There have been some positive surprises in economic data recently, and markets are busy trying to digest what this means for the Fed. Terminal rates are now priced at over 5% in the US and around 4% in Europe, and bond traders are dismissing all 2023 cuts.

This raises questions about whether we have avoided a recession for good and how the global economy will cope with higher interest rates, which will be crucial for portfolio performance in 2023.

Recent macro data has been surprising on the upside: Retail sales, PMIs and housing data all look better.

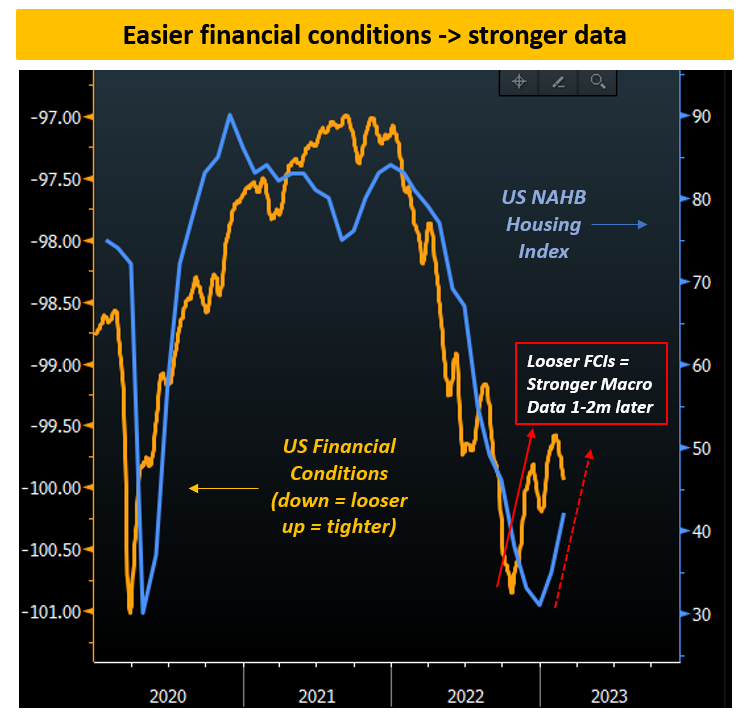

And this is why:

US financial conditions have materially eased from November to early February. A looser financial condition is often associated with an improvement in macro data with a 1-2 month lag.

The chart above proves the point: The US NAHB Housing Index (blue, RHS) readily responded to looser financial conditions (orange, LHS) with a slight time lag, exactly like it did in 2021 and 2022.

Looser financial conditions have led to lower interest rates and easier access to credit, benefiting home buyers and improving sentiment in the housing market.

This has also helped companies and consumers through cheaper access to leverage, higher equity prices, and a weaker USD, resulting in better PMIs.

Should we expect further upside surprises in economic data?

For soft indicators, such as PMIs, the lag is pretty short, while coincident indicators, like labor market and industrial production, take a little longer to react – March might bring some more positive news…but.

Financial conditions have aggressively tightened again in the last two weeks. And March data releases cover February data, where the major seasonality boost from January could reverse.

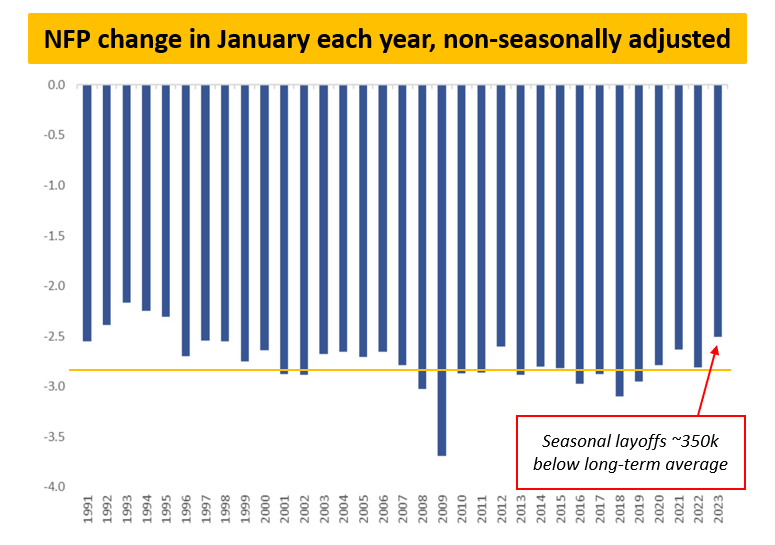

The January nonfarm payrolls numbers were boosted by a much lower amount of post-holiday seasonal layoffs than usual – potential seasonality reversal in February NFPs (released on March 10) could hinder further upside surprises.

So, are further upside surprises or not?

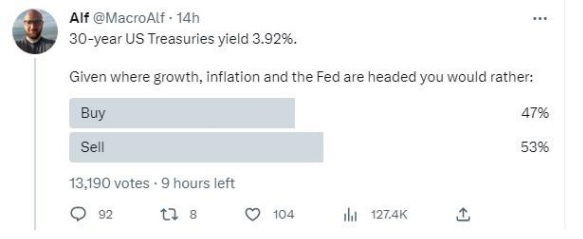

The lack of conviction is evident as markets shifted from pricing a 40-50% chance of a near-term recession in December to pricing away all 2023 Fed cuts in early February.

The results of this poll are very telling – I asked FinTwit whether they'd buy or sell 30y Treasuries here. Over 13,000 people replied, and basically, they had no clue.

I am showing you this so you can zoom out.

To combat information overload and noise, I like smoothing macro data: It has a panoramic view and allows me to take a step back from the noise of daily data and changing narratives.

Disclaimer: This article was originally published in The Macro Compass. Come join this vibrant community of macro investors, asset allocators, and hedge funds - check out which subscription tier suits you the most using this link.