This article was written exclusively for Investing.com

- Ray Dalio’s statement could be prophetic

- Leading cryptos were leaning lower then rallied as October began

- It’s all about flows for the short-term

- Governments have shown their hand; an inconsistent approach from the SEC

- Stops required as downside could get ugly

Cryptocurrencies have gripped the attention of many market participants. Nothing puts the spotlight on an asset like a rip-roaring bull market. Bitcoin’s explosive move from five cents in 2010 to a high of over $65,500 earlier this year has a magnetic impact on investment behavior. At over $48,500 at the end of last week, the token's appreciation stands as the most incredible investment story of our lifetime.

As a sign of the growth of speculative interest, the number of tokens in the cryptocurrency asset class has increased from one in 2010 to over 12,200 at the end of last week.

Bitcoin and blockchain—or blockchain and Bitcoin—reflect an evolutionary revolution in finance with substantial ramifications for economics and politics. I view Bitcoin and blockchain as a philosophical chicken and egg dilemma.

The only answer is possible from Satoshi Nakamoto, the pseudonymous person or group of persons that developed Bitcoin, authored the Bitcoin white paper, created and deployed Bitcoin’s original reference implementation, and devised the first blockchain database.

Blockchain has achieved almost universal acceptance as the technological evolution of finance, increasing transaction speeds and record-keeping efficiency. On the other hand, Bitcoin poses a threat to the status quo in global finance. Central banks, monetary authorities, and governments derive power from the military and control of the money supply. Wide acceptance of Bitcoin as a global means of exchange threatens the latter.

El Salvador made Bitcoin its national currency in early September, becoming the first country to reject the US dollar as the worldwide reserve currency. While other nations may follow, the powerful and wealthiest countries are not going to let Bitcoin and the other cryptocurrencies challenge their control of the world’s purse strings without an epic battle that starts on the regulatory front.

Ray Dalio’s statement could be prophetic

Ray Dalio is a successful hedge fund manager and billionaire. He is the founder of the world’s largest hedge fund, Bridgewater Associates. In mid-September, Dalio told reporters at CNBC that if Bitcoin and cryptocurrencies gain mainstream success, regulators will take control of the market. He added:

“I think at the end of the day if it’s really successful, they will kill it and they will try to kill it. And I think they will kill it because they have ways of killing it.”

Recent actions by regulators point to how prescient Dalio's words were as we see increasing regulation of the asset class.

Leading cryptos were leaning lower then rallied As October began

After reaching a high at $53,210 on Sept. 7, October Bitcoin futures put in a bearish reversal on the daily chart and made lower highs. However, the price action on Oct. 1 broke the short-term bearish pattern.

