- Reports Q2 2022 results on Tuesday, Feb.8, after the market close

- Revenue Expectation: $1.14 billion

- EPS Expectation: -$1.21

Today’s earnings release from exercise product maker Peloton (NASDAQ:PTON) has grown in importance after reports surfaced on Friday that US corporate giants such as Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), and Nike (NYSE:NKE), were exploring the acquisition of the interactive fitness platform.

After the news broke on Friday evening, the stock surged more than 30% in after-hours trading. However, it ended up correcting to an almost 21% gain during Monday's Wall Street session, closing at $29.75.

Interest emerged after the shares of the New York City-based company—best known for its exercise bikes and remote cycling classes—came under severe selling pressure.

As reopenings cooled the pandemic-fueled boom in home-based fitness, Peloton shares went on a year-long slump lower. The broader market selloff in growth stocks, supply chain disruptions, and concerns that revenue and margins are shrinking as customers cut spending further added to the dismal picture, amounting to an 81% loss in market cap.

In its last earnings report, Peloton said that it expected sales of $4.4 billion to $4.8 billion in fiscal 2022, much lower than the $5.4 billion sales the company forecast three months before.

Forecasts are that later today the company will report a loss that widened to $1.21 a share in the fiscal 2022 second quarter.

In a letter to shareholders, Chief Executive Officer John Foley wrote:

“We anticipated fiscal 2022 would be a very challenging year to forecast, given unusual year-ago comparisons, demand uncertainty amidst re-opening economies, and widely-reported supply chain constraints and commodity cost pressures.”

No Quick Fixes

The challenges that Peloton is facing may not have a quick fix, especially when the economic reopenings are bringing customers to traditional gyms. However, PTON’s share weakness offers an attractive entry point to potential investors.

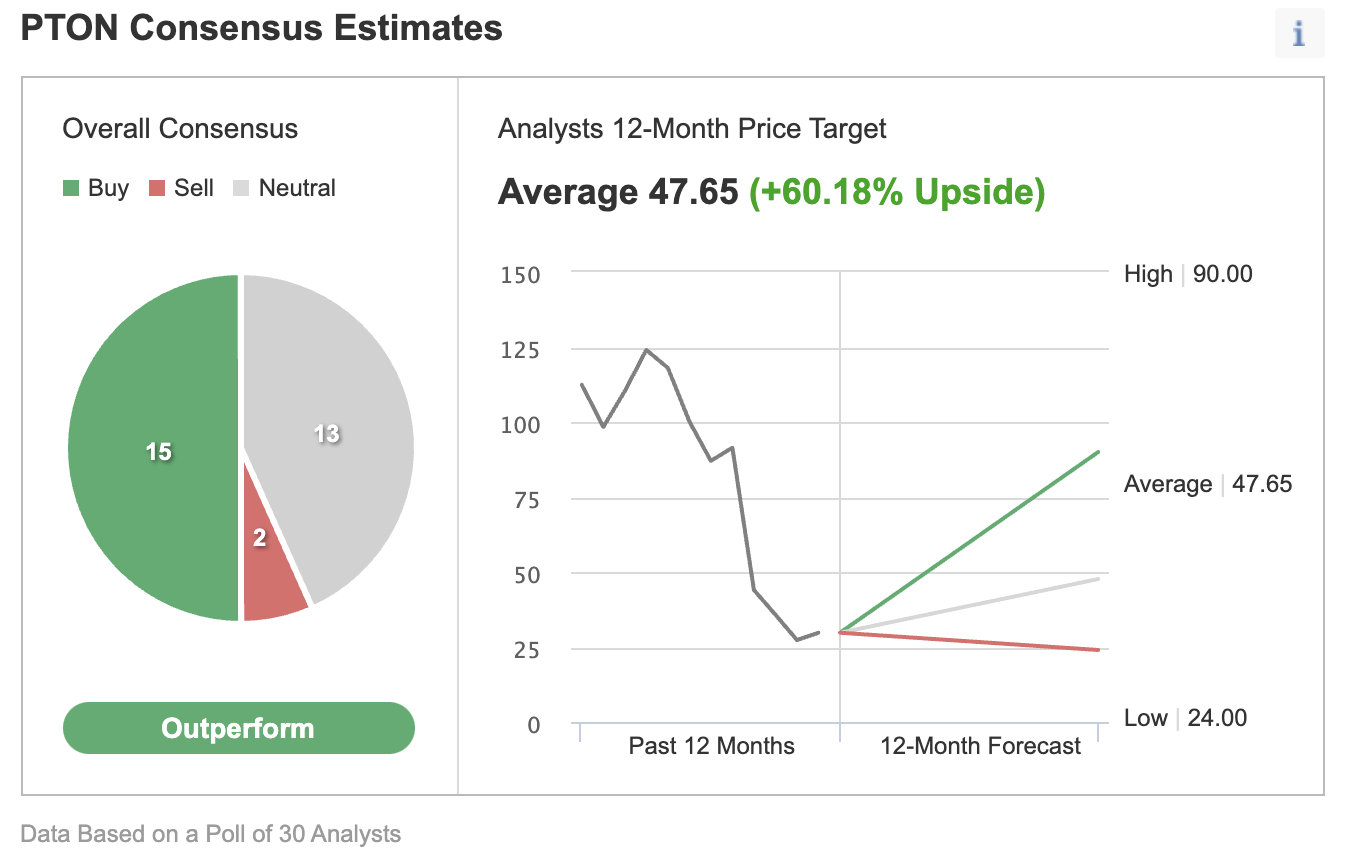

A poll of 30 analysts surveyed by Investing.com provides a 12-month price target of $47.65 per share, a 60.18% upside for the stock.

Source: Investing.com

However, Friday's Wall Street Journal report, which broke the news that Amazon has spoken with advisers about a potential deal, has put some tailwinds under PTON stock. Analysts have speculated that Apple could also be a potential buyer. And, according to the Financial Times, Nike too is considering a separate bid for Peloton.

These reports have helped the stock recover from its deep slump, but some analysts aren’t sure a deal is imminent. BMO Capital Markets wrote in a note on Sunday:

“One has to ask whether the brand is simply too small to make a difference to the world’s largest companies.”

The analysts questioned if Peloton’s roughly 2.8 million subscribers overlapped with Nike, Amazon, or Apple. BMO's note added:

“If the world’s strongest companies weren’t interested when Peloton was expected to grow 15 to 100 million subscribers, are they looking for a fixer-upper now that engagement/demand has faltered?”

Bottom Line

Peloton's earnings report later today is likely to disappoint again as the fitness company struggles to maintain its growth momentum after the pandemic-fueled surge ended.

However, more important information could be provided if management confirms it’s seeking a strategic tie-up with a more significant and deep-pocketed buyer. That admission could propel PTON stock even higher.