New Zealand: room for further rate cuts

The odds of further monetary easing from the Reserve Bank of New Zealand had increase considerably as weak underlying inflation gives Governor Wheeler room to support further the Kiwi economy. Headline CPI jumped 0.4% in Q3 after falling 0.3% in Q3. It could be seen as a sign of improvement as it brings the RBNZ closer to its 2% inflation rate target. However, without an increase of 8.8% in petrol prices, inflation was flat for the second quarter. Moreover, the recent deal between Iran and western powers about Iran’s nuclear program will add more pressure on crude oil prices as market is expected to experience a glut and it would therefore drag inflation back to zero in the third quarter.

We now expect Governor Wheeler to cut the official cash rate by 25bps to 3% at the July meeting. Moving forward, we expect the RBNZ to continue cutting rate after summer given the low inflation trend and weaker growth outlook in the Kiwi economy. It worth mentioning that Whole Milk Powder (WMP) prices dropped more than 13% at the Fonterra auction last night to the lowest level since July 2009 as global demand collapses. NZD/USD dropped more than 8% over the month of June as it keeps breaking support, one after another. We remain bearish on the NZD and we expect further depreciation of the Kiwi versus the Aussie and the greenback.

Greek Parliament approves austerity measures

Very early this morning and after a 4-hour deep and intense debate, Greek parliament has adopted austerity measures with a large majority. 229 members out of 300 voted for those reforms. This is a pre-requisite for the bailout plan of at least €86 billion that is still under negotiations. Greek PM Alexis Tsipras, which led the discussions with Greek creditors since he was elected in 2009 was opposed to the tough austerity measures. Even if austerity measures have been voted, Wolfgang Schauble, the German finance minister said that the deal obtained with Greece is not such a good idea. Schauble even declared that “many Germans would still prefer a Grexit”.

Furthermore, Alexis Tsipras is now seen as a Traitor as he decided to sign in a proposal that he did not believe following the “No” at the 5th of July Referendum. He argued that he faced a dilemma, Grexit or Sign. He preferred to sign. Indeed, exit from the euro and switching back to the drachma would result in a massive devaluation. Last but not least, a Greek default would cut off trust from other countries and it would take decades to get it back. New Greek Finance Minister, Euclid Tsakalotos, even stated “There was no alternative”.

We also think that it was very difficult for Syriza to act otherwise. Yet, all those tough austerity measures may be counterproductive. Increasing VAT to 23% from 13% will consume a lot of the GDP. The last year’s Japan example shows it when sales tax hike went from 5% to 8%. As a result, we anticipate that Greece will have difficulties to honour the austerity measures it has voted and we are likely to face the same situation within the next few years.

Now, the banks are likely to reopen and bailout negotiations will continue. In the meantime Greece still owes €1.6 billion to the IMF and a payment of €3.6 billion must be paid to the ECB next Monday. Nonetheless, this payment should not be an issue and will likely be part of the bailout plan. EUR/USD is decreasing this morning on Greek Parliament votes as traders do not believe in the Greek ability to apply the fresh austerity measures voted by the parliament. 1.0900 is definitely on target.

USD/CAD - Moving Sharply Higher

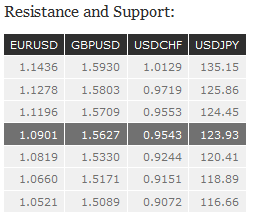

EUR/USD has broken hourly support at 1.0916 (07/07/2016). Hourly resistance lies at 1.1278 (29/06/2015 high). Stronger resistance lies at 1.1436 (18/06/2015 high). However, we expect support at 1.0819 to be challenged. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is now pausing after breaking resistance at 1.5644 (03/07/2015 low). Stronger resistance is given at 1.5803 (24/06/2015 high). Hourly support is given at 1.5330 (08/07/2015 low). Nonetheless, we expect the pair to decrease again within the next few days. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY is still pushing toward resistance at 124.45 (17/06/2015 high). Stronger resistance still lies at 135.15 (14-year high). Hourly support is given at 120.41 (08/07/2015 low). As long as resistance at 124.45 is not broken, we remain bearish on the pair. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF has broken hourly resistance at 0.9543 (27/05/2015 high). Hourly support can be found at 0.9151 (18/06/2015 low). The road is now wide open for the pair to challenge stronger resistance at 0.9719 (23/04/2015 high). In the long-term, there is no sign to suggest the end of the current downtrend. After failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).