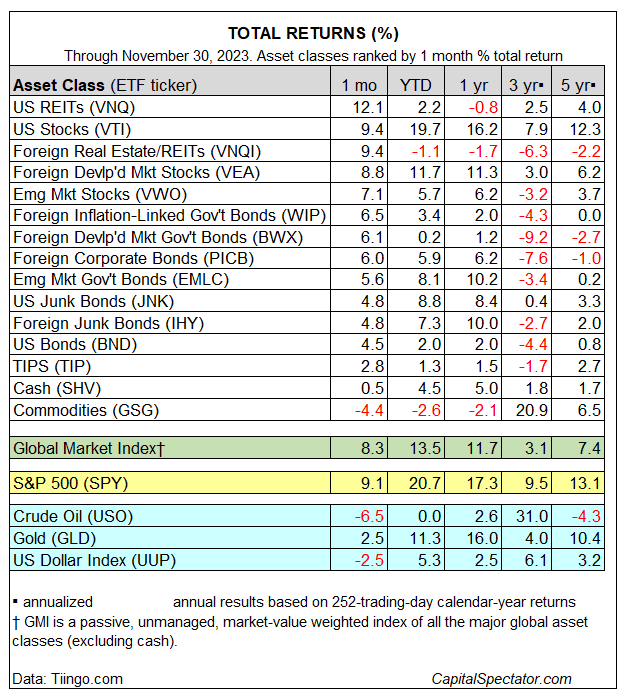

Global markets surged in November—except for commodities, which posted the only decline among the major asset classes last month, based on a set of ETF proxies.

US property shares led the rally. After three straight monthly declines, Vanguard US Real Estate (NYSE:VNQ) roared back in November with a white-hot 12.1% gain.

US stocks were last month’s second-strongest performer. Vanguard US Total Stock Market (NYSE:VTI) rose 9.4%, the first monthly gain for the fund since July.

Year to date, VTI continues to outperform the rest of the field by a wide margin via a near-20% advance.

US bonds (NASDAQ:BND) rebounded in November, partially reversing a painful run of six consecutive monthly declines. Vanguard Total US Bond Market rose 4.5% and is up 2.5% year to date.

The downside outlier last month: a broad measure of commodities. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) slumped 4.4% and is down 2.6% year to date.

The only other major asset class with red ink so far this year: foreign real estate (VNQI) with a 1.1% loss.

Within the commodities space, gold bucked the trend and posted a gain. SPDR Gold Shares (NYSE:GLD) rose 2.5%, boosting its year-to-date gain to 11.3%.

Thanks to November’s widespread gains, the Global Market Index (GMI) surged 8.3% last month after three months of losses. The gain marks the best monthly advance in three years.

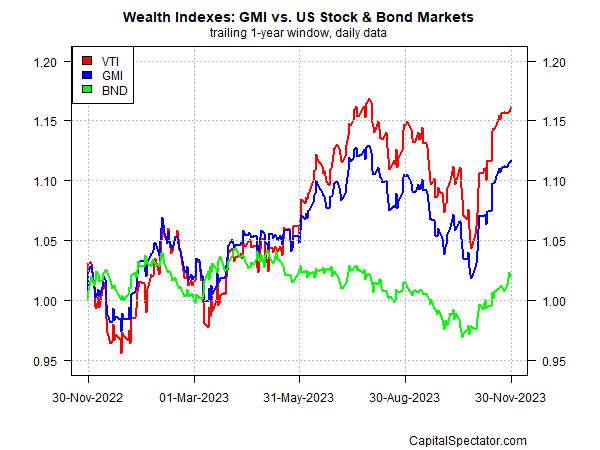

This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios.

GMI’s performance over the past year continues to track the ebb and flow for US stocks(VTI). US bonds (BND), despite last month’s rally, are trailing US shares and GMI by a wide margin over the past 12 months.