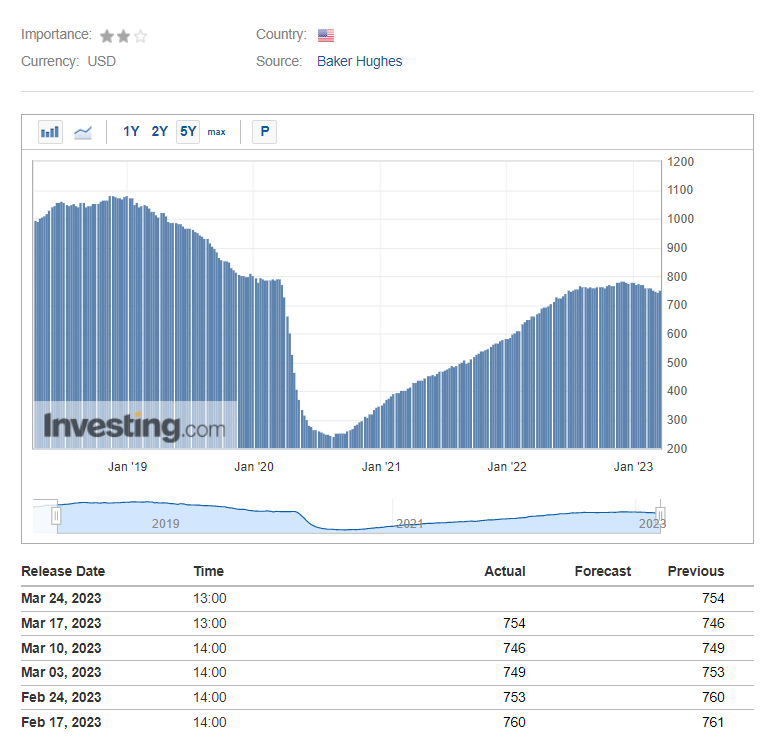

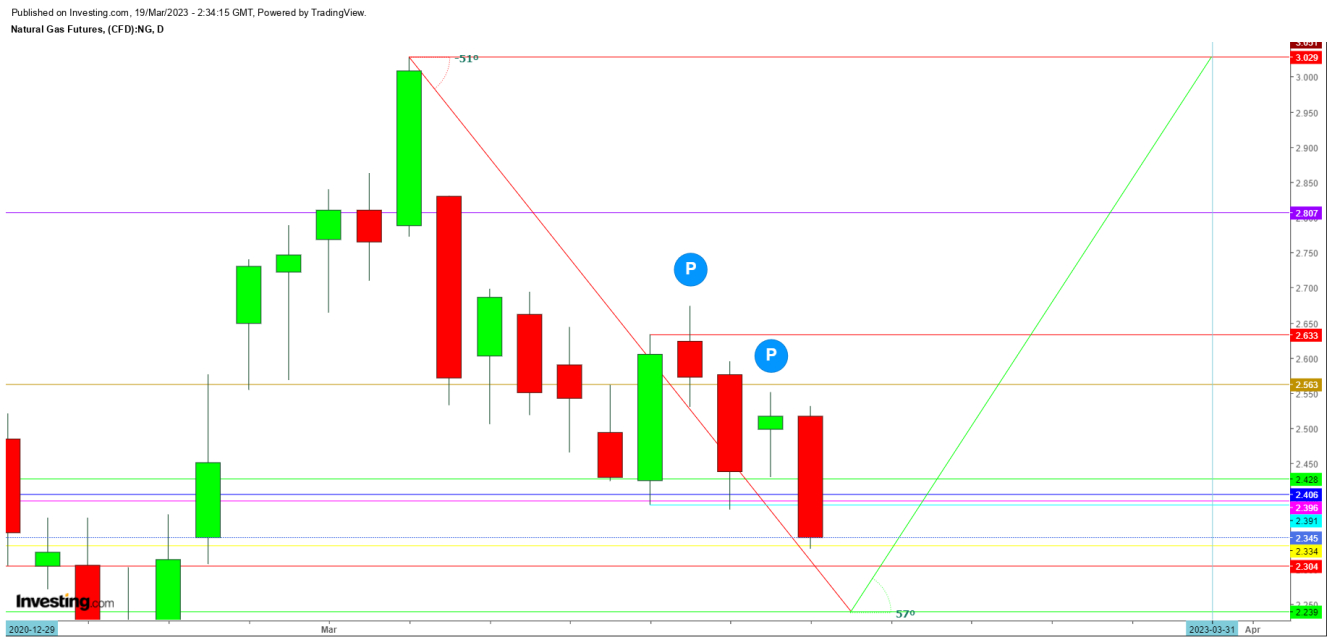

After a bearish inventory announcement last Thursday, a slight increase in the U.S. Baker Hughes Total Rig count from 746 to 754 last week added one more leg to the bearish sentiments. Natural gas futures witnessed a steep fall to hit a low at $2.329 before closing the day at $2.345.

