DXY remains soft and EUR on a tear:

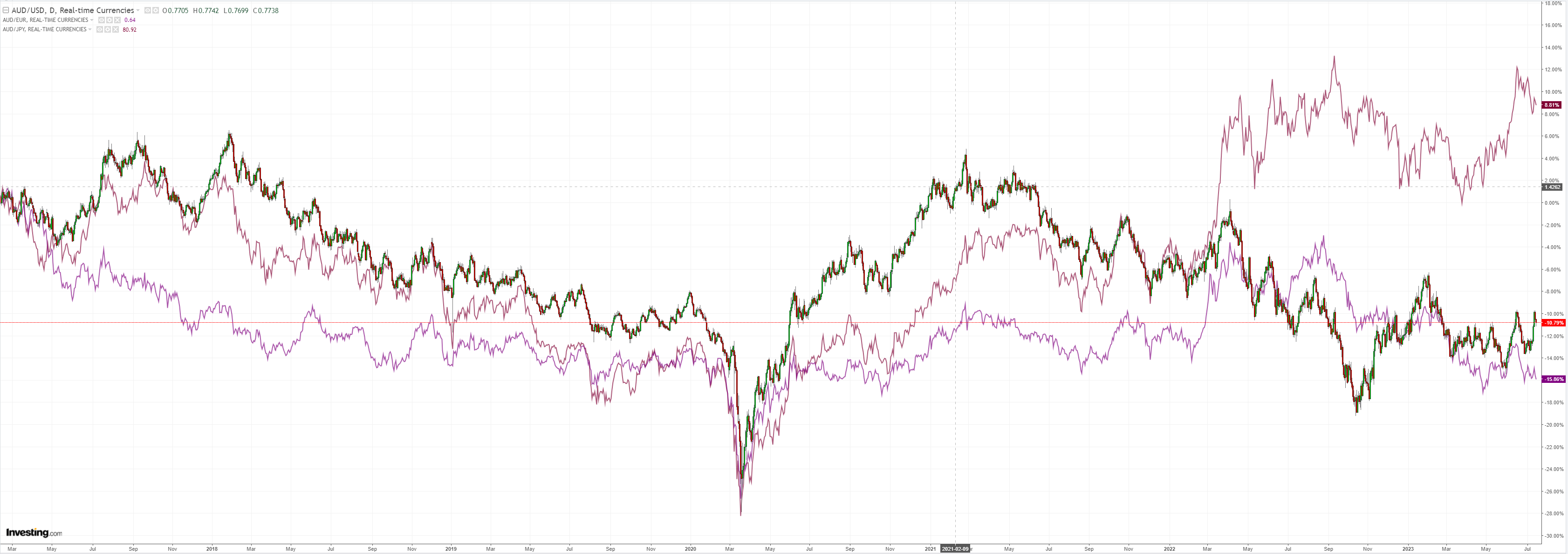

However, AUD has rolled over anyway:

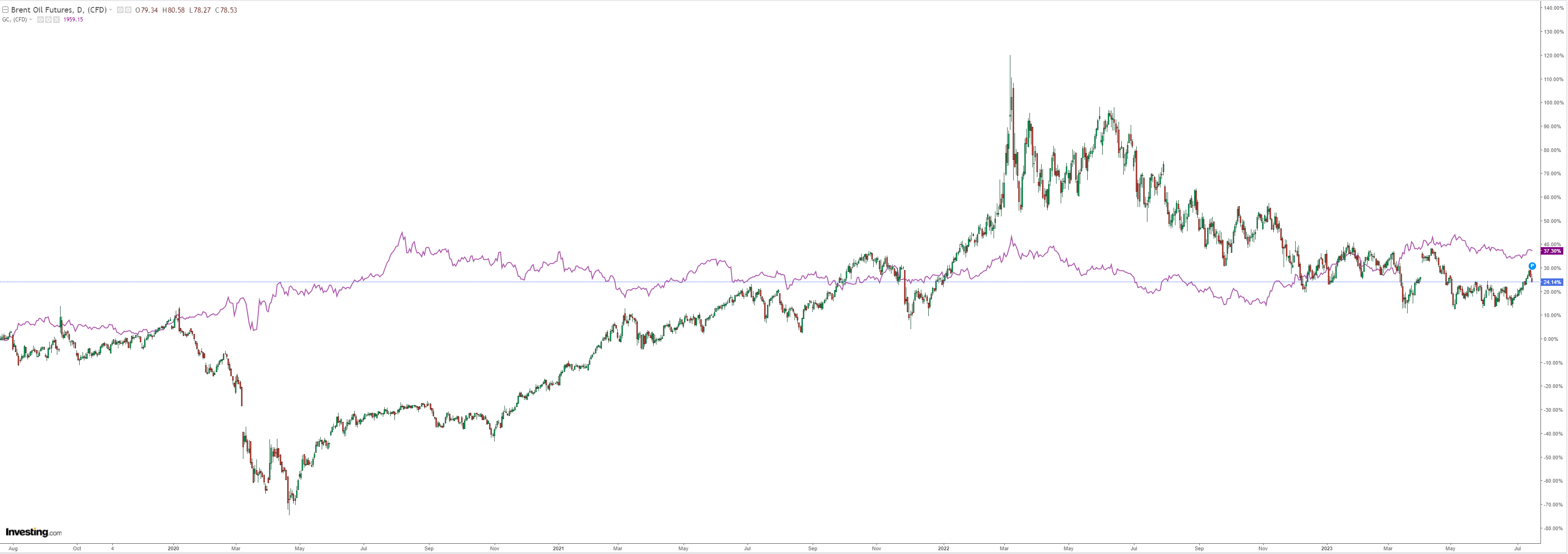

China hit the Complex. Oil:

