- Q3 earnings season expected to be a major test for the market

- S&P 500 Q3 earnings growth of 2.9% and revenue growth of 8.7%

- Energy, Industrials likely to stand out

- Financials, Communication Services likely to struggle

As Wall Street's third quarter earnings season kicks off next week, investors are bracing for what may be the worst reporting season in two years.

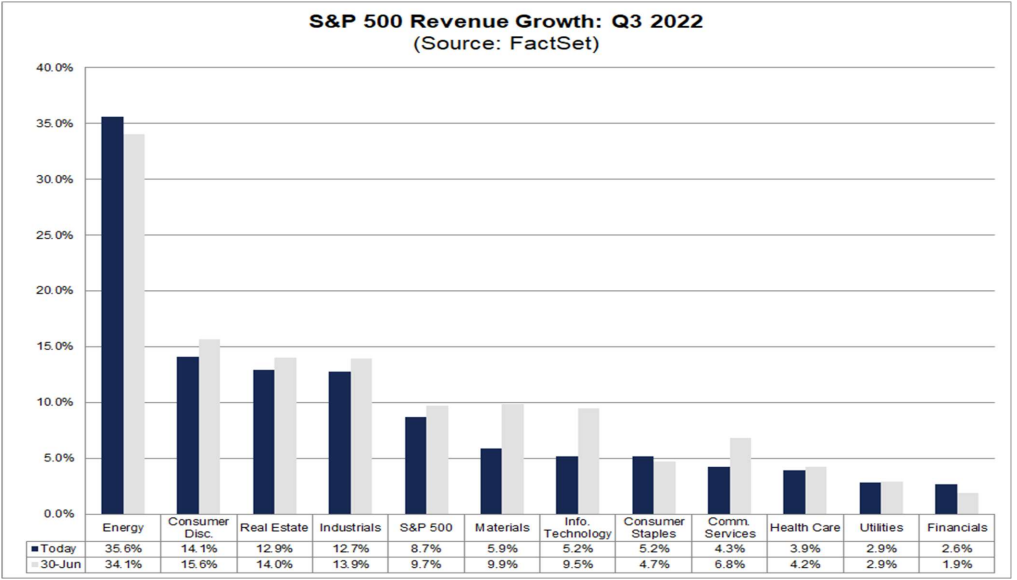

Analysts predict the S&P 500’s earnings growth rate will be just 2.9% which, if confirmed, would be the slowest year-over-year (yoy) increase since Q3 2020, according to FactSet data.

Revenue growth expectations of just 8.7% yoy are also worrying as if that is the reality it would mark the first time since Q4 2020 that the index reported annualized revenue growth below 10%, according to FactSet.

