The People’s Bank of China has finally made their move. After the Shanghai Composite turned negative for the year, China’s central bank responded by once again cutting interest rates.

While seen as stimulatory on the surface, it is another public admission from the secretive, planned economy that Beijing is still worried about the sharp decline in economic growth coming out of the country.

“CHINA CUTS RRR RATIO BY 50 BPS TO 18%, CUTS INTEREST RATES.”

“CHINA CUTS 1 YEAR DEPOSIT RATE, LENDING RATE BY 25 BPS EACH.”

With interest rates slashed again to try to stimulate spending, by cutting the RRR Ratio, the central bank cuts the amount of capital banks must set aside. This is essentially designed to flood the real economy with stimulatory credit.

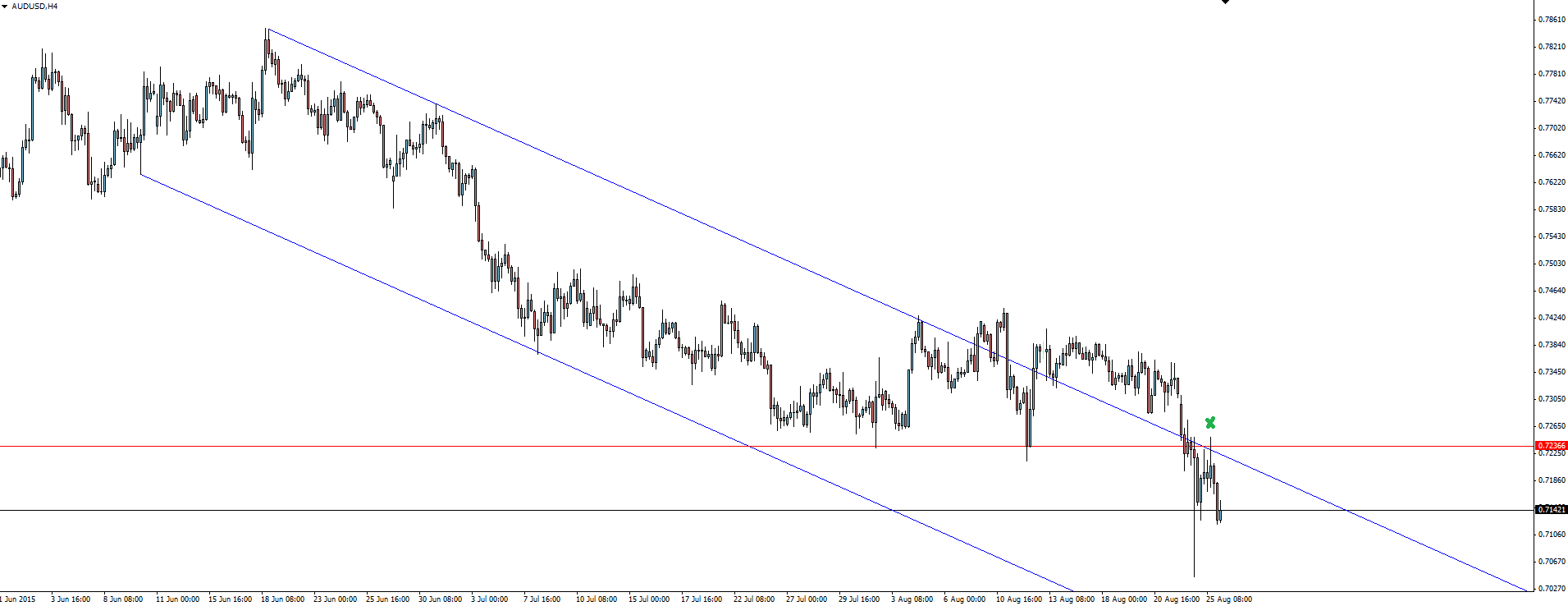

AUD/USD 4 Hourly:

You can see the spike marked on the Aussie chart where the PBOC made their move but the rally failed at its first technical hurdle trying to retest previously broken support as resistance. By then it was too late and the fear in US stocks markets had returned, dragging the Aussie down with it.

The early failed technical signs show the reactive nature of the PBOC move. It would seem that they’ve made their move a couple of days too late and just have to weather the storm until the fear starts to subside.

Turnaround Tuesday Short Lived:

“S&P 500 GOES NEGATIVE, ERASING GAIN OF AS MUCH AS 2.9%.”

