Global Markets

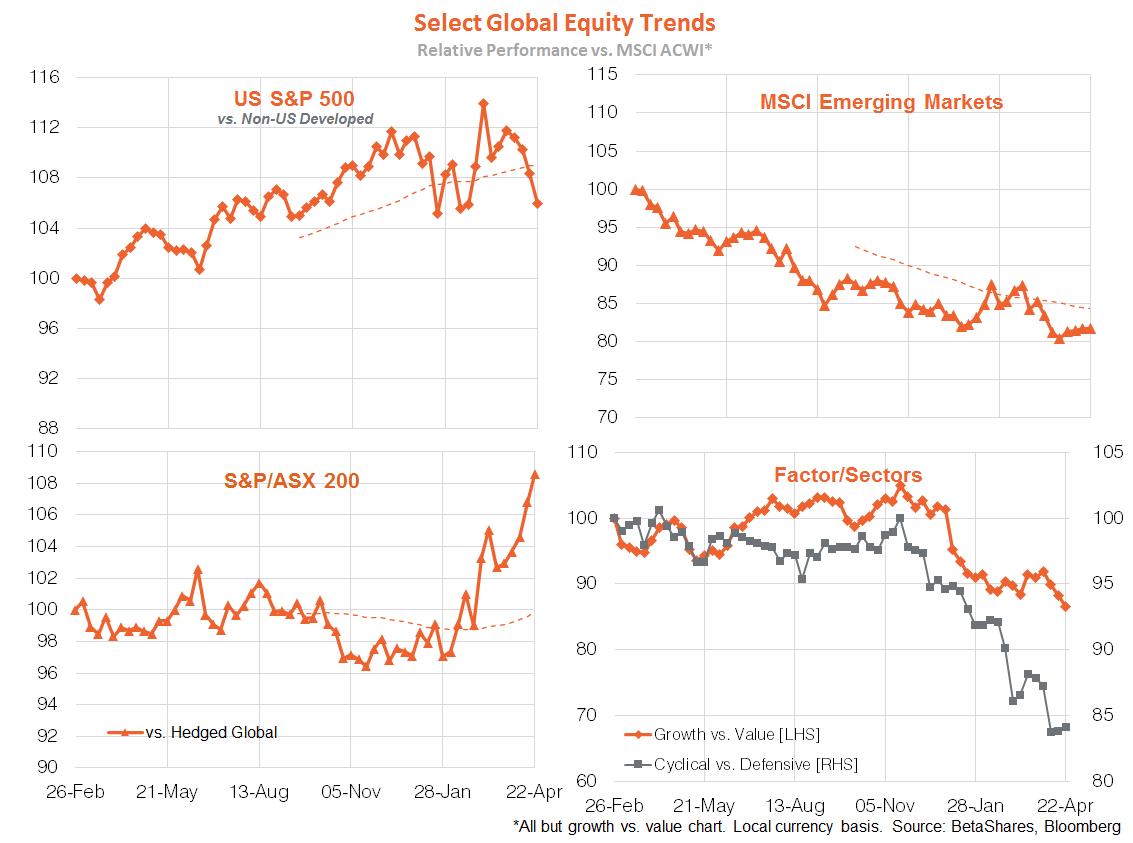

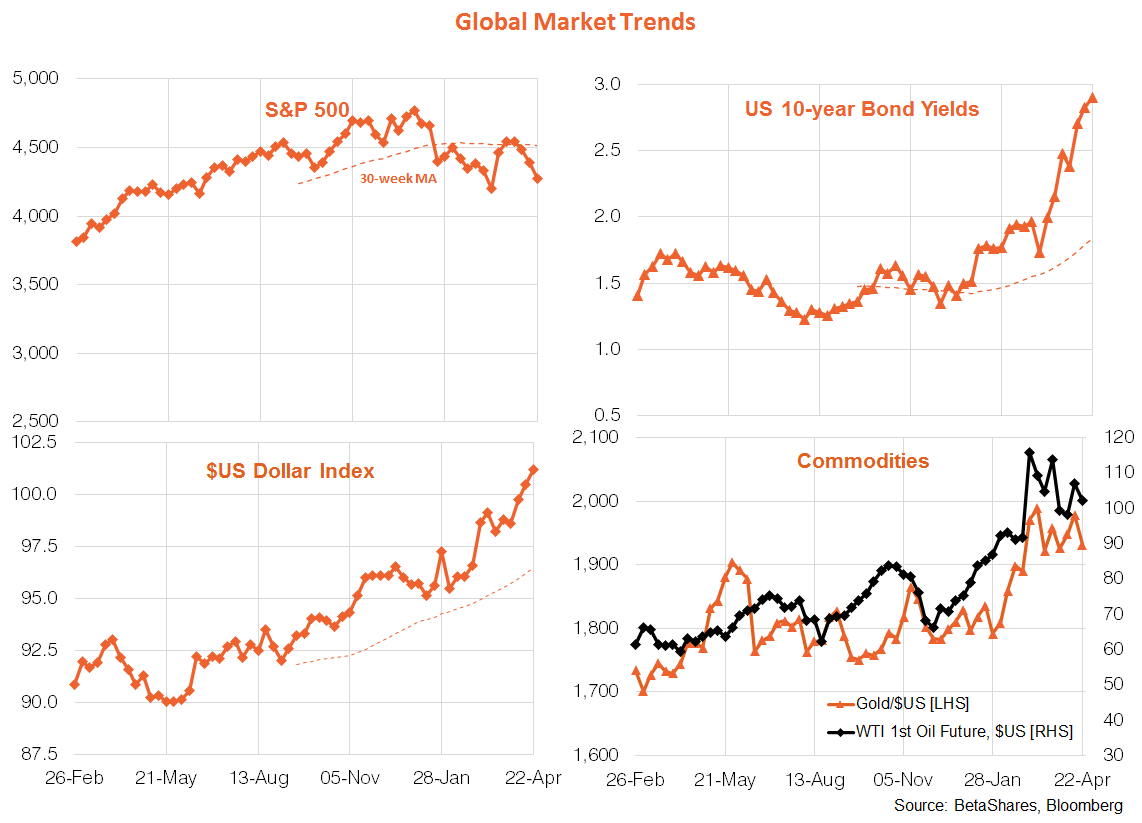

It was a familiar story last week, with global equities again under pressure from the onslaught of hawkish rhetoric from central bankers. The highlight was no less than U.S. Fed Chair Powell hinting at a 50 basis point rate hike at next week’s Fed meeting. Of course, the bond market has been pricing this risk for sometime (it is also pricing in a 50bps move in June), but it seemed the equity market could not quite believe it until Powell himself effectively confirmed the fact. Not to be outdone, Fed President Bullard suggested a 75bps hike next week was also possible!

Meanwhile, hopes of a timely easing in “supply chain bottlenecks” are being quashed by the ongoing war in Ukraine and China’s renewed round of COVID lockdowns. Although it’s quite possible U.S. headline inflation has peaked, most partial pricing indicators suggest cost pressures remain high – and inflation may remain uncomfortably high for much of this year.

