NZD/USD has posted slight losses on Tuesday, reversing the upward trend in the Monday session. The pair is trading just below the 0.70 line in the European session. On the release front, New Zealand will release the Dairy Price Auction. This will be followed with key employment numbers, with the release of Employment Change and the unemployment rate. There are no major US events on the schedule. On Wednesday, the US releases two key events – ADP Nonfarm Employment Change and the ISM Non-Manufacturing PMI.

The New Zealand central bank (RBNZ) remained on the sidelines last week and held the benchmark interest rate at 2.25%. This followed a surprise rate cut in March, when the RBNZ lowered rates from 2.50% to 2.25%. Some analysts had expected another cut in the April decision, and the New Zealand dollar jumped 160 points following the April rate announcement. Following the announcement, RBNZ Governor Graeme Wheeler stated that the central bank was weighing further easing in order to bring inflation up to the RBNZ’s inflation target of 1-3 percent. CPI in the first quarter improved to 0.2%, but this is well short of the central bank’s inflation target. Wheeler also noted that the New Zealand dollar is stronger than the RBNZ would like, as the higher kiwi has weakened the critical export sector. Although a June cut is a strong possibility, lower rates could increase housing demand and overheating the housing market.

Manufacturing remains a sore spot in a generally strong US economy, as weak global demand for US-made goods has taken its toll on the industry. On Monday, US ISM Manufacturing PMI, a key gauge of manufacturing output, missed expectations. The index dipped to 50.8 points, shy of the estimate of 51.6 points. This reading just above the 50-point line points to near stagnation in the manufacturing sector. As well, Final Manufacturing PMI and Construction Prices both missed expectations, but ISM Manufacturing Prices easily beat the forecast.

Last week, Core Durable Goods dropped 0.2%, well off the estimate of a 0.6% gain. This marked the fourth decline in five months. Durable Goods Orders was stronger at 0.8%, but also missed expectations, as the estimate stood at 1.9%.

The first quarter of 2016 has been marked by shaky global markets and a sharp drop in oil prices, so slower growth for the US economy was not unexpected. GDP climbed 0.5% in the first quarter, shy of the estimate of 0.7%. This was considerably lower than the 1.4% gain in the fourth quarter of 2015, and marked the weakest quarter of growth in two years. Although economic growth remains moderate, the lukewarm reading will not help the cause of Fed policymakers who favor a rate hike, especially with inflation at low levels.

The markets, which had not expected any moves from the Fed in April, are keeping a close eye on key numbers and looking for clues as to whether the Fed will raise rates at its June policy meeting. The April policy statement sounded cautiously optimistic about the US economy, leaving the door open regarding a rate hike in June.

NZD/USD Fundamentals

Tuesday (May 3)

- Tentative – New Zealand GDT Price Index

- 18:45 New Zealand Employment Change. Estimate 0.6%

- 18:45 New Zealand Unemployment Rate. Estimate 5.5%

- 18:45 New Zealand Labor Cost Index. Estimate 0.3%

- 21:00 New Zealand ANZ Commodity Prices

Upcoming Key Events

Wednesday (May 4)

- 8:15 US ADP Nonfarm Employment Change. Estimate 205K

- 10:00 US ISM Non-Manufacturing PMI. Estimate 54.9

- 10:00 US IBD/TIPP Economic Optimism. Estimate 46.6

- 10:30 US FOMC Member Loretta Mester Speaks

- All Day – US Total Vehicle Sales. Estimate 17.3M

*Key releases are highlighted in bold

*All release times are EDT

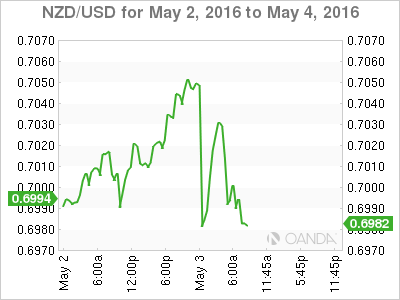

NZD/USD for Tuesday, May 3, 2016

NZD/USD May 3 at 8:00 EDT

Open: 0.7032 Low: 0.6976 High: 0.7053 Close: 0.6978

NZD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6621 | 0.6738 | 0.6897 | 0.7011 | 0.7100 | 0.7231 |

- In the Asian session, NZD/USD posted losses but then partially recovered. The pair posted gains early in European trade but then retracted

- 0.6897 is providing support

- 0.7011 was tested earlier in resistance and is under strong pressure

Further levels in both directions:

- Below: 0.6897, 0.6738 and 0.6621

- Above: 0.7011, 0.7100, 0.7231 and 0.7322

- Current Range: 0.6897 to 0.7011

OANDA’s Open Positions Ratio

The NZD/USD is unchanged on Tuesday, as long positions have a slight majority (53%). This is indicative of trader bias towards NZD/USD reversing directions and moving higher.