By Caroline Gerber

Risk-on investor sentiment has propelled markets to new records as 2019 comes to a close. In the last few weeks of the year, U.S. equities rallied to all-time highs with the S&P 500 up about 28.5% ahead of the final day of trade, fueled, in part, by the Fed's decision to cut interest rates three times this year, the most cuts per year since the 2008 financial crisis.

Adding to the positive attitude: recent major geopolitical risks have cooled. The U.S.-China trade dispute, which has kept investors on edge since mid-2018 and cost global economy roughly $700 billion USD according to the IMF, could see a Phase One agreement signed in January. This alone boosted investor confidence, and global and U.S. markets, in December.

Brexit, the other political stalemate worrying investors, is also heading toward some sort of decisive resolution after the UK's Dec. 12 general election was won resoundingly by Prime Minister Boris Johnson. That victory shifted the political map, empowering the PM to leave the EU even if the inevitable struggle of “getting Brexit done” ends up being a hard exit.

While optimism powered equities, persistent global economic uncertainties have helped lift gold. The safe haven precious metal is up about 16.31% with just one trading day left in 2019. Trade war risks, stagnating growth in Europe and Japan and political unrest in Hong Kong and Latin America continue to be market hazards.

On the domestic front, many of 2019's highly anticipated unicorn IPOs, including Uber (NYSE:UBER), LYFT (NASDAQ:LYFT) and Slack (NYSE:WORK), left investors seriously underwhelmed. Another heralded debut, WeWork, collapsed entirely before even making it to the starting gate.

For all the sound and fury surrounding the resurgence of initial public offerings, however, it was Saudi Aramco's (SE:2222) tender, on Riyadh’s Tadawul exchange, that eclipsed them all, proving to be the largest IPO in history, raising 25.6 billion which gave the oil producer a valuation of $1.7 trillion. (Since Aramco shares reached a high of $38 on Dec. 16, they have dropped 7.63% to the current price of $35.1).

To kick off 2020, we turned to some of our most popular contributors for insight into where they see markets heading in the coming year. In this part 1 of our two-part series, three contributors weigh in on where they think equities will be heading next year. Tomorrow, New Year's Day, we'll publish contributor analysis focused on commodities, forex and the general market outlook.

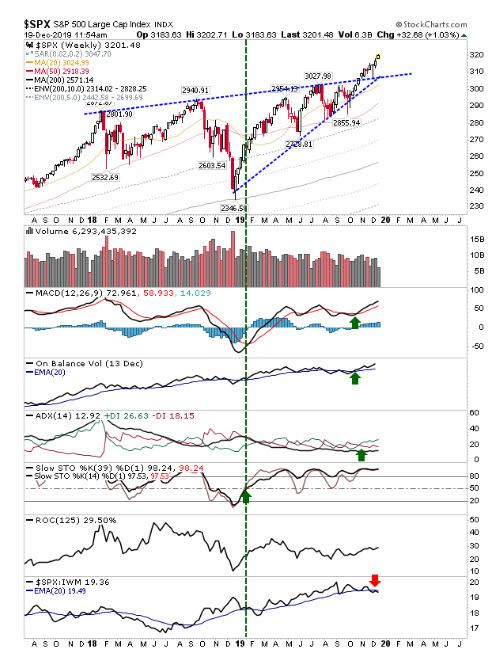

Declan Fallon: New Breakout Following Cyclical Bear Recovery

Most of 2019 was spent making back the losses from the latter part of 2018 with the S&P and NASDAQ waiting until October to finally provide the rally that delivered new all-time highs for this year. The Russell 2000 still has some ground to make up, with the 2018 high around 1,740 remaining some distance away.

So while some may talk of big gains delivered from the start of the year for indices, what we are really looking at is a new breakout following a cyclical bear recovery. When framed like this, the true winner for 2020 could be growth stocks.

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is primed to challenge the 2018 high with a mini-breakout from this year’s consolidation. This is a very healthy looking chart.

Adding fuel to the rally is an election year that Trump will be keen to pump.

The Semiconductor sector has done well for 2019. Like the rail companies of old, it is a bellwether for the economy, so if it is booming, businesses are expanding and updating their technology requirements. While the pace of this rally may slow for 2020, the tone has been set for the year.

Bitcoin traders may have to wait until the summer before they see some joy to the upside. The 200-day MA was the bounce point from early in the year and 4,500s was a resistance level in 2017, so it may turn into support for 2020. Bitcoin is to Millenials as Gold is to Boomers; it will have its day again.

