- Henry Hub’s front-month back at above $6 after 4 weeks below that key level

- Market trapped between resistance of $6.28 and support of $5.80, charts show

- US storage likely grew by smaller-than-usual 59 bcf last week on colder weather

After nine weeks in the red, US natural gas is at an inflection point as technical buying from oversold conditions and the return of some heating demand in an unusually warm pre-winter combine to drive the market back into key $6 pricing.

From 14-year highs of above $10 for each milliliter of British thermal units (mmBtu) in August, the front-month natural gas contract on the New York Mercantile Exchange’s Henry Hub was more than halved to $4.75 earlier this week.

That was before the upside traction that began on Tuesday and carried through Thursday, adding a net 18% to prices over a three-day stretch amid a brief spike in heating demand.

Other bullish catalysts in play include railroad strike rhetoric and record low water levels in the Mississippi River and Ohio Rivers, which could cause some coal delivery logistical headaches.

Technically, the inflection point in natural gas means a break above $6.80 and a drop below $5 were both viable, says Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

“For now, the market is trapped within a resistance of $6.28 and support of $5.80,” said Dixit.

He said a sustained break above the 5-Day Exponential Moving Average of $6.07 if followed by the Middle Bollinger Band of $6.39, should provide some lift off to the 200-Day Simple Moving Average of $6.80—which had appeared a weak possibility until now. Adding:

“On the other hand, a sustained break beneath $5.80 can push prices down for a retest of the swing low of $5.35, below which it can potentially extend the drop further towards the 100 week-SMA of $4.90.”

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates, said bargain-hunters have been waiting on the sidelines for signs to jump back into the market.

“From the weather demand viewpoint, while the near-term temperature outlook is undoubtedly bearish, the Global Forecast System (GFS) and the European (ECMWF) weather forecast models have been hinting at a potential flip to colder conditions at the end of the first week of November.”

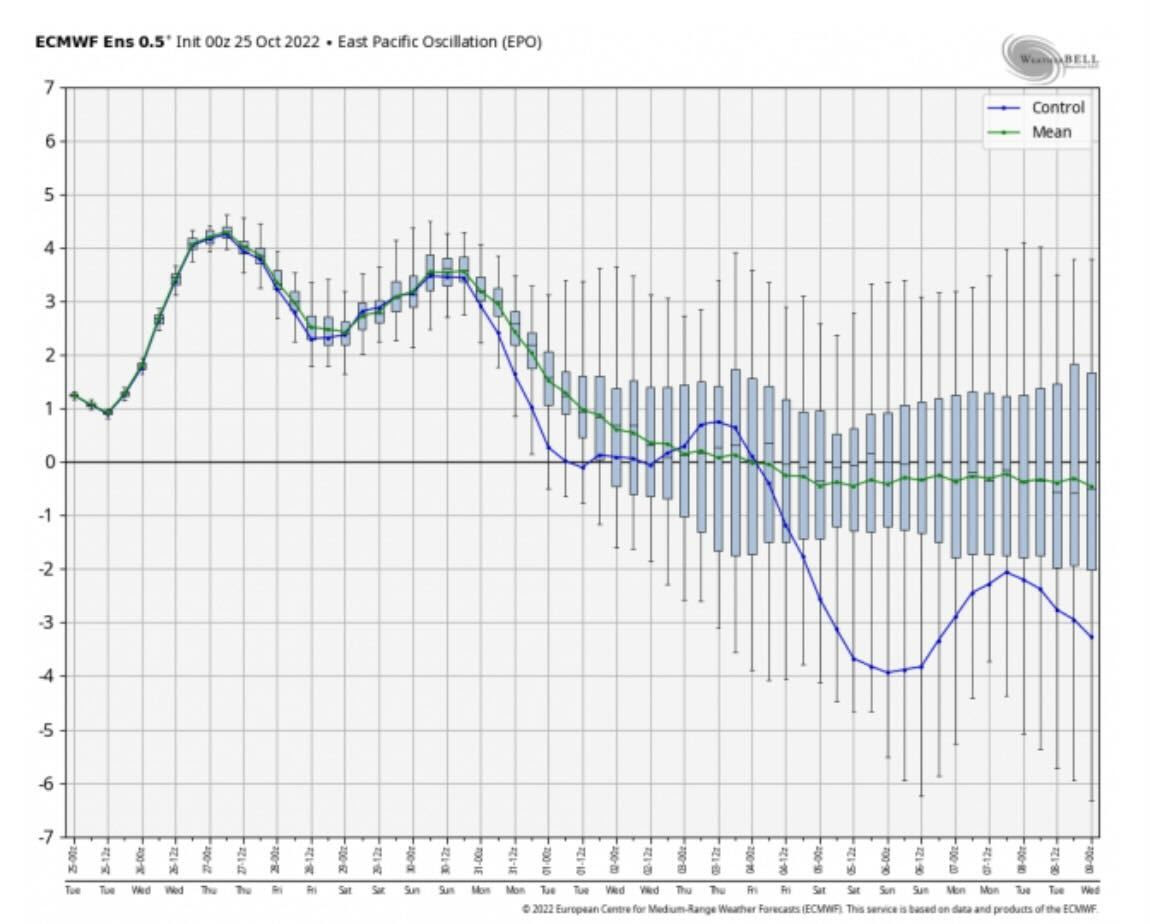

“We are also closely monitoring other significant weather indicators, such as the Eastern Pacific Oscillation (EPO), which suggests that the central and eastern regions of the US may turn colder in a little over two weeks, around mid-November.”

