- Except for the South, typical heat for this time of year eludes many parts of U.S.

- Demand for gas-powered cooling has accordingly been lower

- Analysts caution that both weather and gas production could favor the bulls soon

In a whole swathe of the Lower 48 States, the question’s growing by the day for traders in U.S. natural gas: Where’s the pre-summer heat?

Forecasts continue to show intensifying heat and the likelihood of increased gas consumption next week, NatGasWeather said Wednesday in a blog carried by naturalgasintel.com.

Lofty temperatures in Texas and neighboring states already took hold this week, and conditions in the South are expected to spread in coming days and carry through June for “slightly stronger-than-normal national demand,” the forecaster adds.

That’s the forecast. The reality on the ground has been quite different thus far.

Gelber & Associates, a Houston-based energy markets advisory, said to its own clients in natural gas:

“Until significant power demand from summer heat materializes and LNG export demand comes back online following maintenance, gas that would be taken by those demand sources will instead be injected into storage.”

Chart by SKCharting.com, with data powered by Investing.com

Chart by SKCharting.com, with data powered by Investing.com

What’s Happened Thus Far

The South aside, temperature readings have been benign in the U.S. Northeast and generally elsewhere, resulting in lower demand for cooling than typical for this time of year.

It’s mid-June, just a week before the official start of summer. In some parts of the country, however, the evenings feel more like late fall or early spring with temperatures ranging from the low to mid-60s Fahrenheit in Boston, Chicago, and New York City even as El Paso in Texas bakes at 88F.

Mobius Risk Group put the phenomenon down to the overlap between the El Niño and La Niña conditions — the first leading to the warming of the Pacific Ocean and the other its cooling.

So far, the effects of La Niña seem to be prevailing, or at least sufficiently offsetting El Niño formations, to create either unusually cool nights and inordinately mild days in several parts of the United States.

Mickey Shuman, a senior meteorologist at Atmospheric G2, said the split-flow pattern has probably suppressed temperatures in the eastern and southwestern U.S. of late, skewing Cooling Degree Days, or CDDs, to the lower side of the average.

It’s no secret that after the warmest U.S. winter in two decades, one of the coolest starts to summer has begun.

There were 27% fewer cooling degree days, or CDDs, in May compared with the same period last year. The data tracks the number of days where the average temperature is above 65 Fahrenheit and is used to estimate demand to cool homes and businesses.

There were around 47 cooling degree days (CDDs) last week, less than the 30-year normal of 55 CDDs for the period, data from Refinitiv showed.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit.

For all of last week, there were around 47 cooling degree days (CDDs) last week, less than the 30-year normal of 55 CDDs for the period, Reuters-associated data provider Refinitiv said. Source: Gelber & Associates