The SP500 Index experienced all the whipsawing expected from a panic stricken market, gapping up and rallying to a 2.9% increase, before experiencing a wild turnaround in the final few hours of trade and dropping to close 1.4% down!

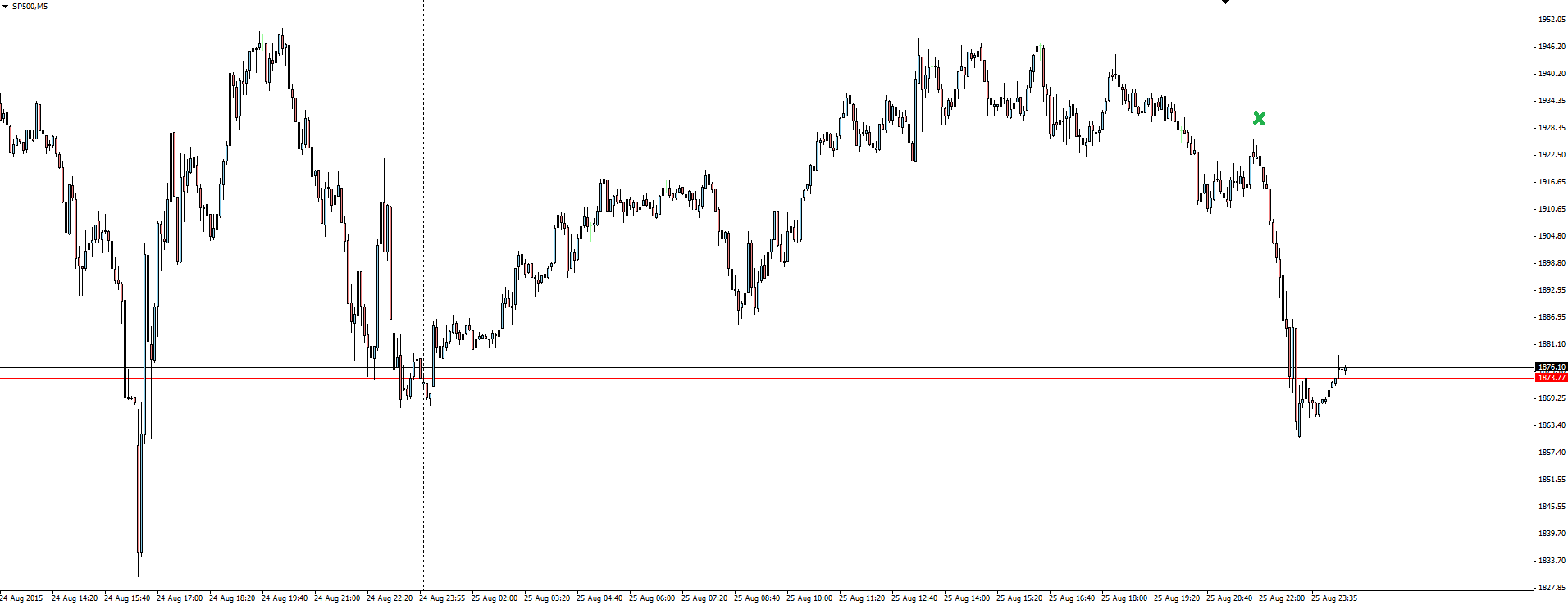

SP500 5 Minute:

The sell-off at the end of the trading session doesn’t look that bad except when you take into account that it’s back to yesterday’s lows. It’s all about sentiment and the fact that even after the potentially positive move from the PBOC, the fact that stocks sold off as hard as they did is huge.

Markets are nervous. There’s been plenty of talk about value and buying dips for the long term on the television to calm people down (blah blah blah), but when asked to put their money where their mouth is, none of the major players have any conviction when it comes to buying the dip at this time. Definitely a worry after seeing the Chinese injection all but withered within a single trading session.

So do we have something… anything positive? Last night’s August CB Consumer Confidence survey actually printed a sharp increase and came in above expectation. The 101.5 print was actually the 2nd highest print in more than 8 years. While dodging this week’s moves, this increase has been credited to the much more favourable labour market numbers and confidence that the Fed has spoken about in the early parts of August.

Many of the investment banks are still delivering reports that speak of an expectation that the Fed will still hike in September but the futures markets have crashed to pricing in now only a 1 in 4 expectation of a hike. Everything has changed.

On the Calendar Wednesday:

NZD: Trade Balance (-649M v -665M expected)

AUD: RBA Gov Stevens Speaks

USD Core Durable Goods Orders m/m

USD FOMC Member Dudley Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.