Lammey adds that when the EPO turns negative, it typically produces a ridge of pressure in the upper levels of the atmosphere over the west coast of the US.

“It opens the door to a sending cold into the central and eastern regions of the country. In other words, the ridge of high-pressure air essentially blocks the flow of cold air from reaching the West, but it instead redirects the Arctic chilled air flow into the upper Midwest and the eastern third of the US."

“Presently, it appears that the temperature trend in the US is setting up for a colder-than-normal second half of November for the central and eastern regions of the nation, as well as a potentially colder-than-average month of December.”

Source: Gelber & Associates

Leticia Gonzales, who blogs on at naturalgasintel.com, adds:

“On the weather front, there continued to be only minor changes in the long-range data. Both the American and European models project modest national demand for at least another two to three weeks. This suggests that it won’t be until late November or early December before sustained cold invades the northern or eastern United States.”

Gonzales said that did not mean that some brief blasts of chilly air won’t make their way into the Lower 48 States.

“Forecasts show weather systems impacting the western half of the country the next few days, while Texas also is set to cool further as a weather system tracks through with heavy showers by the end of the week,” she added.

Nevertheless, the mostly mild outlook should result in another two to three larger-than-normal storage builds after last week’s print that should come “near normal”, NatGasWeather said.

US utilities likely added a smaller-than-usual 59 billion cubic feet (bcf) of natural gas to storage last week as colder-than-normal weather boosted heating demand for the fuel, a Reuters poll showed ahead of Thursday’s weekly update on natural gas storage from the Energy Information Administration.

The forecast injection for the week ending Oct. 21 compared with a build of 88 bcf during the same week a year ago and a five-year (2017-2021) average increase of 66 bcf.

In the week ended Oct. 14, utilities added 111 bcf of gas to storage.

If correct, the forecast for the week ended Oct. 21 would lift stockpiles to 3.401 trillion cubic feet (tcf), about 3.8% below the same week a year ago and 5.3% below the five-year average.

The weather was colder than normal last week.

There were around 76 heating degree days (HDDs) last week, higher than the 30-year normal of 58 HDDs for the period, according to data provider Refinitiv.

HDDs, which are used to estimate demand to heat homes and businesses, measure the number of degrees a day's average temperature is below 65 Fahrenheit (18 Celsius).

NatGasWeather said forthcoming plump injections should further improve deficits. Notably, after sitting more than 300 bcf below the five-year average this summer, deficits have the potential to improve to near the five-year normal if colder weather patterns don’t show up over the northern and eastern United States in late November.

Meanwhile, the market continues to await the return of the Cove Point and Freeport LNG facilities. Cove Point is expected to resume operations sooner than later, with planned maintenance largely seen wrapping up by the end of the month.

Freeport, however, is a different story.

Any delay in Freeport’s return would be a bearish development for US markets, as the ongoing outage has cut 2 bcf/d off demand and made that gas available for storage.

Also, the longer Freeport remains offline, the more precarious the situation may become in Europe, which is dependent partly on US LNG to get through the current winter amid continued fallout from Russia’s war on Ukraine.

That said, European gas prices are now at their lowest levels since June 2022, with the benchmark Title Transfer Facility (TTF) reaching $28/MMBtu on Monday after dropping 28% in a week.

Rystad Energy attributed the decline to Europe’s storage facilities now being at high levels. Aside from this, it cited above-normal forecast temperatures for the upcoming European winter, high output from wind generation, and political agreement within the European Union on cooperative measures to reduce gas prices and consumption.

In Asia, Japan Korea Marker (JKM) prices have fallen to $31, tempting some Asian buyers back into the market.

Rystad said an average of 24 LNG cargoes have been in slow transit in recent weeks. This is because of a combination of factors, including regasification plants in Europe being unable to further receive new cargoes, near-full inventories reducing capacity to store further gas volumes, and expectations of higher prices as the northern winter approaches.

For now, though, mild temperatures expected across Continental Europe for the next two weeks are exerting downward pressure on prices, according to Rystad.

“The weather will be a strong driver for the rate of withdrawal from storage this winter,” Rystad analyst Nikoline Bromander said.

“In general, meteorologists are forecasting that Europe will experience milder-than-normal temperatures this winter, which is positive news for Europe’s gas balance.”

The difference between a cold and a mild winter is around 25 billion cubic meters (bcm) or 7-8% of total EU gas demand, according to Bromander.

“Europe has enough gas stored to survive this winter unless it gets very, very cold. But the continent is not out of the woods yet—with Russian flows continuing to decline, winter 2023 will be even tougher.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.