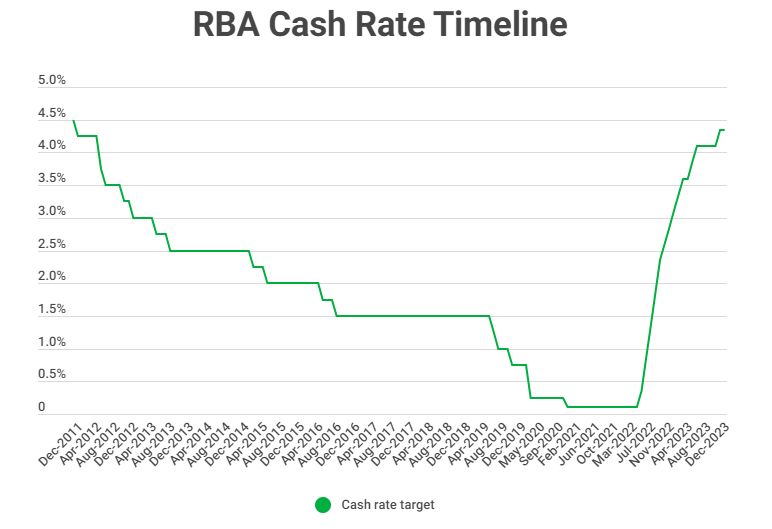

The cash rate will remain at 4.35% at least until the board convenes once again in February.

December's hold was widely anticipated, with economists from all of the big four banks and 95% of traders predicting rates would remain unchanged.

Data released since the November rate hike, including soft retail trade and a slight uptick in unemployment in October, did not look likely to lend itself to rates going up.

RBA governor Michele Bullock said the pause would allow the board more time to assess the inflation outlook, ahead of a February decision widely considered at the moment to be much more live.

"The impact of the more recent rate rises, including last month's, will continue to flow through the economy," Ms Bullock said.

"[This decision] will allow time to assess the impact of the increases in interest rates on demand, inflation and the labour market."

The fourth-quarter CPI inflation figures will be out by February, so the RBA will have a clear picture about whether inflation is moderating enough.

NAB economist Tapas Strickland expects domestic price pressures to necessitate another 25 bps hike in February, while Westpac Chief Economist Luci Ellis says a hike is likely if there are upside surprises to the inflation outlook.

Property prices to keep surging?

November saw Australian property reach a new high median price after strong growth throughout 2023, despite rate hikes.

PropTrack senior Economist Eleanor Creagh says today's decision to not raise rates further will help maintain this strong growth.

"Property prices have defied expectations and home values have remained resilient to higher interest rates this year," she said.

"The decision [to hold] will maintain both buyer and seller confidence.

"With a shortage of new home builds and challenging conditions in the rental market, prices are expected to continue rising, though the pace of growth will continue to slow."

CBA head of Australian economics Gareth Aird said the RBA's tough talk on inflation is weighing on property sentiment.

"We think that the Governor is trying to 'jawbone' to the housing sector to elicit a greater behavioural response to the November rate increase," he said.

However according to NAB's Mr Strickland, November jawboning was not enough to undo softer rhetoric in the months prior.

"It could be the RBA’s less hawkish communications between July and October 2023 led many to believe the cash rate cycle was over," he said.

"RBA decides against Christmas rate hike" was originally published on Savings.com.au and was republished with permission.