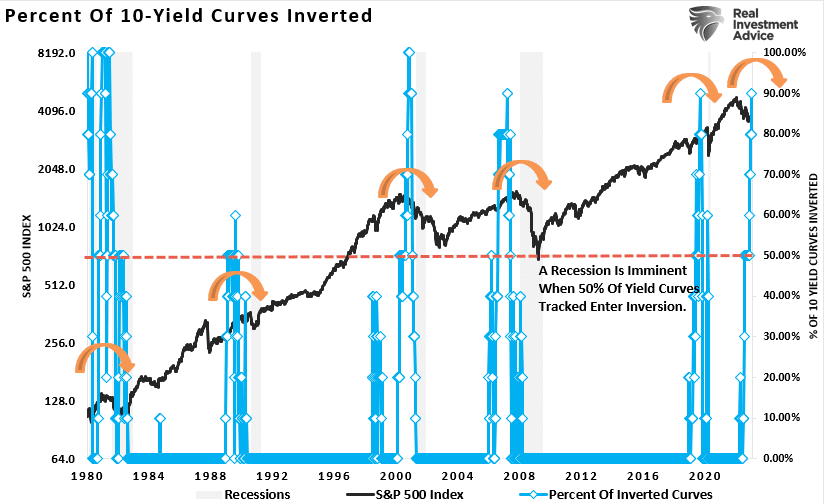

We recently discussed the recession signals from the NFIB (National Federation Of Independent Business) and the inverted yield curve.

“As in 2019, we see many of the same recession signals from the NFIB survey again combined with a high percentage of yield curve inversions. Notably, out of the ten yield spreads we track, which are the most sensitive to economic outcomes, 90% are inverted.”

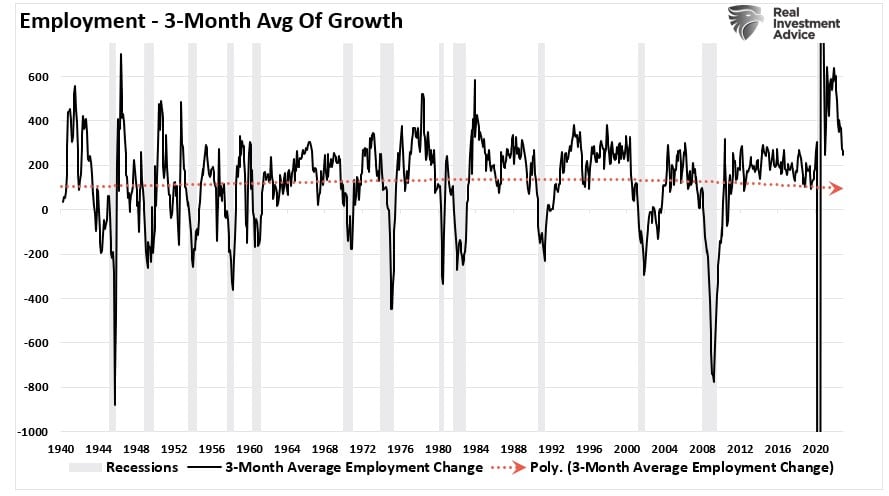

As we noted, many analysts suggest the economy may have a "soft landing." Or, rather, avoid a recession, primarily due to the continued strength in the monthly employment reports.

While those employment reports remain strong, the rapid decline in growth has been a recession signal in and of itself. As we have stated earlier, the trend of the data is far more important than the monthly number.