Source, all charts: CQG

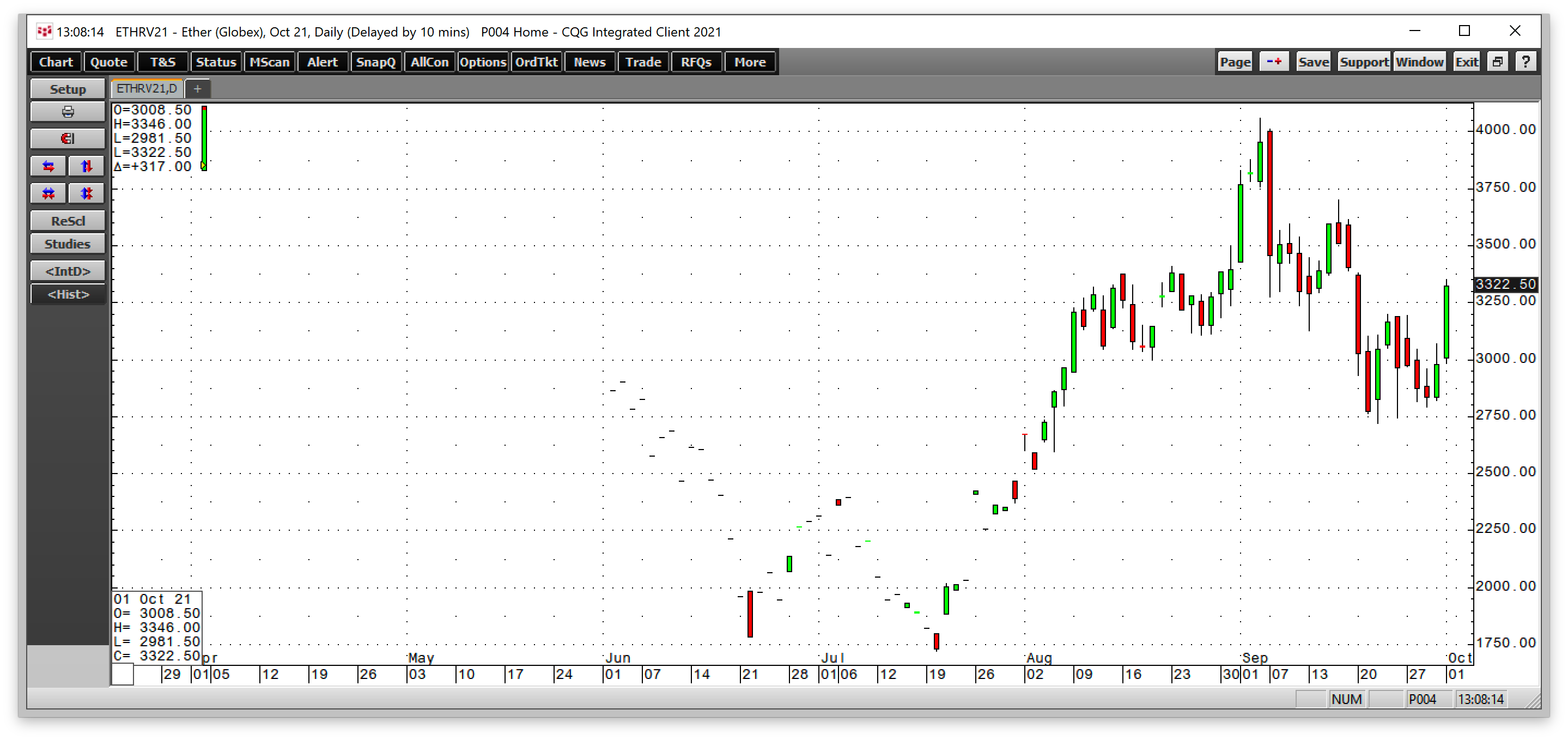

The daily chart shows Bitcoin futures rose to a high of $48,705 on Oct. 1, marginally surpassing the lower high of $48,610 from Sept. 15. Contracts on Ethereum, the second-leading crypto, also made a comeback on Oct. 1.

October Ethereum futures rallied to over the $3,320 level last Friday, but they did not break above a level that erases the short-term bearish price action.

It’s all about flows for the short-term

Bitcoin, Ethereum, and the ideologies for each of the other, over 12,250 cryptocurrencies, are that they fly below the radar of central banks, monetary authorities, and governments and are contrary to their control of the money supply. A cryptocurrency’s value is determined solely by bids and offers in the market, allowing individuals to determine their value.

Crypto prices move higher when buyers are more aggressive than sellers and vice versa without the interference of the governments using their power to expand or control the monetary supply. The bottom line is it’s all about short-term flows in the cryptocurrency arena, so long as governments allow them to trade freely.

In September, China banned all cryptocurrency transactions.

Governments have shown their hand; an inconsistent approach from the SEC

In September, the US Treasury Department fired a missile at a cryptocurrency exchange when it sanctioned Suex for facilitating “transactions involving illicit proceeds from at least eight ransomware variants.”

The Securities and Exchange Commission recently sent Coinbase (NASDAQ:COIN), the leading crypto exchange, a Wells notice warning the company it would take it to court if COIN's plan to introduce a Lend product, where customers could lend tokens to borrowers and earn a yield, were to proceed. Coinbase dropped its plans for the product.

SEC Chairman Gary Gensler is no stranger to the burgeoning asset class. He was the CFTC Chairman when the Commission approved Bitcoin futures and taught a course in fintech at MIT during his hiatus from the CFTC and SEC. Many market participants believed that his appointment as SEC Chairman would help usher in ETF products on cryptos.

However, that may not end up being the case. The Wells notice was perhaps a first regulatory shot at the asset class as the SEC considers borrowing and lending activity to be securitization, requiring a higher regulatory level to “protect the public.”

Moreover, Chairman Gensler recently compared the asset class to wildcat banking which occurred in the US from 1837 until 1863 in the absence of federal bank regulation. He commented:

“I don’t think there’s long-term viability for five for six thousand forms of money. So in the meantime I think it’s worthwhile to have an investor-protection regime placed around this.”

Still, inconsistently, the SEC Chairman reiterated support for Bitcoin futures ETF products saying, “I look forward to staff’s review of such filings.” Meanwhile, approving ETFs could be a route to regulation of the underlying assets.

The comments and actions of the Treasury and SEC are likely skirting the 800-pound gorilla for now. It's also the underlying reason the agencies are carefully watching the asset class’s market cap as it grows.

As cryptocurrencies move towards mainstream acceptance, they threaten the government’s control of the money supply, one of the critical powers for existing authorities.

Stops required as downside could get ugly

Government power comes from control of the military and a tight grasp on the purse strings. Maintaining the status quo is the reason why additional regulations for cryptocurrencies are on the horizon.

China’s move to ban cryptos signifies that other governments will follow the world’s second-leading economy. The Chinese ban caused a downdraft in values. The same behavior from the US or Europe would likely cause carnage in the cryptocurrency arena.

Cryptos are a novel means of exchange that operate on blockchains. The wide acceptance of blockchain technology does not necessarily go hand-in-hand with cryptos governments might be developing.

Holding Bitcoin, Ethereum, and a variety of the other over 12,000 tokens has turbocharged portfolios over the past year. Many leading financial institutions are now offering crypto exposure to their customers as well. While keeping a small percentage of assets in cryptocurrencies diversifies portfolios, the high level of price variance requires attention to the risks.

While the returns have been nothing short of spectacular, it is not a good idea to bet the ranch on the asset class, especially not now. As Ray Dalio summed up, if the asset class gets too big, governments could “kill” it, making the high-flying assets worthless, potentially decimating some investors in the process.