- Wall Street’s Q4 earnings season kicks off next week and is expected to be the next major test for the stock market.

- Analysts expect annualized profit growth of +2.4% and an increase of +3.1% in revenue growth.

- I used the InvestingPro stock screener to find high-quality stocks poised to deliver robust profit and revenue growth amid the current climate.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

Wall Street's fourth-quarter earnings season unofficially begins on Friday, January 12, when notable names like JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), BlackRock (NYSE:BLK), UnitedHealth (NYSE:UNH), and Delta Air Lines (NYSE:DAL) all report their latest financial results.

The following two-week period sees high-profile companies like Tesla (NASDAQ:TSLA), Netflix (NASDAQ:NFLX), IBM (NYSE:IBM), Intel (NASDAQ:INTC), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), American Express (NYSE:AXP), Procter & Gamble (NYSE:PG), Johnson & Johnson (NYSE:JNJ),AT&T (NYSE:T), American Airlines (NASDAQ:AAL), and United Airlines (NASDAQ:UAL) report earnings.

The earnings season gathers momentum in the final week of January when the mega-cap tech companies, including Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META), Amazon (NASDAQ:AMZN), and Apple (NASDAQ:AAPL), are scheduled to deliver their Q4 updates.

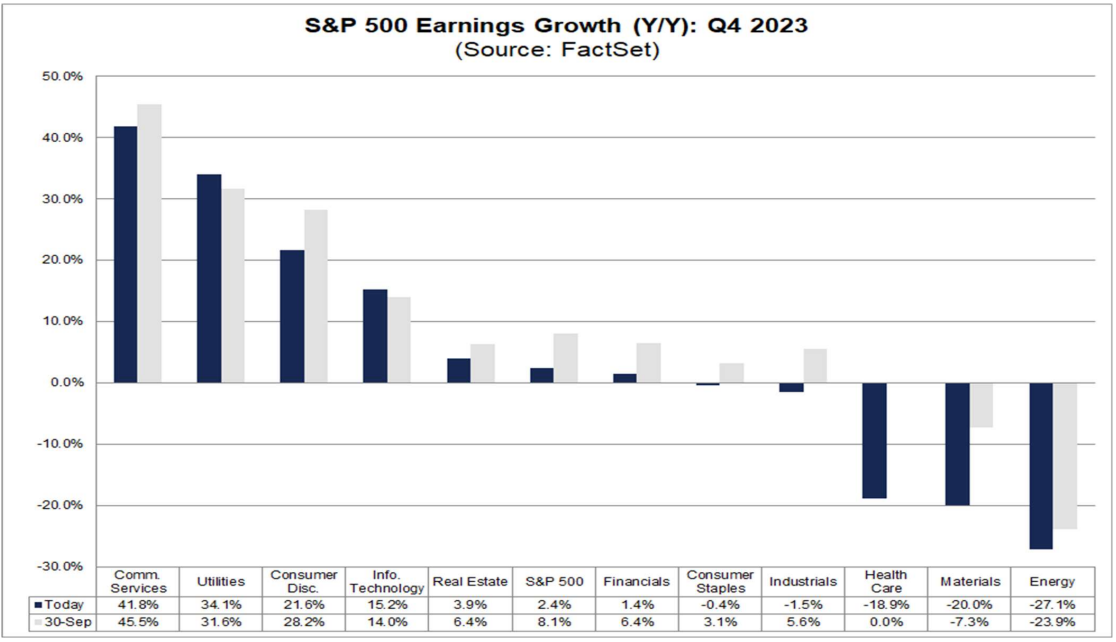

Despite concerns about a possible recession, earnings per share for the S&P 500 are expected to grow +2.4% in the fourth quarter when compared to the same period last year, according to FactSet estimates.

If +2.4% is the actual growth rate for the quarter, it will mark the second consecutive quarter of year-over-year earnings growth for the index. However, it will also represent a lower growth rate compared to the third quarter.

On a quarterly basis, the S&P 500 reported earnings declines of -1.7% and -4.1% for Q1 2023 and Q2 2023, respectively. However, the benchmark index reported earnings growth of +4.9% for Q3 2023.