Source: Gelber & Associates

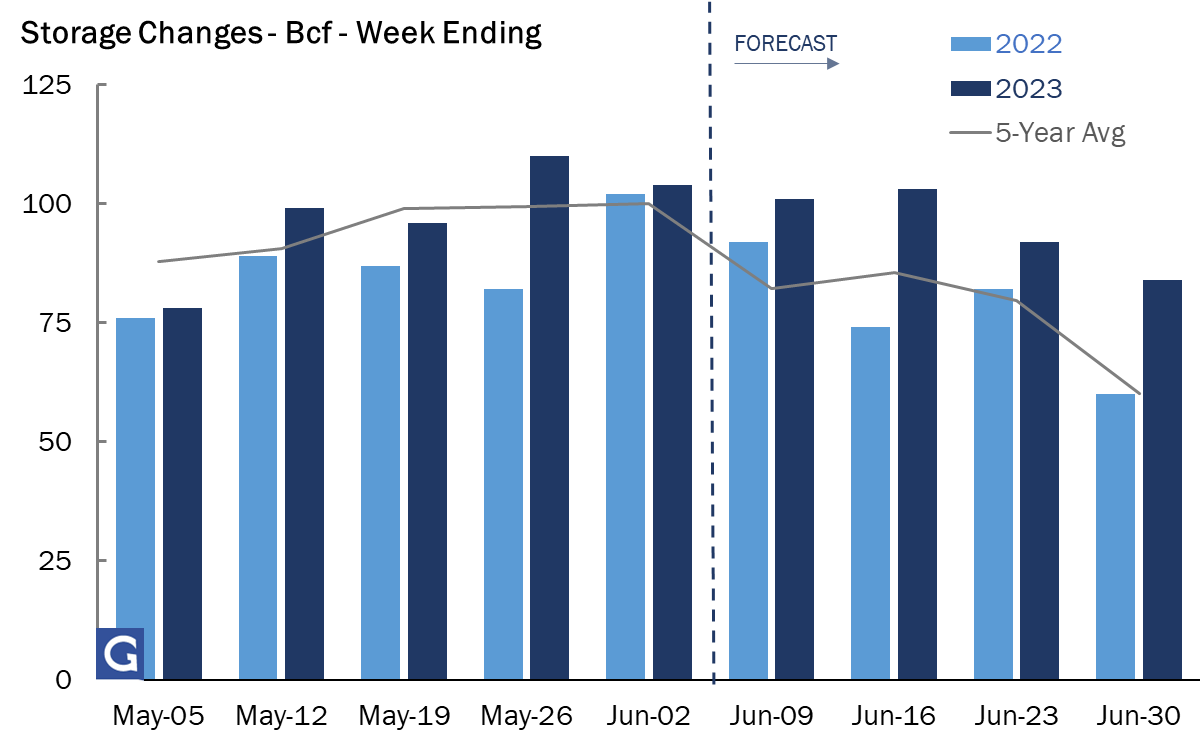

Resultantly, U.S. utilities likely added a bigger-than-normal 96 billion cubic feet, or bcf, of natural gas to storage during the week to June 9 as mild weather kept demand for cooling low, a Reuters poll showed.

In the prior week to June 2, utilities added 110 bcf of gas into storage.

Last week’s forecast for 95 bcf is barely above the 94 bcf injection during the same week a year ago. But it is significantly above the five-year (2018-2022) average increase of 84 bcf.

The forecast for the week ended June 9 also would lift total gas in U.S. storage to 2.645 trillion cubic feet, or tcf — some 27% above the same week a year ago and about 16% above the five-year average.

The U.S. Energy Information Administration, or EIA, will show how close the market is to those estimates when the agency releases its weekly storage report today.

What’s Likely to Happen From Now

Production slid further in Wednesday’s estimates amid multiple maintenance events across the central and eastern United States, according to Wood Mackenzie in notes carried by naturalgasintel.com.

Wood Mackenzie reports that output declined about 3 bcf daily to 98 bcf/d on Tuesday. Production ticked even lower Wednesday to around 97.6 bcf/d, almost matching Bloomberg’s call of 97.5 bcf/d, the firm said.

Laura Munder, an analyst at Wood Mackenzie, says:

“Lower 48 production continues to tumble.”

EBW AnalyticsGroup echoed that sentiment, noting the mounting heat wave and the potential for an enduring decline in production. Adds the company’s senior analyst Eli Rubin:

“Although a downturn may prove temporary, pipeline scrapes appearing to show steep production losses could accelerate the realization of upside potential

Haynesville, the lynchpin to slowing natural gas production nationally and potentially the most significant near-term bellwether for natural gas prices, may reduce output amid an extended outage from Texas Gas Transmission that could narrow southbound supply outlets from the Haynesville to the Gulf Coast through July 11.”

Because a portion of gas can be rerouted into intrastate pipelines – where operators are not required to publicly post volumes – estimates “may overstate reality,” Rubin said. Still, if this week’s estimated declines are “even halfway accurate, Nymex natural gas futures could push” even higher, he adds.

On the bearish side is relatively light demand for LNG, or liquefied natural gas. Exports of the super-cooled, liquefied gas were soft around 12.5 Bcf/d early this week, down from spring highs close to 15 Bcf/d.

With stout supplies likely through at least early summer, bulls need to maintain momentum on the back of weather-driven demand to establish the “case for a more significant recovery” following a weak run in May, said analyst Brian LaRose of ICAP Technical Analysis.

NatGasWeather said an active pattern with scattered storms would continue to track across the northern two-thirds of the country this week, with comfortable highs of 60s to 80s for seasonally light demand. However, states across the South, from Arizona to Texas to Florida, are enduring a hot ridge that is resulting in highs of 90s to 100s for regionally strong demand.

Such conditions are projected to broaden into other regions and drive stronger national demand next week. Northern markets could see highs in the upper 80s and lower 90s – conditions likely to galvanize widespread air conditioner use.

Wood Mackenzie said conditions in Texas already are sweltering, with triple-digit highs in central and southern areas of the Lone Star State. The firm noted that the Energy Reliability Council of Texas forecast this Friday’s peak demand to exceed last summer’s high.

Space City Weather meteorologist Eric Berger on Wednesday called conditions in the Houston area “sultry” and “face-melting.”

So, where do prices go from here?

In Wednesday’s session, the front-month gas futures contract on the New York Mercantile Exchange’s Henry Hub settled at $2.342 per mmBtu or million metric British thermal units.

Unseasonable weather, weak LNG demand, and stout production have left the front-month stranded in the low-to-mid $2 level since April, versus the August 2022 peak of above $10.

Technically, the front-month could range between a high of nearly $2.70 and a low of around $2.10 in the immediate term, said Sunil Kumar, chief technical strategist at SKCharting.com.

“Price action on the daily time frame remains stable looking for triggers to break above $2.40, to resume an uptrend which could retest the swing high of $2.68 initially.

But weakness below $2.29 will call for a further drop to $2.13.”

**

Disclaimer: The content of this article is purely to educate and inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.