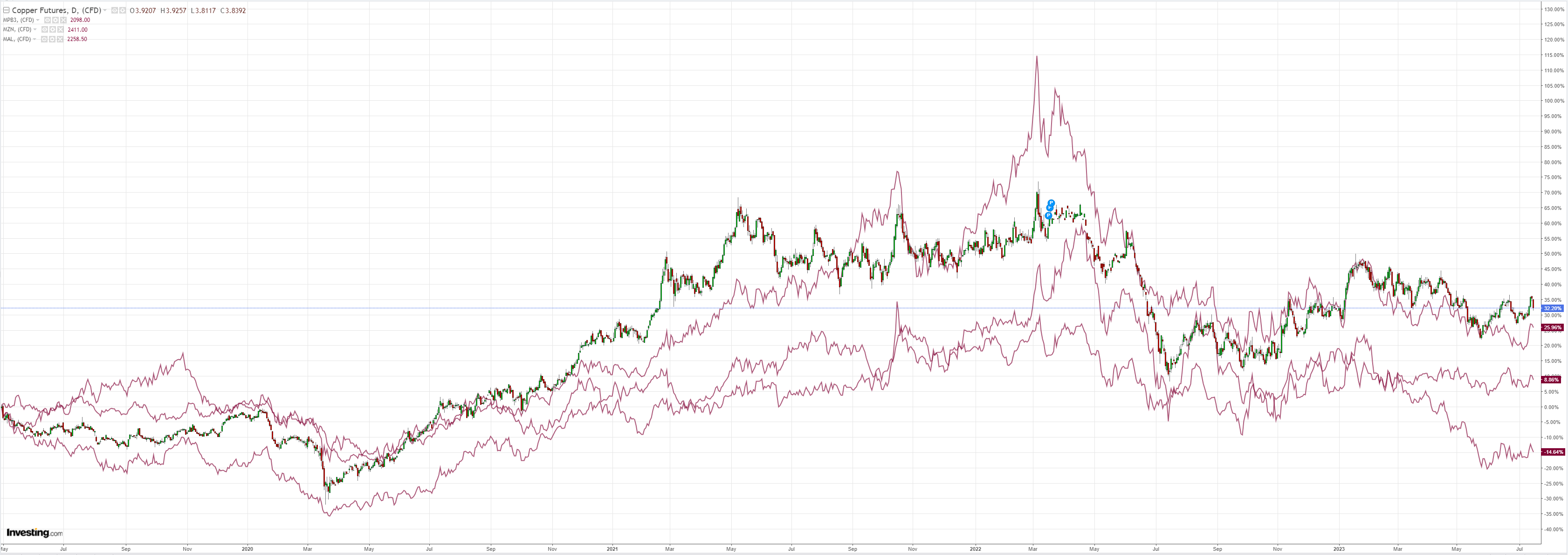

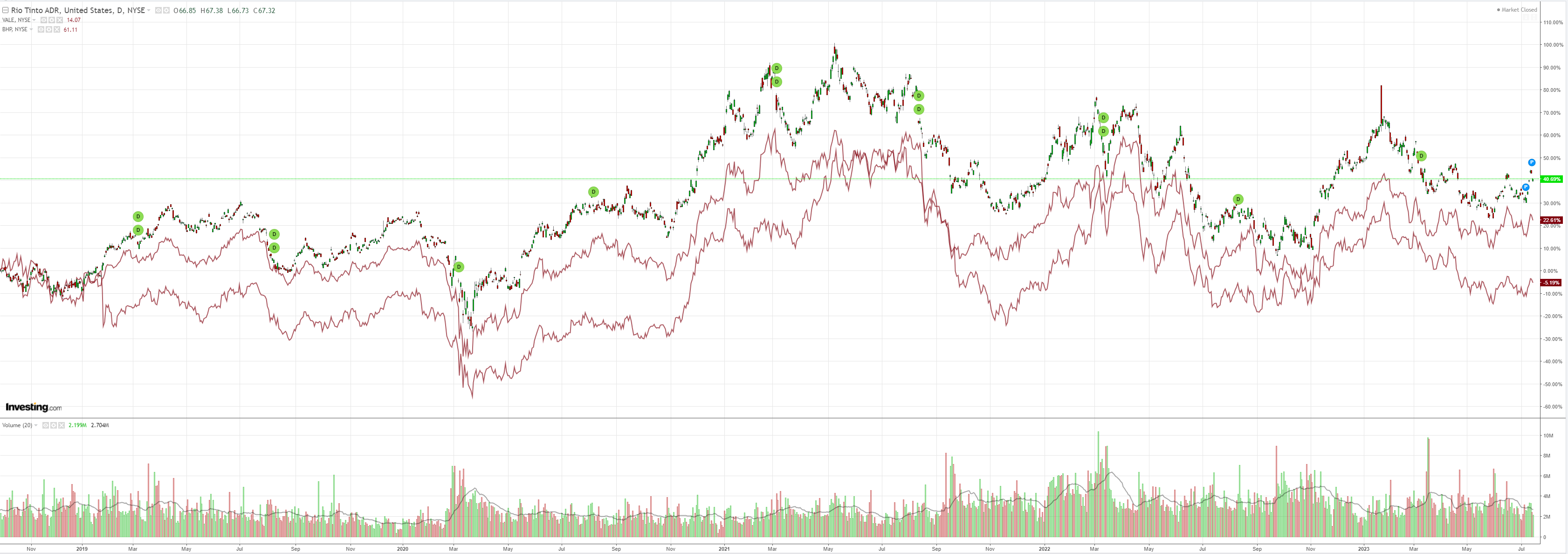

Dirt:

Miners (NYSE:RIO):

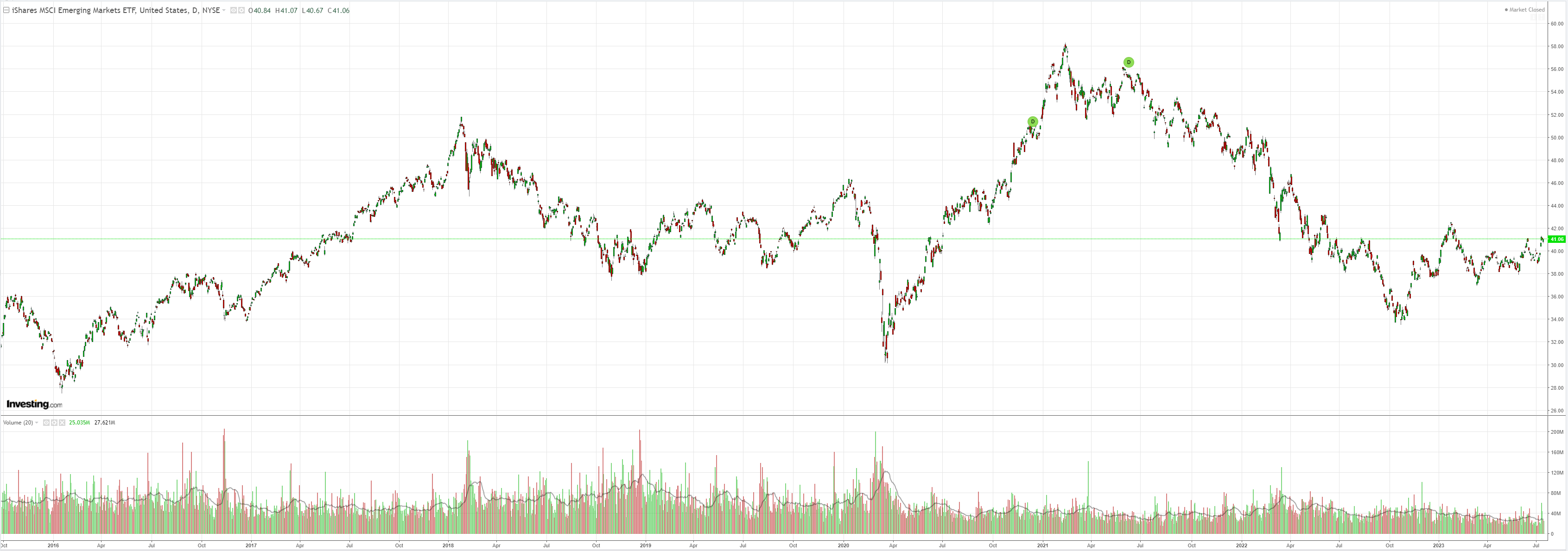

EM (NYSE:EEM):