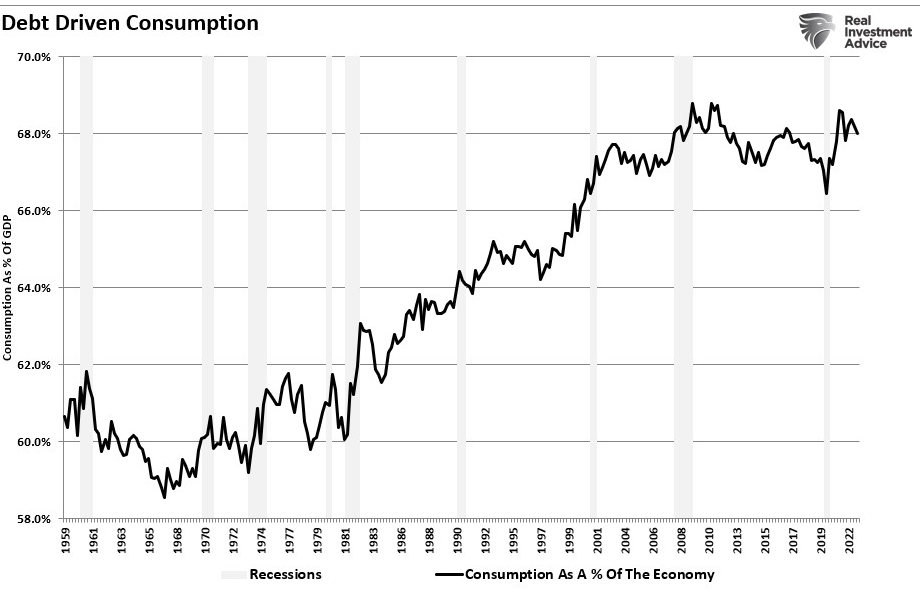

Employment is a critical factor in the recession equation because the U.S. economy comprises roughly 68% of personal consumption expenditures.

In other words, what individuals buy and use daily drives economic activity. It is also the bulk of revenue and earnings growth for corporations.

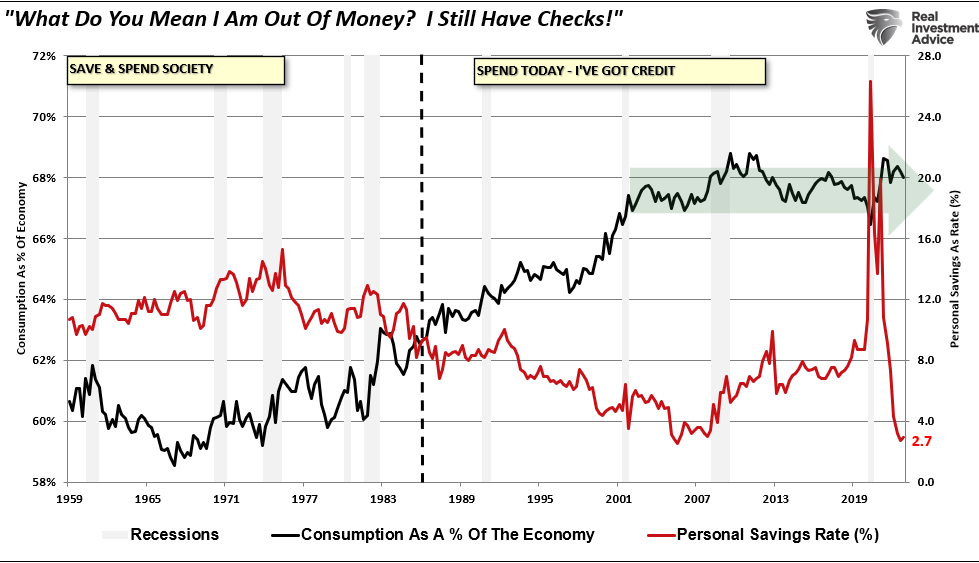

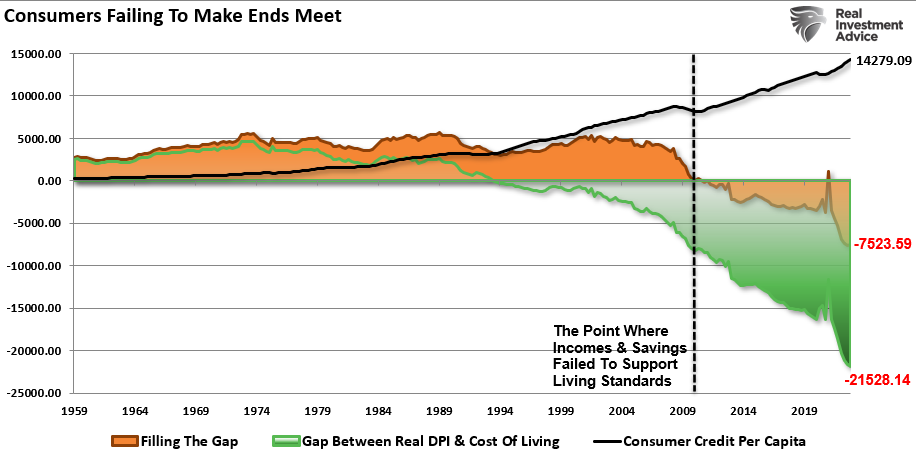

The massive drawdown in savings and rise in credit card debt supported the consumption surge in the U.S. economy. However, since the turn of the century, consumption slowed along with economic growth.

A particular recession signal comes from the massive surge in savings due to the “stimulus checks.”

That boost has fully reversed as consumers struggle to pay bills. Currently, nearly 40% of Americans are having trouble paying bills, and almost 57% of Americans can’t afford a $1000 emergency.

“68% of people are worried they wouldn’t be able to cover their living expenses for just one month if they lost their primary source of income. And when push comes to shove, the majority (57%) of U.S. adults are currently unable to afford a $1,000 emergency expense.

