Stocks fell sharply as rates pushed back toward their highs. There was a 5-year Treasury auction that did not go well, and that just pushed rates even higher after 1 p.m. today, there will be a 7-year auction at 1 p.m., and it too could be a market-moving event and needs to be paid attention to.

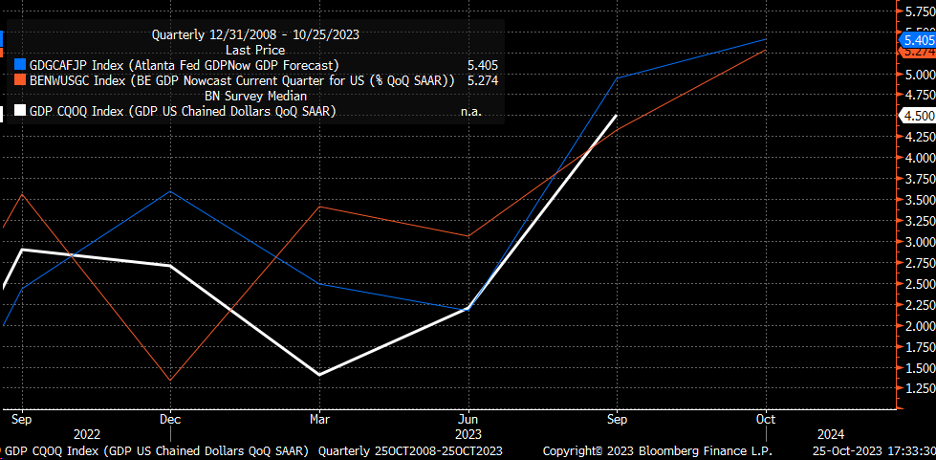

We will also get that highly anticipated 3Q GDP, and the estimate is for 4.5%. The Atlanta Fed GDPNow and Bloomberg Economics suggest a number greater than 5%. Even if the number comes in around 4.5%, it is almost hard to believe, given the 2.1% print in 2Q. That would be a big acceleration in the economy. That will be a closely watched number as it will greatly impact rates.

Today could be an active day for the rate complex between the GDP numbers in the morning and the 7-year Treasury auction. There will also be an ECB rate announcement.

S&P 500's Drop Wipes Out Summer Rally

Meanwhile, the S&P 500 closed today at 4,186, meaning the entire summer rally is gone. We are returning to levels on May 31, when the S&P 500 closed at 4,179. To make matters worse, we tested that 200-day moving average the last few days, and today, we moved firmly below it after it worked as resistance.

The decline in the S&P 500 doesn’t look complete yet, and I wouldn’t be surprised to see 4,115 in the days ahead based on the wave counts.

Meta Stock Could Head Lower

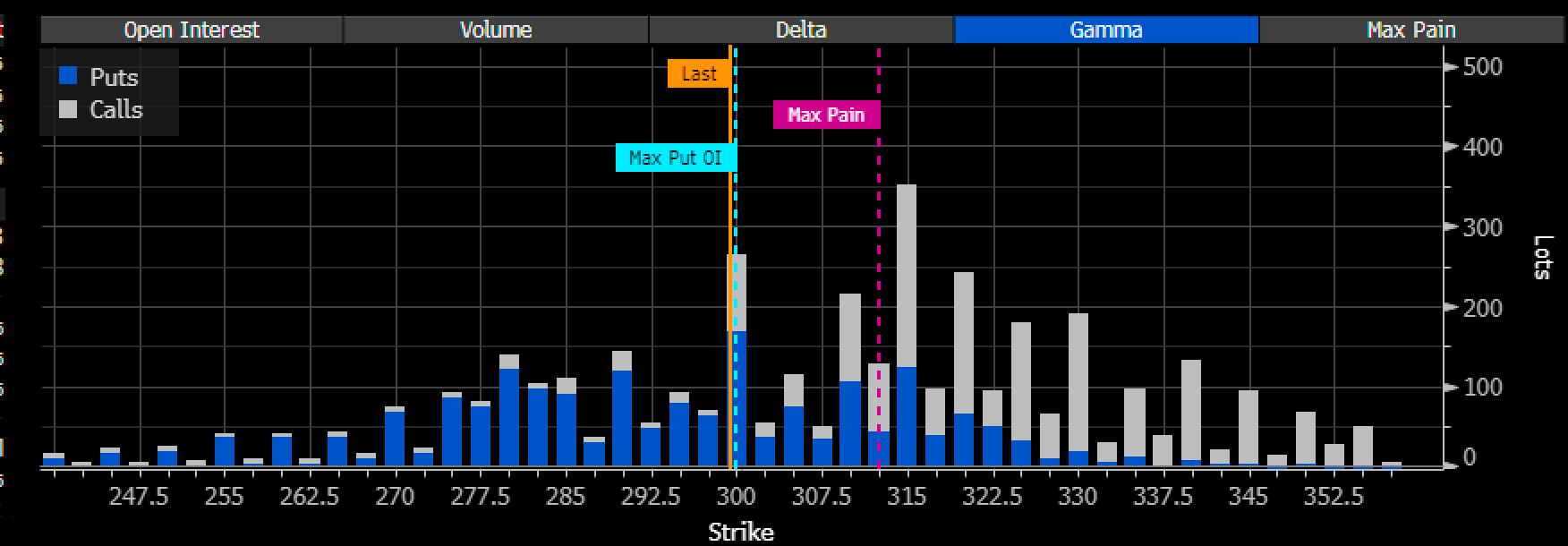

I don’t think Meta (NASDAQ:META) will save the day; the share fell today by 4% from $312.55 to $299.53. The company beat on the top and the bottom but then issued guidance of $36.5 billion to $40 billion, or $38.25 billion at the mid-point, which was light of estimates for $38.76 billion.

So, it missed guidance by a bit. Despite the beat and inline guide, the stock is up less than 2% as of 5:30 ET and is trading around $305, so it is still below where it closed the day before yesterday. Not very encouraging.

But the bigger problem for Meta is that there is a lot of call gamma sitting up $315, and put gamma, for that matter, which expires on Friday.

So unless Meta can get above $315, all of that call gamma will start to lose a lot of value as implied volatility begins to melt, which means market makers will likely be sellers of Meta tomorrow.

So if the stocks trade down today, despite the “fantastic, groundbreaking results, lead by generative AI,” as noted on TV multiple times, you know why.