As higher-for-longer gains further traction, yield curves are bear flattening again. Only moderately, though, as risk sentiment holds up with the acute banking crises fading from view

Higher-for-longer is gaining traction as the acute banking crises fade from view

Fed Beige Book suggests banking turmoil had little impact on economic activity or credit availability.

Rates are still testing higher as the acute banking crisis is further fading in the rearview mirror. The Fed Beige Book last night indeed suggests that the banking turmoil had little impact on economic activity or credit availability. And Fed officials are now using their last opportunity ahead of the pre-meeting quiet period to push the view that rates will still have to stay higher for longer to tackle still elevated inflation.

The impact is not so much that we are seeing imminent hike expectations rise – the probability that the Fed will take another 25bp step beyond May is seen at about 20% – but rather that we are seeing rate cut expectations being priced out. The Fed Funds rate is now seen just below 4.6% at the end of this year, the highest since the banking turmoil surrounding Silicon Valley Bank began and implying markets are pricing only two full cuts from the Fed's peak by then.

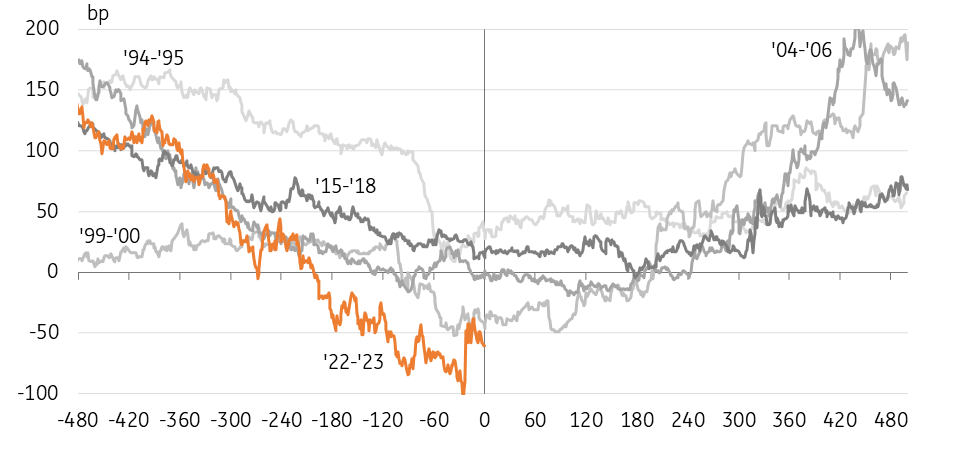

The peak in Fed rates historically also marked a change in curve dynamics, even if actual re-steepening had to wait.

Source: Refinitiv, ING

... but it still means the Fed is close to ending the tightening phase.

Longer-term rates are also moving higher, but by definition, they look further beyond the money market pricing the higher-for-longer narrative. We are seeing, thus, a moderate bear flattening as the 10Y US Treasury yield struggles at previous post-SVB yield highs. All else equal, even if things don’t look as bad as initially feared, the turmoil has added a downside risk and pre-SVB highs look harder to attain.

When the Fed peaked 10Y yields usually had already seen their peaks and the flattening dynamic also subsided.

Considering the broader picture the Fed soon moving from hiking rates to keeping them steady will still mark an important turning point. Historically at this stage, outright 10Y yields had already seen their peaks and the flattening dynamic has also tended to subside. Flattening still happened, but was usually rare and only temporary once the Fed had reached its peak in policy rates. Re-steepening, however, only gained traction once the first actual rate cuts have moved into sight.

In Europe data and officials are also pushing toward still higher rates

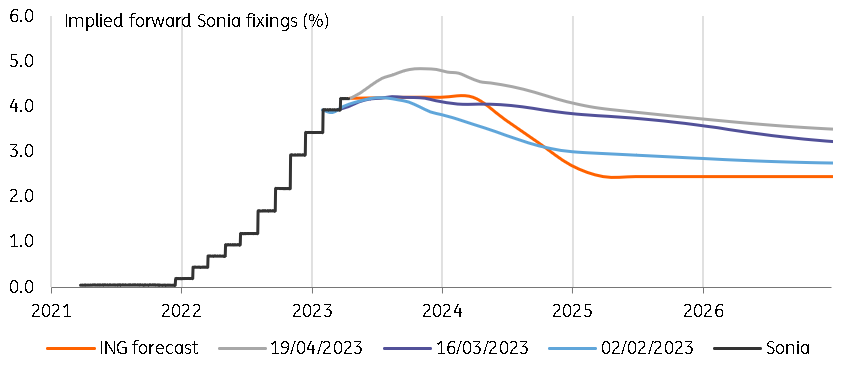

In Europe, market sentiment is also still moving towards higher rates. UK inflation data yesterday proved stickier than hoped and saw markets repricing their Bank of England policy rate expectations. After the CPI data markets now see a BoE hike in May by 25bp now as a done deal. Further out, the terminal rate was lifted more than 15bp, implying markets are now expecting at least three more hikes in total. Our economists are less convinced, but market sentiment is clearly geared towards a higher-for-longer story.

BoE rate expectations repriced higher in the wake of the inflation data

Source: Refinitiv, ING

The developments we are seeing in the US and UK chime with the tones coming out of the European Central Bank, where officials like Belgium’s Wunsch see very limited impact on monetary policy from the banking turmoil. The decision in May is between 25bp and 50bp and erring on the side of a robust increase would make sense in his view. Chief Economist Lane continues to reiterate that in the baseline scenario, rates still need to move higher.

The ECB has regained confidence in its baseline scenario since March

Later today, Isabel Schnabel is also scheduled to speak. She is a known policy hawk, and we have learned from earlier news reports that she had pushed for the ECB to still provide explicit guidance in the March policy statement that rates could increase further. In the end, the ECB decided on a more cautious approach in the wake of the banking turmoil, with President Lagarde only providing verbal guidance.

Today's events and market view

The market is going along with the hawkish push we are witnessing in the US and also Europe. Curves are bear flattening, though only moderately, as risk sentiment is still holding up, given more indications that fall-out from the banking turmoil might be limited.

Some of the contemporaneous data on the Fed’s emergency lending and money market fund flows have also suggested tensions are gradually easing. We will get the next update on these data sets tonight.

The main focus in the US is on the Fed officials ahead of the quiet period. Next to Waller, we will hear from Bostic, who recently called for one more hike and for holding rates there for “quite some time.” Similar tones had come from Mester while Bowman has more recently only commented on the resilience of the banking system. Both are expected to speak tonight.

In primary markets, we will see government bond auctions from France and Spain.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more