As the chart above shows, the Communication Services sector, which includes names like Google-parent Alphabet, Facebook owner Meta Platforms, Netflix (NASDAQ:NFLX), Walt Disney (NYSE:DIS), as well as Verizon (NYSE:VZ), and AT&T, is expected to report the largest annualized earnings growth rate of all eleven sectors, at +41.8%.

The Utilities sector is expected to come in second, with +34.1% year-over-year earnings growth. The space includes notable companies such as NextEra Energy (NYSE:NEE), Southern Company (NYSE:SO), Duke Energy (NYSE:DUK), Dominion Energy (NYSE:D), and PG&E Corp (NYSE:PCG).

Elsewhere, the Consumer Discretionary sector, which is perhaps the most sensitive to economic conditions and consumer spending, is expected to report the third-highest annualized earnings growth rate, at +21.6%. Some of the biggest names in the sector include Amazon, Walmart (NYSE:WMT), Home Depot (NYSE:HD), McDonald’s (NYSE:MCD), Nike (NYSE:NKE), Starbucks (NASDAQ:SBUX), and Coca-Cola (NYSE:KO).

On the other hand, earnings from companies in the Energy sector are expected to fall -27.1% compared to last year - the worst drop of any sector by far. Lower year-over-year oil prices are contributing to the decrease in earnings for the sector. Despite the recent rally, the average price of oil in Q4 2023 ($77.78) was still 18% below the average price in Q4 2022 ($94.33).

The Materials sector - which includes companies in the metals and mining, chemicals, construction materials, and containers and packaging industry - is projected to report the second worst Y-o-Y earnings slump of all eleven sectors, with EPS set to tumble -20.0% from a year earlier, per FactSet.

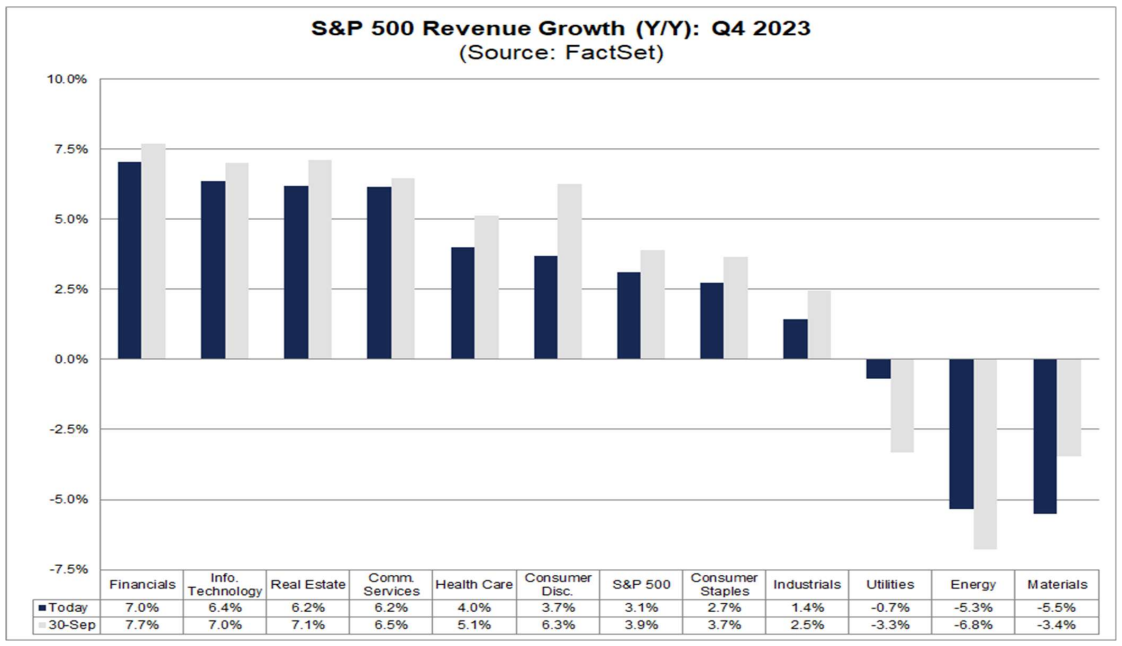

Meanwhile, revenue expectations are slightly more positive, with sales growth expected to increase +3.1% from the same quarter a year earlier. If that is in fact the reality, FactSet pointed out that it would mark the 12th straight quarter of revenue growth for the index.