We’ll learn more on U.S. price and wage inflation with the release of the private consumption price deflator on Friday, along with the March quarter employment cost index. Annual core consumer price inflation is expected to edge back to 5.3% from 5.4%, which may heighten talk that “inflation has peaked” – while annual growth in the employment cost index is expected to edge higher to 4.2%, from 4.0%.

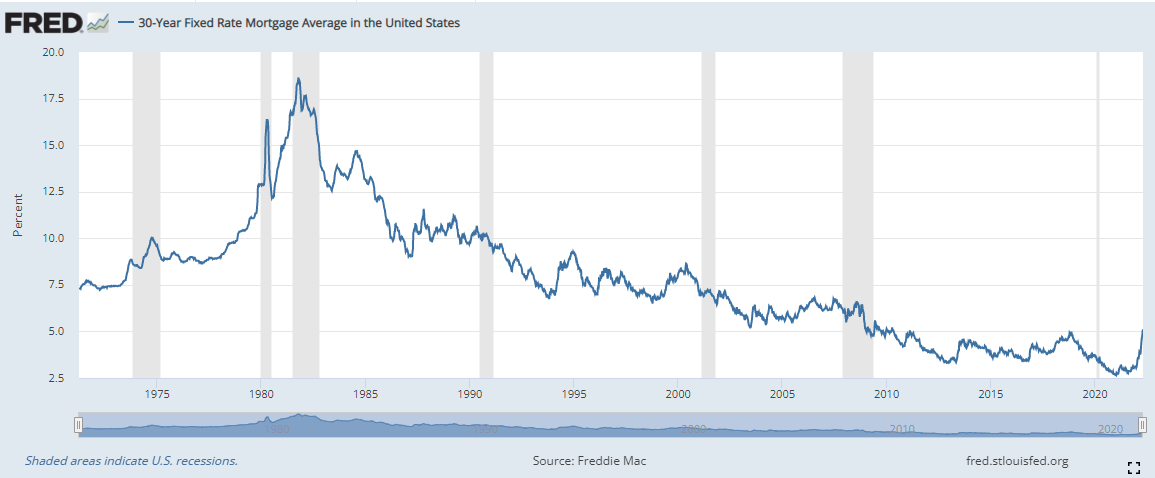

This week also see’s one third of S&P 500 companies report their Q1 earnings, including tech stalwarts such as Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL). Although the earnings season so far has been OK, it’s not been enough to help the market. Indeed, equity investors in general still appear unsure whether stronger economic data and earnings are good news, or now bad news because it means the Fed is only likely to hike rates faster. Given the recent surge in U.S. fixed mortgage rates, we also need to keep watch on housing indicators – such as home sales and house prices this week – and these are likely to be the first U.S. economic indicators to buckle under the onslaught of higher rates.