When broken down by generation, Gen Zers (85%) and Millennials (79%) are more likely to be worried about covering an emergency expense.

Such is not surprising considering the current gap between the inflation-adjusted cost of living and the spread between incomes and savings. It currently requires more than $7500 of debt annually to fill the “gap.”

This is why nearly 75% of middle-income families are struggling with the impact of inflation, according to a CNBC report.

“Nearly three-quarters, or 72%, of middle-income families say their earnings are falling behind the cost of living, up from 68% a year ago, according to a separate report by Primerica based on a survey of households with incomes between $30,000 and $100,000. A similar share, 74%, said they are unable to save for their future, up from 66% a year ago.”

The Recession Signal From Credit Cards

The “recession” signal from consumers should certainly not be dismissed, given their contribution to economic growth. However, the risk of deeper recession increases as the Federal Reserve continues to hike interest rates.

Credit cards are no longer just for luxury items and travel. For many Americans, credit cards are now the difference between buying food and gasoline or not.

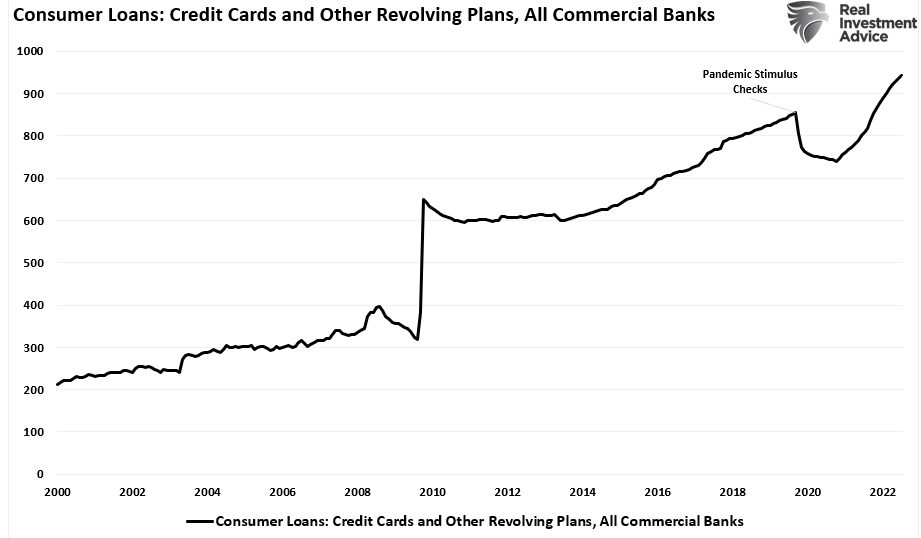

Notably, as shown above, since 2000, consumption has flatlined as a percent of economic growth. However, credit card loans have continued to rise to support the standard of living.

As consumers demand larger houses, luxury goods, cars, travel, and entertainment, real incomes have failed to keep up with demand. With near-zero interest rates, consumers leveraged themselves on the back of cheap debt, particularly since the financial crisis.

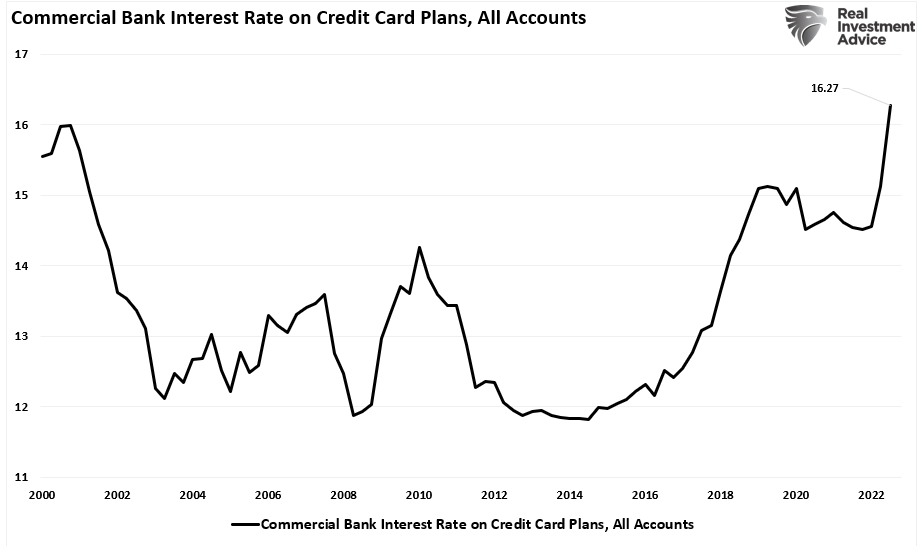

However, as the Fed continues its aggressive rate hiking campaign, those short-term rates feed through to variable rate debt, such as credit cards.