As seen above, eight sectors are projected to report year-over-year growth in revenues, led by the Financials and Information Technology sectors, at +7% and +6.4%, respectively.

In contrast, three sectors are predicted to report a y-o-y decline in revenues, led once again by Materials and Energy, at -5.5% and -5.3% respectively.

Guidance

Beyond the top-and-bottom-line numbers, investors will pay close attention to announcements on forward guidance for the first quarter of 2024 and beyond, given the uncertain macroeconomic outlook.

Other key issues likely to come up will be the health of the U.S. consumer, future hiring plans, as well as lingering supply chain concerns.

Meanwhile, in the tech sector, artificial intelligence is likely to be a big theme again. Investors will look to see if companies can turn optimism over AI developments into an improved bottom line.

What to Do Now?

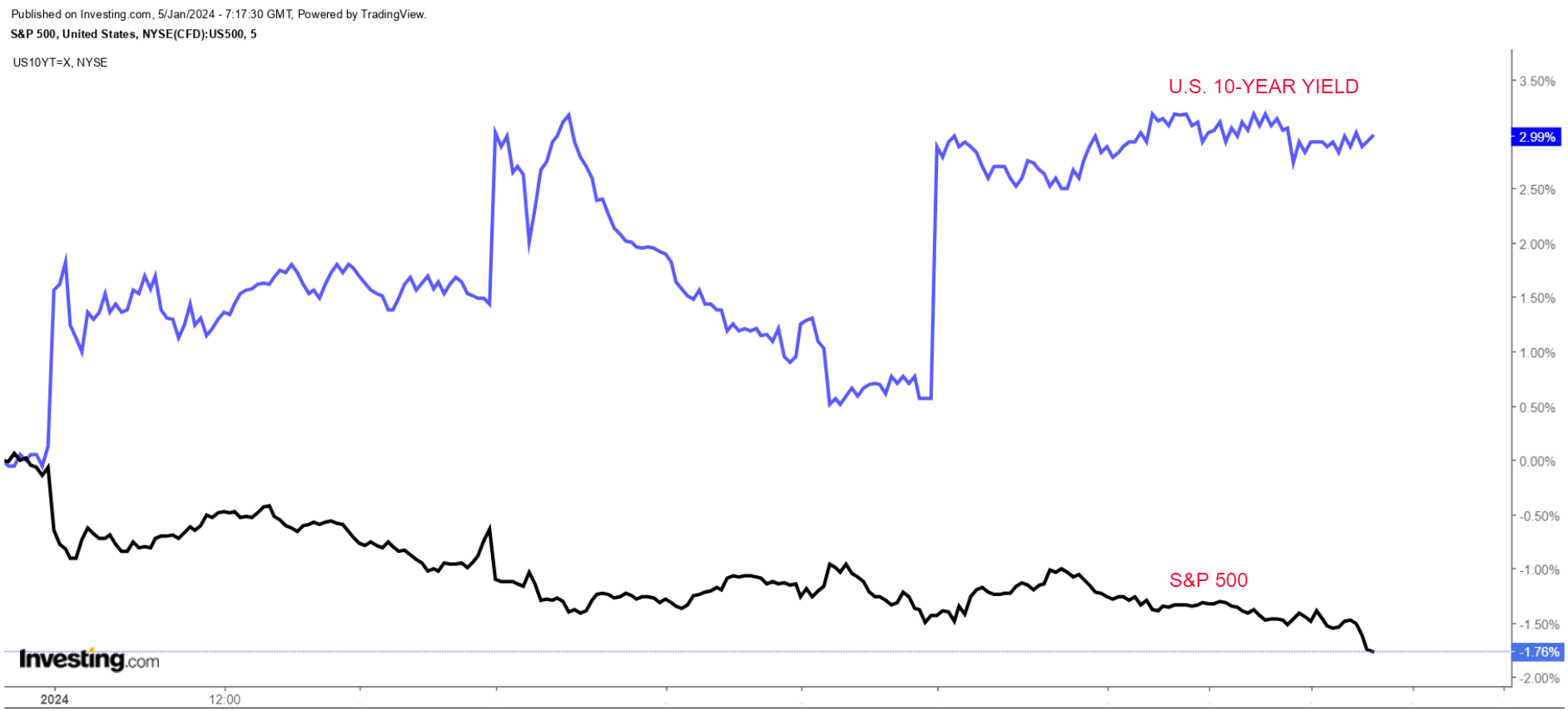

Markets are heading into the Q4 reporting season on a wobbly note amid renewed uncertainty around when the Federal Reserve will begin to cut interest rates.