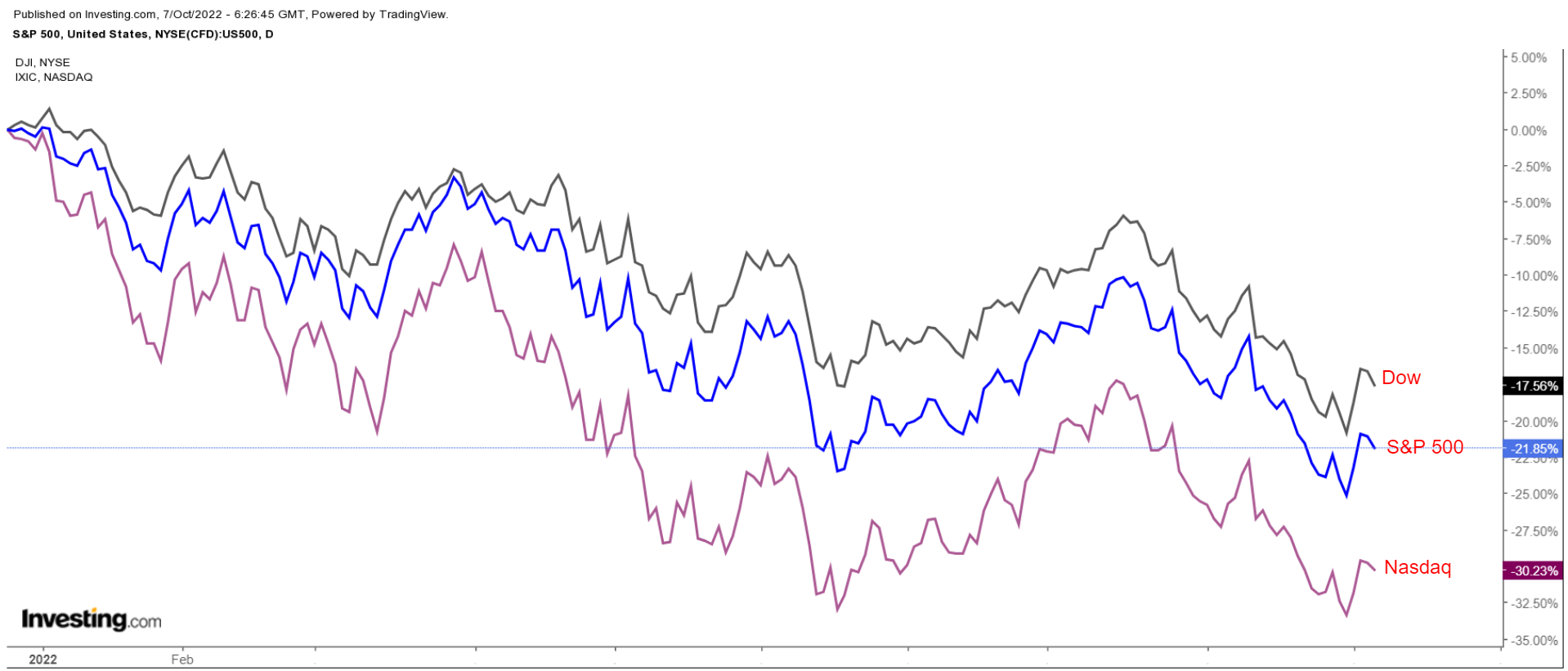

Markets are heading into the reporting season on poor footing as US stocks are on track to suffer one of their worst years in recent history amid concerns that the Federal Reserve’s aggressive rate hikes will result in a possible recession.

The S&P 500 is down 21.4% year-to-date (ytd) and roughly 23% below its Jan. 3 record close. Meanwhile, the Nasdaq, which slumped into a bear market earlier this year, is off 29.2% ytd and 31.7% away from its Nov. 19, 2021, record high. The Dow is down 17.6% ytd and 19% off its record high reached at the start of the year.

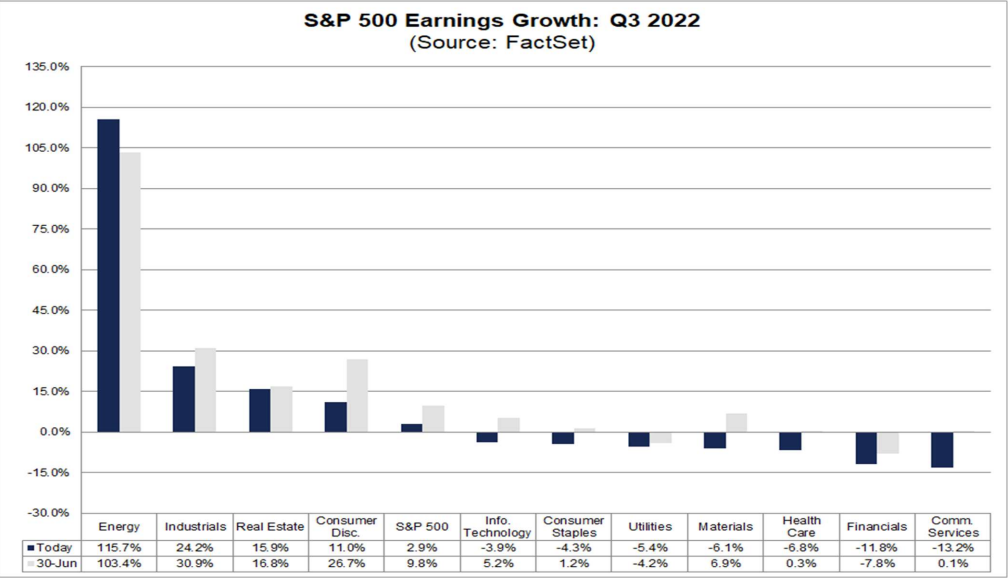

Q3 Sector Estimates: Winners and Losers

The Energy sector is expected to report the biggest yoy gain in earnings with a whopping 115.7% surge in third quarter EPS, according to FactSet. The sector's revenue is expected to increase 35.6% yoy due to higher oil and natural gas prices—the average price of WTI crude in Q3 2022 was $91.62 per barrel, 30% higher than a year earlier.