Michele Schneider: Watch Growth Signals From Russell, Retail, Transports

Considering the December rally in the indices, and particularly the S&P 500, NASDAQ 100 and the Dow, two possible scenarios emerge for 2020:

Either the market is forward-thinking and assumes the economy will begin to expand in 2020. Or, by keeping interest rates near zero or in some cases negative, the Federal Reserve and global central banks have incentivized corporations to continue their record share-buybacks for the upcoming year.

To date, corporations have done little to expand development or hiring. Instead, they have mainly raised dividends to reward shareholders as well as invested in their own stocks. That will have to change to keep up with the tight job market.

To tell if the U.S. economy is indeed expanding, investors should watch the domestically focused Russell 2000 along with two key sectors:

The Russell 2000 (IWM) is the best representative of the U.S. economy. It's composed of small cap companies that manufacture or produce goods in the U.S. To date, IWM has begun to move out of a base, but it's still well off the all-time highs made in 2018. We can consider IWM as the “supply” side of economics.

Transportation (NYSE:IYT) has also lagged the SPX (via the SPDR S&P 500 ETF (NYSE:SPY), the NASDAQ (via Invesco QQQ Trust (NASDAQ:QQQ) and the Dow (via SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA)). With the recent dismal performance of FedEx (NYSE:FDX), transportation, or the “demand” side of economics has a major job to do to prove goods are robustly moving throughout the country. IYT must hold over 188.00 and eventually clear 200.00.

Bricks-and-mortar Retail (NYSE:XRT) has been the biggest laggard with retail sales weak. This sector has been the ugly duckling, reflecting high consumer debt likely to increase further during the holiday season. Therefore, XRT must hold above 44.00 and clear 47.00 or the 2019 highs.

Regardless of what the key index and sectors do, geopolitically 2020 is likely to become more volatile. That makes stagflation another real possibility.

In 2019, the ratio between stocks and commodities hit a 100-year low. As we end 2019, the ratio has contracted some but can shrink much more in 2020. Since 1979, inflation has remained muted. Given statements by Steven Kaplan, the President of the Dallas Reserve, that interest rates will remain low and the future of the dollar as the world’s reserve currency is questionable, the best trades for 2020 could be in commodities. There will be more on this tomorrow.

To summarize, investors need to watch the small caps, transportation and bricks-and-mortar retail sectors for signs of economic growth or stagnation. With low interest rates, an uncertain future for the dollar and rising geopolitical volatility, inflation should increase with the possibility of an emerging stagflation environment.

Jani Ziedins: No 2019 Repeat, But 2020 Could Be Great For Opportunistic Swing-Traders

2019 was the year of a generous and gentle rally. The S&P 500 climbed nearly 30% and most pullbacks were benign, with prices recovering quickly. This strength was definitely aided by a snapback from 2018’s grossly oversold 4th quarter. Regardless of the source, this looks to be the market’s second strongest annual performance since the dot-com bubble.

While crashes are scary and forever seared into the memory of anyone who lives through one, they are exceedingly rare. Most active traders will only see one or two in their careers. Will next year be one of those years? Probably not. Especially since the market is not grossly overbought or overleveraged like it was during the dot-com and housing bubbles. Stocks are definitely not cheap, but they are not “bubblelicious” either.

Unfortunately for us, 2020 will look nothing like 2019 as the market almost never repeats a performance and next year won’t be any different. If we a cross the prospect of a strong rally off the list of possibilities, we're left with three potential scenarios: modest rally, slight dip or stock market crash.

Crossing both extremes off the list leaves us with a little up or a little down. At this point, I could see either happening. The labor market is stretched and labor shortages will keep a lid on economic growth going forward. If a business cannot find new staff, it cannot expand no matter how strong demand is.

On the other side, modest stock market gains could easily be wiped out if an unpopular Republican president is replaced by a Democrat. Fear of looming regulations and taxes will send stocks retreating in the final months of 2020. And so, that is my prediction, fairly modest gains between 5% and 10% if Trump wins. If he loses, expect a flat year.

But where we end is only one piece of the puzzle. How we get there is even more important to active traders.

Everyone knows stocks cannot sit still and like a sugared-up 5-year-old, they always have to be moving. Sometimes they move up for extended periods like they did in 2019. Other times they decline relentlessly as happened in 2008. But most of the time, they move up and down for no other reason than they cannot sit still. 2020 will be a year of moving just because, which means lots of moderate dips and bounces along the way.

While it won’t show up in a long-term portfolio, 2020 will be a great year for the opportunistic swing-trader.