Australian Market

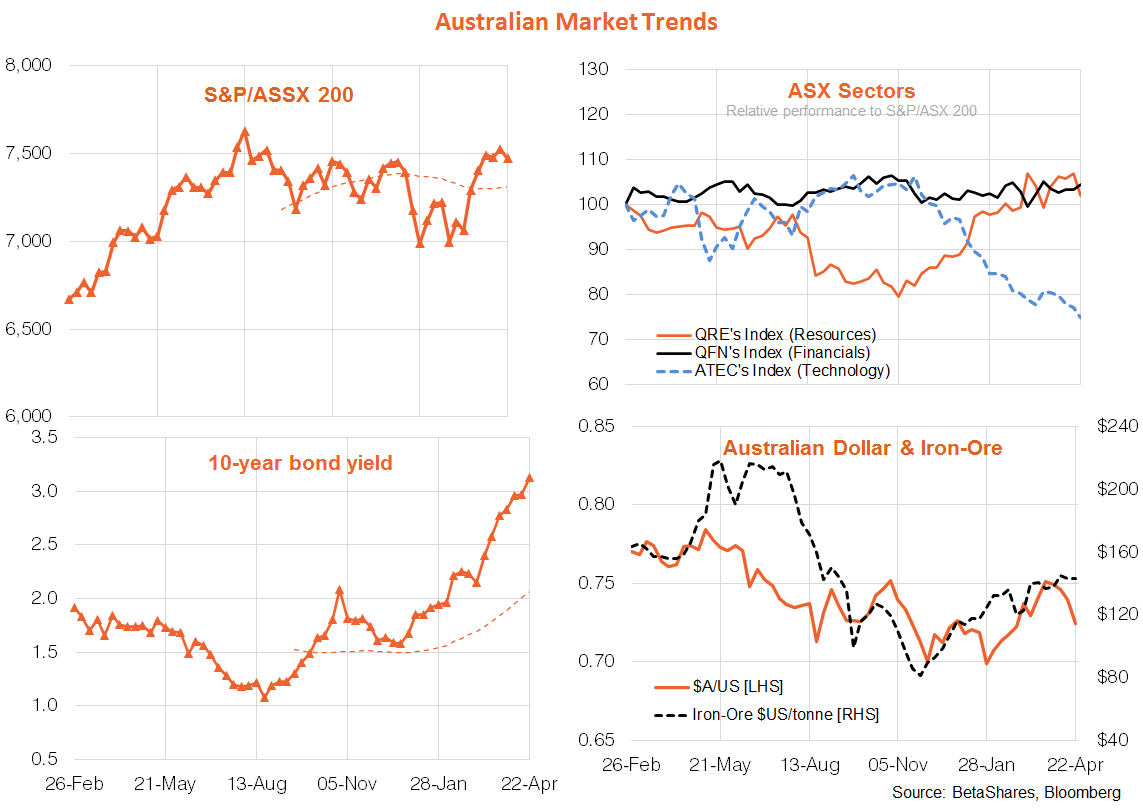

Although it has displayed impressive outperformance of late, the Australian equity market also began to buckle a little last week, not helped by renewed concerns over China and increased talk of higher local interest rates. The $A has also been knocked back again, reflecting the stronger $US and weaker iron-ore prices (especially yesterday).

Regarding interest rates, we get an important update on consumer prices tomorrow, with the all-important trimmed mean measure expected to show a lift in annual underlying inflation from 2.6% to 3.4% – or well above target. Price pressures appear broad based, moreover, with strength in housing, food and petrol prices. That said, most in the market, myself included, have tended to think the RBA would still not raise rates at next week’s May Board meeting, but rather wait for the wage cost index report next month to confirm at least a further modest lift in annual wage growth toward 3%. And given the RBA will wait until June, some now suggest the RBA will then hike by an outsized 40bps.

Given heightened global supply chain bottleneck problems, and more aggressive rate hikes expected in the United States, however, I now think the RBA should and likely will raise interest rates next week by 0.15bps – the case to hike is so obvious it need not feel bound by next months wage report.

Indeed, while inflation pressures are building in Australia they remain less acute than in the United States – accordingly we don’t need to risk jarring economic sentiment with a “shock and awe” 40 bps move next month. I think it makes more sense to start off slow with a 15bps next week, followed by a traditional 25bps move in June. Indeed, the only real argument for delay now is the current Federal election – as was last the case in 2007, I think this is another good opportunity for the RBA to again demonstrate its independence.