Industrials are expected to report the second highest yoy gain in earnings with a notable 24.2% jump in Q3 EPS, led by the Airlines, and Aerospace & Defense groups. Despite being the most sensitive to economic conditions, the industrial sector is expected to report the fourth largest yoy revenue growth, with Q3 sales set to rise 12.7%.

In contrast, Communications Services, which includes telecom companies as well as media, entertainment, and online media services providers, is projected to report a 13.2% slump in yoy earnings.

Higher provisions for loan losses, a substantial slowdown in equity trading, and reduced M&A and IPO activity means that Financials, are anticipated to report a mere 2.6% yoy increase in revenue and a slide of 11.8% yoy in Q3 EPS.

Q3 Stocks Biggest Upward EPS Estimate Revisions

At the company level, ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) are expected to be the largest contributors to the yoy spike in earnings for the Energy sector, according to FactSet, with the two oil giants forecast to report triple-digit profit growth and double-digit sales growth.

Other names in the group that are set to enjoy significant improvements in Q3 results are Occidental Petroleum (NYSE:OXY), which is projected to post EPS of $2.68, up 208% from a profit of $0.87 in the year-ago period, and ConocoPhillips (NYSE:COP), which is anticipated to record a 117% yoy increase in EPS.

In the Industrials sector, Delta Air Lines (NYSE:DAL), Southwest Airlines (NYSE:LUV), and United Airlines (NASDAQ:UAL) are a few to watch amid the rebound in air travel. Delta is forecast to post Q3 EPS of $1.56, improving 420% from last year.

Raytheon (NYSE:RTN) Technologies (NYSE:RTX), Lockheed Martin (NYSE:LMT) and Northrop Grumman (NYSE:NOC) are other notable names in Industrials enjoying upward revisions to Q3 EPS estimates as the geopolitical conflict between Russia and Ukraine drags on.

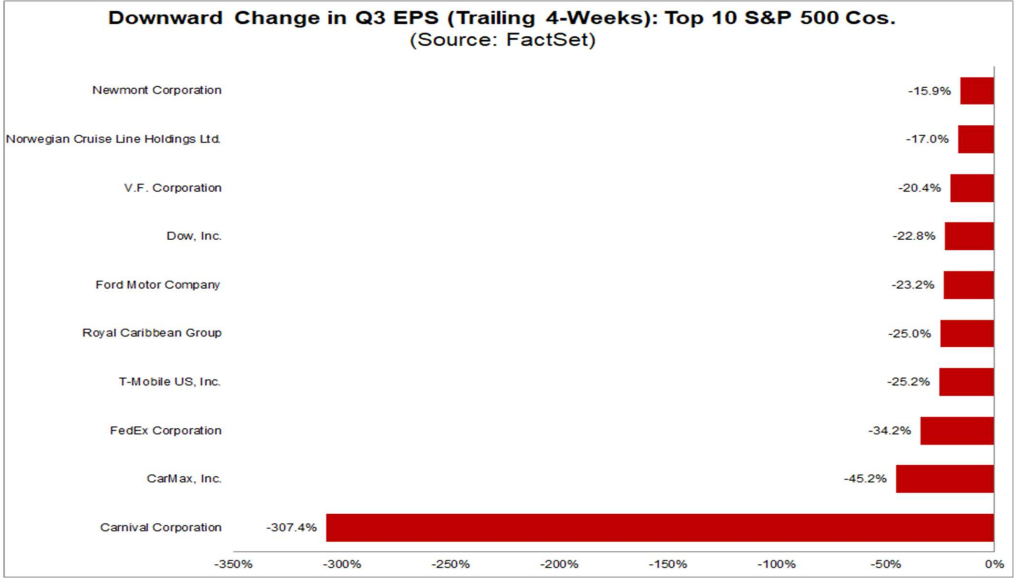

Stocks With Largest Cuts To Q3 EPS Estimates

On the downside, Meta Platforms (NASDAQ:META) and Netflix (NASDAQ:NFLX) have been two of the most significant contributors to the decrease in expected earnings for the Communication Services sector in Q3. META is forecast to see its EPS tumble 40% to $1.93, while Netflix is expected to see its earnings drop 31.7% to $2.18 per share.