This is why a recession signal we should pay attention to is the sharp spike in credit card payments which further detracts savings and wages from consumptive spending to debt service.

Of course, when it comes to the economy, bad economic outcomes always start with the consumer.

“The combination of record high credit card debt and record high credit card interest is nothing short of catastrophic for both the US economy, and the strapped consumer who has no choice but to keep buying on credit while hoping next month’s bill will somehow not come. Unfortunately, it will and at some point in the very near future, this will also translate into massive loan losses for US consumer banks; that’s when Powell will finally panic.” – Zero Hedge

As shown in the consumer spending gap chart above, the temporary surplus consumers had in 2020 following the deluge of stimulus resulted in a massive reversal.

Such was precisely what we suspected would be the case, as discussed in Biden’s stimulus Will Cut Poverty For One Year, to wit:

“Social programs don’t increase prosperity over time. Yes, sending checks to households will increase economic prosperity and cut poverty for 12-months. However, next year, when the checks end, the poverty levels will return to normal, and worse, due to increased inflation.

In a rush to help those in need, economic basics are nearly always forgotten. If I increase incomes by $1000/month, prices of goods and services will adjust to the increased demand. As noted above, the economy will quickly absorb the increased incomes returning the poor to the previous position.“

That outcome was evident with the eruption of inflation throughout 2022, which left the poor in poverty. In 2023, the consequences of tighter monetary policy will likely affect many more.

Recession Coming In 2023

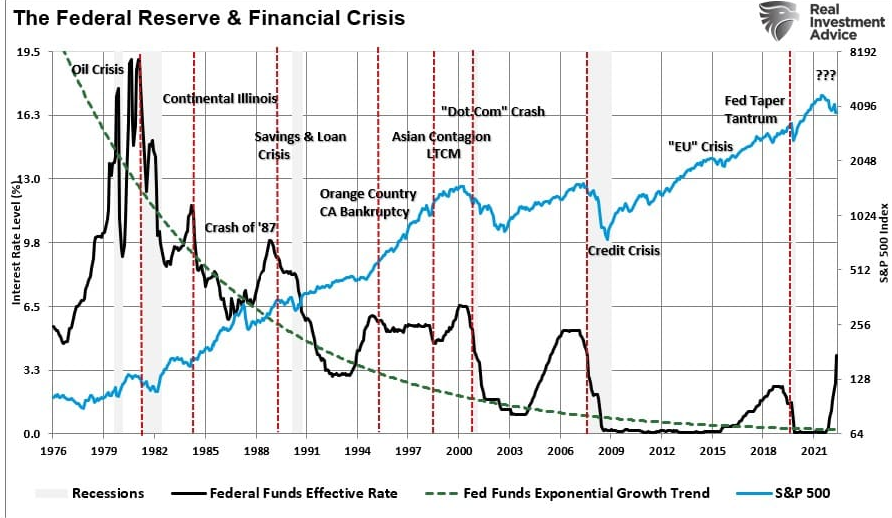

While the market is defiant that the Federal Reserve will engineer a “soft landing.” The Federal Reserve has never entered into a rate hiking campaign with a ”positive outcome.”

Instead, every previous adventure to control economic outcomes by the Federal Reserve has resulted in a recession, bear market, or some “event” that required a reversal of monetary policy. Or, rather, a “hard landing.”

Given the steepness of the current campaign, it is unlikely that the economy will remain unscathed as savings rates drop markedly. More importantly, the rate increase directly impacts households dependent on credit card debt to make ends meet.

While investors may not think a hard landing is coming, the risk to consumption due to indebtedness and surging rates suggest differently. Importantly, what matters most for investors is the coincident repricing of assets as earnings decline due to the contraction in consumption.

The whole point of the Fed hiking rates is to slow economic growth, thereby reducing inflation. As such, the risk of a recession rises as higher rates curtail economic activity. Unfortunately, with the economy slowing, additional tightening could exacerbate the risk of a recession.

Therein lies the risk. Since earnings remain correlated to economic growth, earnings decline as rate hikes ensue. Such is especially the case in more aggressive campaigns. Therefore, market prices have likely not discounted earnings enough to accommodate a further decline.

The media, and the White House, have proclaimed victory by stating the first two quarters of 2022 were not a recession but only an economic slowdown. However, given the lag effect of changes to the money supply and higher interest rates, indicators are pretty clear recession risk is very probable in 2023.

The consumer is likely to be the biggest loser.