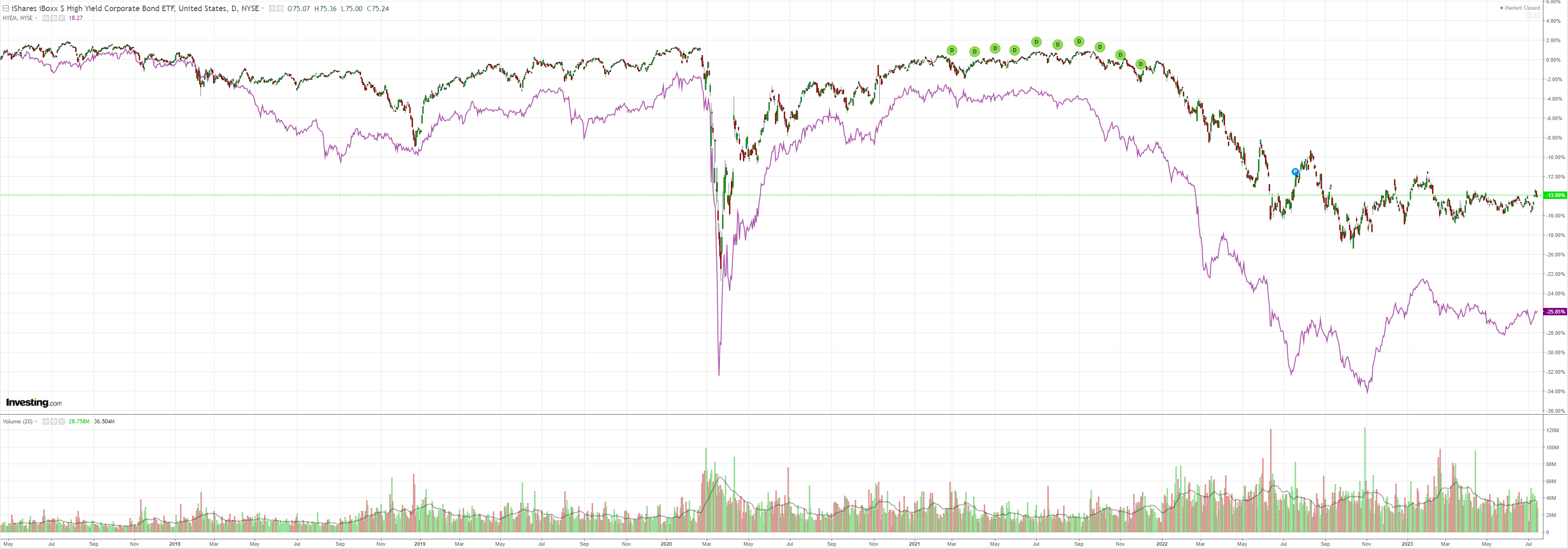

Junk (NYSE:HYG):

