The kiwi dollar is facing a significant rout as concerns over a slowing domestic economy and the potential for looser monetary policy by the RBNZ continue to weigh.

The NZD continued to slide last week, as the market started to price in the impact of a potential rate cut by the Reserve Bank of New Zealand. In recent months, the New Zealand economy has started to slow, in line with its major trading partners, Australia and China.

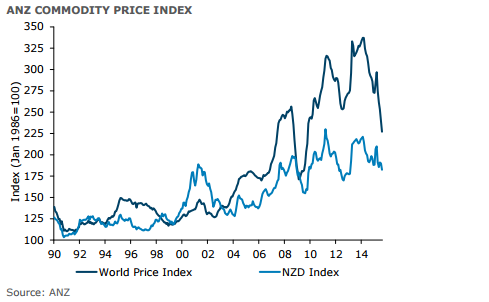

Despite some recent positive results in the Global Dairy Trade (GDT) auction, the nation is still facing diminished demand for its exports as the global macro-economy slows. In fact, the ANZ Commodity Price Index has turned relatively sour, and has demonstrated consistent contraction over the last five months. This, coupled with the CNY yuan devaluation, and the downward revisions for world growth, continue to build a case for the central bank to take action to ease monetary policy.

Subsequently, it would appear that most analysts have the RBNZ taking decisive action on Wednesday to cut the official cash by 25bps. These forecasts are likely, especially given the fact that the central bank has recently introduced a range of macro-prudential policy changes to effectively shield the Auckland property market from an accommodative monetary policy.

However, never underestimate the canniness of RBNZ Chairman, Graham Wheeler. The venerable central banker has often found ways to disappoint currency traders and has an apparent knack in persuading and cajoling the market’s expectations without actually following up with rate cuts. Subsequently, be on the watch out for jawboning come Wednesday, but given the current economic data, a cut in the range of 25bps still remains highly probable.

In the week ahead, the kiwi dollar is likely to experience some sharp volatility as the RBNZ release their decision, but traders should also be aware of the risk that the US economic news poses. Given the importance of the US labour figures, the greater market is likely to focus upon any strength in them for hints of the US Fed’s direction come September.

Subsequently, given the double whammy of an RBNZ rate cut, and a slew of US labour market data that is likely to feed a case for the Fed to hike rates, we could see some sharp falls in the NZD. From a technical perspective, the pair remains decidedly bearish, ahead of the RBNZ decision on rates. The moving averages remain bearish and price action remains stubbornly below the 12 and 30 EMAs. Support is found at 0.6219, 0.6069, and 0.5918. Resistance is found at 0.6406, 0.6521, and 0.6707.

Ultimately, there are two competing monetary policies at play, working directly against any bullish activity in the NZD. It is therefore likely that the 0.62 cent handle will become the major battleground in the coming days.

So prepare your short positions… and watch RBNZ Governor Wheeler’s statement closely, because we might just be witnessing the kiwi peso heading for a strong fall.