The S&P 500 closed lower for the third day in a row on Thursday, extending a losing streak that kicked off 2024.

For the S&P, this is the worst start to a year since it began 2015 with a three-session skid and comes in stark contrast to how the market ended 2023.

Since the Dec. 28 close, the benchmark index has lost nearly 3%.

A tick-up in yields on longer-dated U.S. Treasuries - the benchmark U.S. 10-Year note is back above 4% - prompted traders to move away from risk assets to start the new year.

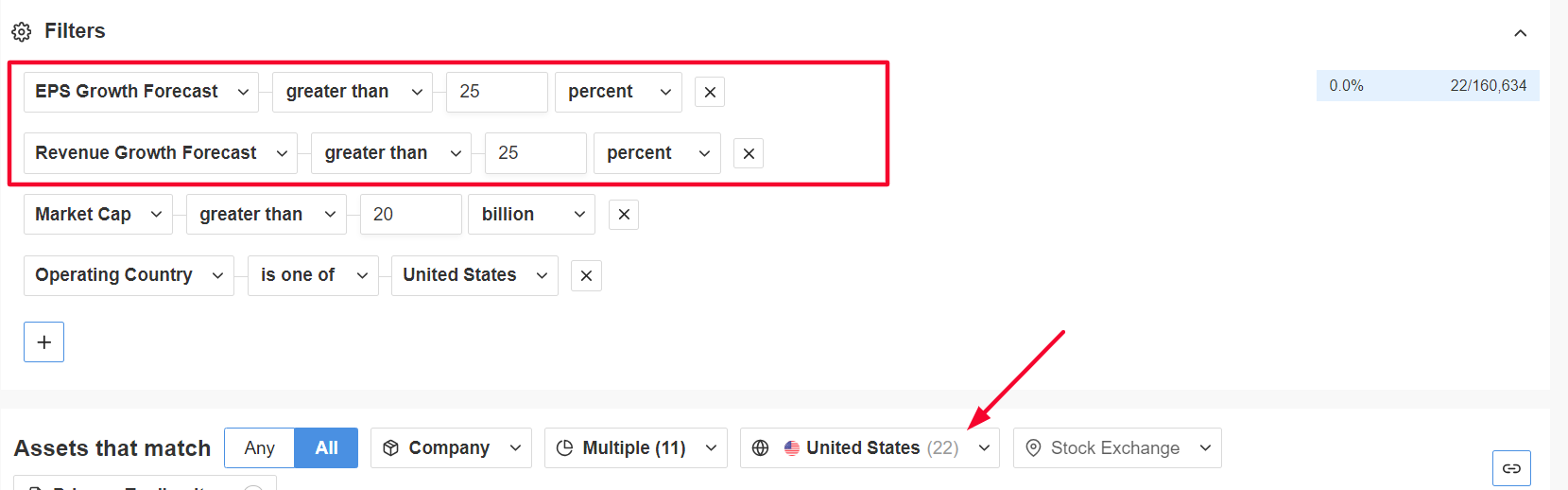

Amid the current backdrop, I used the InvestingPro stock screener to search for companies that are poised to deliver annualized growth of at least 25% or more in both profit and sales as the fourth quarter earnings season kicks off. In total, 22 names showed up.

Source: InvestingPro

InvestingPro's stock screener is a powerful tool that can assist investors in identifying high quality stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters.

Some of the notable tech-related companies to make the list include Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), Arista Networks (NYSE:ANET), Snowflake (NYSE:SNOW), CrowdStrike (NASDAQ:CRWD), Datadog (NASDAQ:DDOG), Zscaler (NASDAQ:ZS), MongoDB (NASDAQ:MDB), and Cloudflare (NYSE:NET).

Meanwhile, JPMorgan Chase, DoorDash (NASDAQ:DASH), Las Vegas Sands (NYSE:LVS), and Royal Caribbean Cruises (NYSE:RCL), are a few consumer-sensitive stocks to watch out for that are also projected to deliver upbeat Q4 earnings and revenue growth.

Source: InvestingPro

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.