The Technology sector is perhaps the most vulnerable to rising interest rates and elevated inflation and Intel (NASDAQ:INTC) is one of the largest contributors to the decline in expected earnings for this sector. The struggling chipmaker is projected to post EPS of $0.35, down 79.5% from EPS of $1.71 in the year-ago period. NVIDIA (NASDAQ:NVDA), which is anticipated to report a 40% yoy drop in EPS, is another name getting its EPS estimates cut lately.

Several stocks in the Consumer Discretionary sector which are heavily reliant on the strength of the US consumer are also expected to post disappointing results. Carnival (NYSE:CCL), Royal Caribbean (NYSE:RCL), and Norwegian Cruise Line (NYSE:NCLH) have all seen their estimates slashed amid the current economic environment.

CarMax (NYSE:KMX), FedEx (NYSE:FDX), T-Mobile (NASDAQ:TMUS), and Ford (NYSE:F) are a few more names you should stay away from as they prepare to report their Q3 earnings.

It’s All About Guidance

Investors will be paying close attention to announcements on forward guidance and updated outlooks for the months ahead, given a toxic combination of rising interest rates, mounting recession worries, and sky-high inflation.

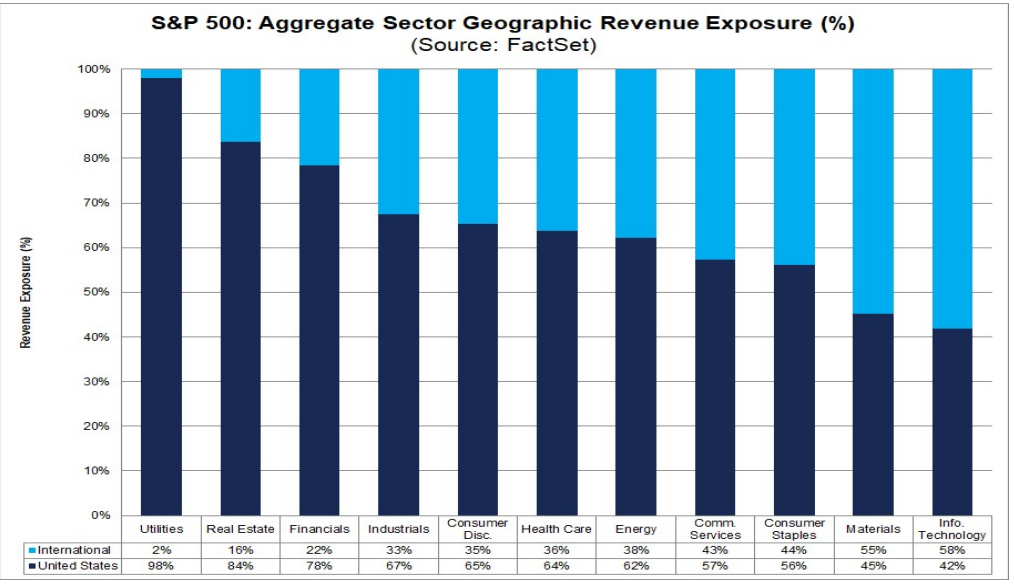

The strength of the US dollar will also be of major importance as it creates significant headwinds for companies with international revenue exposure, mainly those in the Information Technology, and Materials sector.

Other key issues likely to come up will be supply chain concerns, the health of the US consumer, as well as future hiring plans.

Considering the multitude of worries outlined, I expect to see a higher percentage of companies lower their outlook for earnings and sales growth for Q4 2022 and early 2023, and possibly even withdraw forward guidance altogether.

The big US banks will kick off the earnings bonanza when JPMorgan Chase (NYSE:JPM) reports on Friday, Oct. 14, along with Citigroup (NYSE:C).

Get ready for more volatility, the next major test for the stock market is upon us.

Disclosure: At the time of writing, Jesse is long Exxon, Chevron, and Occidental Petroleum. He is short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.