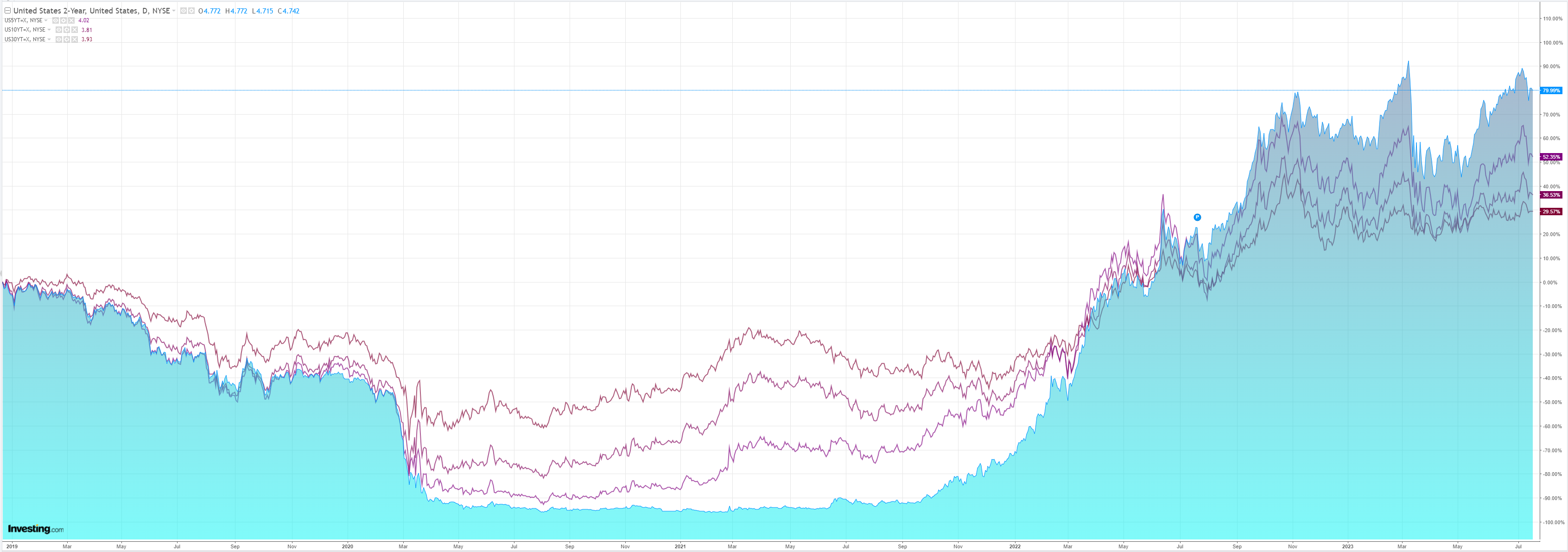

US yields eased:

The bubble grew:

Peak China is here. As Nomura’s Lu Ting said yesterday:

…[stimulus] measures may not turn things around, due to weak confidence, negative sentiment, the huge fiscal cliff due to the collapse of land sales, clogged transmission channels, a shrinking tool box, slow decision-making on economic matters and conflicts among multiple targets. We believe markets should curb their expectations for a fast, cure-all package and instead embrace expectations of a growth slowdown towards below 4.0% in 2024.”

China is attempting to navigate its way through the “impossible trinity”. It is a fact that any nation can only control two of three variables in macro management: interest rates, currency value and capital flows.

China has chosen to sacrifice the property market in this endeavour. It is holding interest rates too high to engender any property recovery to protect the currency and sustain capital flows.

The issue is can China grow at all without property?

The answer is barely. 4% GDP is more like 1-2% when calculated properly.

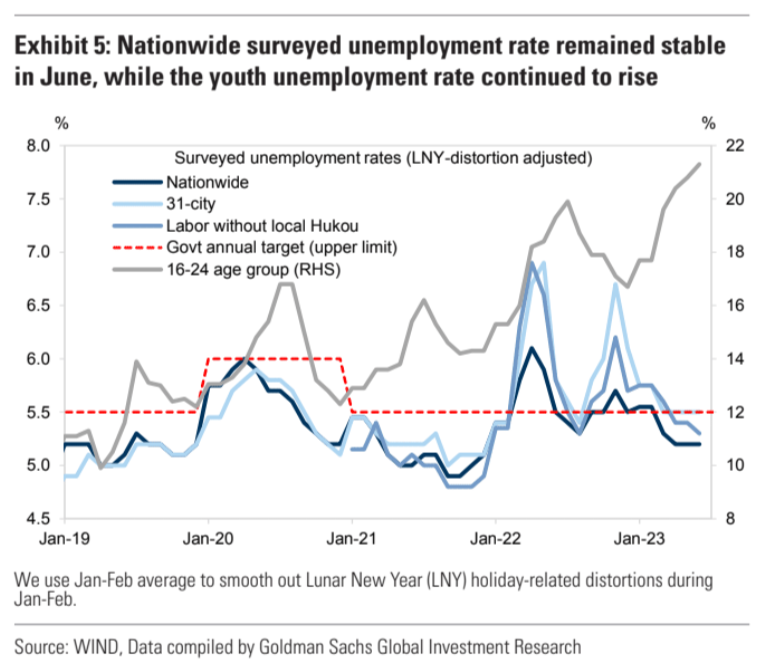

This is not enough to hold youth unemployment down so political risks for the CCP further complicate the equation:

This is Peak China unfolding before our very eyes. The CCP risks losing its legitimacy if it does not liberalise the economy much more aggressively to rebalance private ownership, consumption and services that soak up labour slack.

But it can’t do it for fear of that very freedom.

If this continues, Xi may be forced to weaponise unemployment in an invasion of Taiwan to prevent revolution at home.

Anybody holding unhedged Chinese assets at this juncture is a complete idiot.

That includes the entire Australian economy and its currency.