This was a fall of more than 12% in natural gas prices from the last week’s high at $2.675, tested by the futures on Mar. 13, 2023. In March, natural gas has witnessed a fall of 23% after testing a high on Mar. 3, 2023, at $3.029,

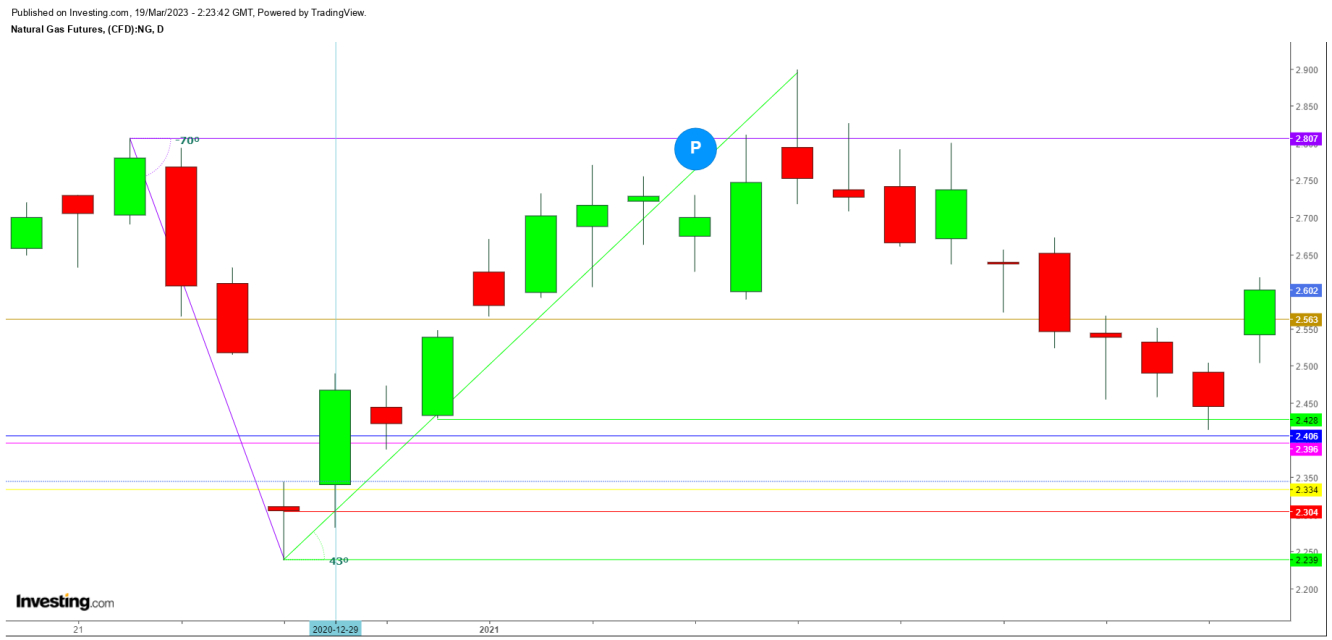

However, despite the prevalence of bearish sentiments, hopes for a steep reversal are in sight as the sell-off during the last week has pushed natural gas to a crucial level, tested in the last week of Dec. 2020.

A closer look at the movements of natural gas futures on Dec. 29, 2020 provides some bullish evidence in the following daily chart:

Natural gas closed the last week at a crucial level. In a daily chart, immediate support is at $2.304, and a significant support at $2.239 indicates the weekly opening levels and the further moves by the futures on the first two trading sessions will define the next direction for the next two weeks.

A gap-down opening could retest the lows at $1.967, tested on Feb. 22, 2023, if not hold above the significant support at $2.239.

On the other hand, if natural gas starts the upcoming week with a gap-up opening above $2.428 and sustains above $2.531 in the first two trading sessions, it could continue a bullish reversal during the next two weeks.

The futures will face immediate resistance at $2.563, then at $2.633, and the next significant resistance at $2.807 before crossing the psychological resistance at $3. But the natural gas futures are likely to repeat the movements of the last week of December 2020 amid wild price swings despite the prevalence of bearish sentiments as the Commodity Futures Trading Commission's (CFTC) weekly Commitments of Traders (COT) report provides a breakdown of the net positions for 'non-commercial' (speculative) traders in U.S. futures markets.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities in the world.