- The closely watched U.S. November CPI report comes out today.

- Headline annual inflation is seen rising 2.7% and core CPI is forecast to increase 3.3%.

- A "hawkish cut" scenario could emerge if CPI comes in hotter than expected, tempering expectations for 2025 Fed rate cuts.

- Looking for more actionable trade ideas? Subscribe here for 55% off InvestingPro as part of our Cyber Monday Extended sale!

As the November Consumer Price Index (CPI) report approaches, its release on Wednesday is poised to be a pivotal moment for markets, as it could significantly impact the Federal Reserve's outlook for monetary policy.

With the Fed’s FOMC meeting coming up on December 17-18, this data will play a critical role in determining whether the central bank continues easing in the months ahead or adopts a more cautious stance.

While markets currently anticipate an 88% chance of a rate cut next week, hotter-than-expected inflation data could revive fears of prolonged monetary tightening.

What’s Expected

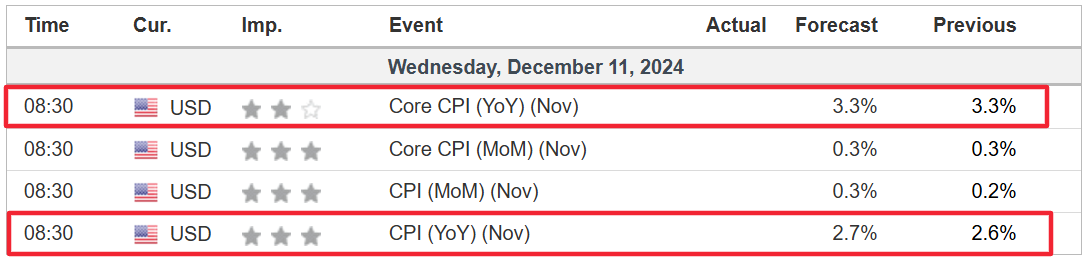

Economists forecast headline CPI to accelerate to 2.7% year-over-year, up from 2.6% in October. Meanwhile, core CPI, which excludes food and energy prices, is expected to increase by 0.3% month-over-month, with an annual gain of 3.3%.

Source: Investing.com

This would mark the fourth consecutive month of a 3.3% core reading, signaling ongoing challenges for the Fed, which is focused on the ‘last mile’ of its journey to bring inflation back down to 2%.

Any surprises—higher or lower—could sway the Fed's current stance on monetary policy. A softer CPI print may bolster the case for a rate cut, while hotter-than-expected data might prompt the Fed to maintain its current range of 4.50%-4.75%, or even deliver a "hawkish cut" that tempers expectations for 2025.

Market Implications

Inflation remains central to financial markets, particularly amid record highs for the S&P 500 and the tech-heavy Nasdaq Composite, which are both on track for a banner year in 2024.

Source: Investing.com

The interplay between inflation trends, Fed policy, and the economy's resilience will shape market dynamics as we move into 2025. As such, this report is not just a reflection of inflation but also a key determinant of how the Fed might balance growth and price stability in the coming months.

What To Do Now

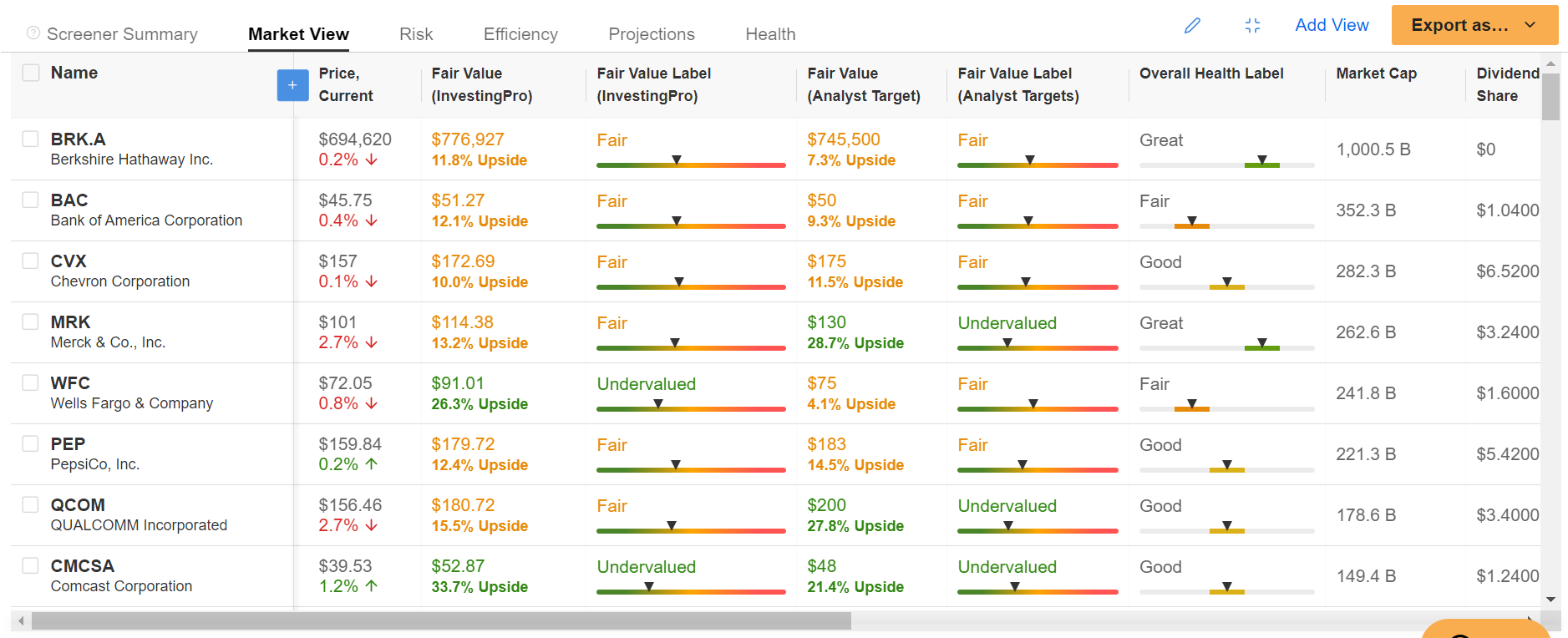

Using tools like the InvestingPro Stock Screener can help easily identify high-quality companies that are worth owning amid the current climate. As inflation dynamics evolve, certain sectors stand out for their ability to weather inflationary pressures.

- Energy Stocks: Rising costs often benefit energy producers. Consider companies like Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), and Schlumberger (NYSE:SLB), which thrive in inflationary environments.

- Consumer Staples: Companies like Pepsico (NASDAQ:PEP), Coca-Cola (NYSE:KO), Nike (NYSE:NKE), and Procter & Gamble (NYSE:PG) maintain pricing power and steady demand, making them defensive plays.

- Financials: Banks such as Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), JPMorgan Chase (NYSE:JPM), as well as Berkshire Hathaway (NYSE:BRKa) benefit from higher interest rate environments.

- Real Assets: Investments in REITs like American Tower (NYSE:AMT) and commodity-focused firms such as Barrick Gold (NYSE:GOLD) provide inflation protection.

Source: InvestingPro

These assets are well-positioned to offer resilience and growth potential as inflationary trends develop, giving investors opportunities to capitalize on shifting macroeconomic conditions.

Stay tuned for the CPI report and the resulting implications for the Fed’s policy path. The stakes are high, and the outcomes could shape the investment landscape for months to come.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get 55% off all Pro plans and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.