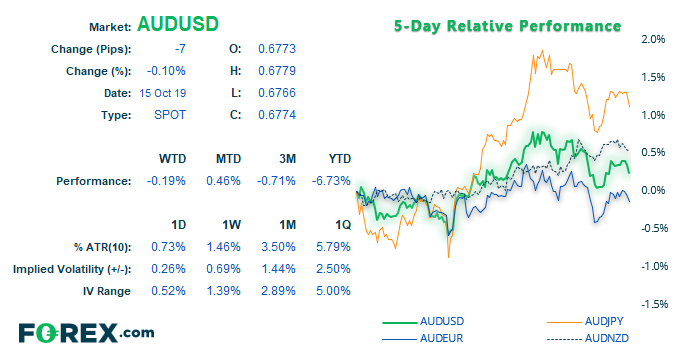

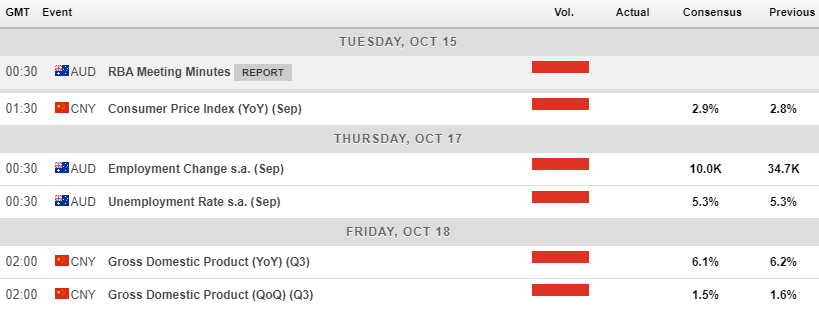

As my colleague Joe Perry mentioned, it could be a busy week for AUD given the slew of data from China alongside AU employment data on Thursday. RBA just released the minutes from their October meeting, although the underlying message remains consistent; expect rates to remain low, they could go lower, and employment and consumption are key metrics. That said, there are signs that they’re thinking about how low rates really should go, having discussed keeping rate cuts in reserve for emergencies, and the risks that low rates would inflate (already overinflated?!) home and asset prices.

The reaction was minimal at best although, on the domestic front, Thursday’s employment report could provide the catalyst for volatility. Whilst employment growth has remains strong, RBA expect it to slow. Given full-time employment is now softening on a year over year basis and unemployment is rising against RBA’s wishes, then a worse than expected employment report on Thursday could bring forward expectations of another RBA cut. And this is before we add Chinese data to the mix.

Still, with so much data on tap, it can also muddy the waters where price action is concerned. Whilst weak data from China and AU is generally a bearish case for the Aussie, that’s quite a few data points we’d need to see miss the mark. Furthermore, if data from China gets too bad, it can inadvertently trigger a risk-on rally as markets assume yet more fiscal policy is on the cards from Beijing (after the initial knee-jerk, bearish reaction). Of course, we’ll have to wait for the data to come in to confirm, but it could also surprise to the upside and support AUD. So for now, here’s a couple of potential setups which may be of interest for bulls, if the data allows.

EUR/AUD: This cross may not provide the nicest of trends on the daily chart, yet when volatility erupts it can provide large swings. In the last week for July, for example, it rallied over 5.5% in 11 sessions in practically a straight line, which could have also provided shallow pullbacks and continuation patterns on lower timeframes. Yet recently prices have been coiling within a potential bearish wedge. As this follows on from a move lower, we’re looking for a break lower as part of a continuation patter.

AUD/NZD: Prices are trading within a potential corrective channel / flag, although there’s also the risk we could see it recycle lower within the pattern before it’s bullish breakout. In some way this would be preferred, as it could improve potential reward to risk ratio for bulls.