Global markets

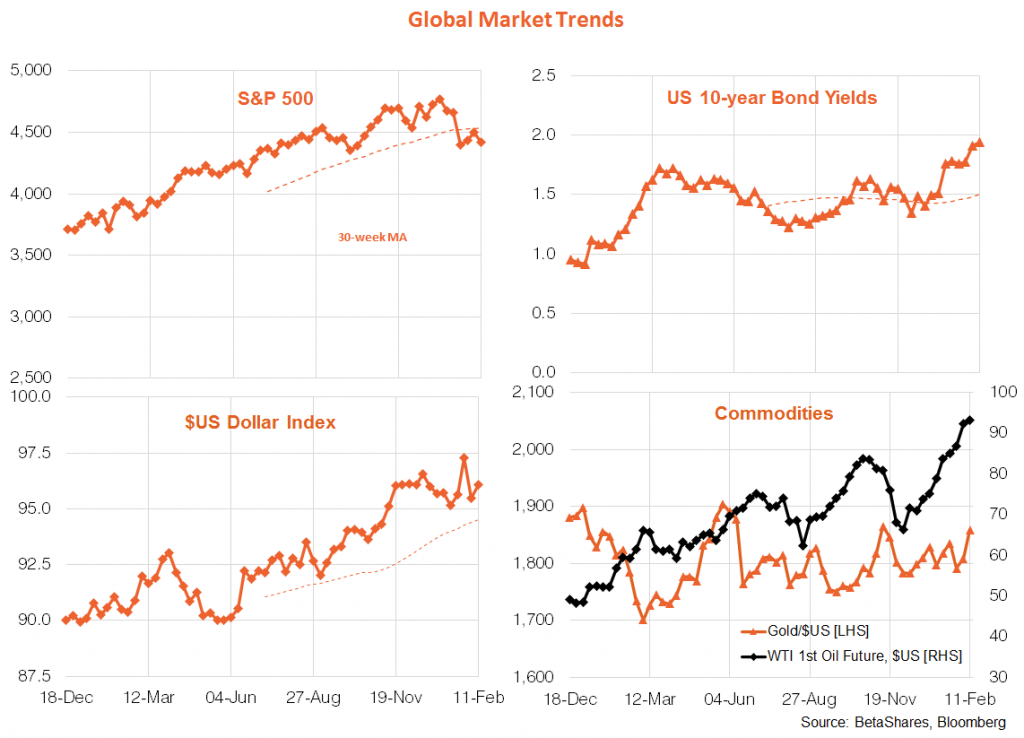

A hot U.S. consumer inflation report and fears of a Russian invasion of Ukraine dominated market sentiment last week, resulting in global equities retreating after bouncing back over the previous two weeks. Markets are once again looking vulnerable – if Powell does not get you, Putin just might. The S&P 500 dropped 1.8%, while U.S. 10-year bonds ended at 1.94% after breaking above 2% earlier in the week.

Equities started the week on a hopeful note, with investors cheered by commentary suggesting the Fed at least won’t hike rates by 50bps at the upcoming March meeting. But a stronger then expected CPI report – headline inflation hit 7.5% compared to a market expectation of 7.3% – led those fears to resurface, which was not helped by comments from the Fed’s Bullard ruling out neither such a move nor even a move before the meeting. Adding to the angst, no less than the White House warned of a possible Ukraine invasion on Friday, which further hit stocks and sent the oil price soaring.

Goldman Sachs (NYSE:GS) on Friday also argued the Fed would raise rates seven times this year – by 25bps at each of the remaining meetings! What’s more, this now is virtually fully priced into the market. Another worry is Friday’s further slump in U.S. consumer sentiment, reflecting fears over both interest rates and inflation.

Against this backdrop, the broadly solid Q4 earnings season still underway has taken a back seat.

In terms of the week ahead, Ukraine clearly will be in focus. Otherwise, minutes to the Fed’s January meeting are released Wednesday as is the producer price index. There’s also no fewer than six Fed speakers out and about, who no doubt will share their own views about a likely 50bps move in March and the road ahead. All up, it’s a minefield of potentially explosive issues that the market will need to carefully navigate through.

Among global equity themes, U.S. relative performance slumped last week, though Friday’s weak U.S. close will be reflected across Asian markets today. As would be expected, given higher interest rates and Oil prices, value stocks had another weekly win over growth stocks.

Australian markets

There was mixed to somewhat softer local data last week.

Local data continues to be heavily influenced by the timing of COVID waves, among other factors.

Although nominal retail sales dropped 4.4% in December, retail volumes were up a blistering 8.2% over the quarter. ANZ Jobs ads dropped in January for the second month in a row, though remain at high levels. The NAB index of business conditions also eased back in January, with firms still reporting concern over cost pressures. Consumer sentiment also dropped. All up, the Omicron wave has led to some softening in economic conditions over the Christmas/New Year period, though assuming this wave will also crest the outlook remains positive.

The local bond market, meanwhile, continues to ignore the dovish signals from the RBA – with rate hikes by mid-year still expected. Ongoing firm Iron ore prices continue to support relative performance by resource stocks, while growth/technology stocks remain under pressure.

RBA board minutes on Tuesday will attract some interest, though we probably know most of what the Bank is thinking given the flurry of commentary over the previous week. Thursday’s January labour market report is the data highlight, with a modest 15k drop back in employment expected with the unemployment rate holding steady at 4.2%. One risk is a lurch down in the unemployment rate to under 4% if we also see a big drop in labour force participation due to Omicron restrictions/concerns.