It was a good start to the week across all indexes as buyers began the day in a buoyant mood and didn't let up all day.

If there is a caveat to the buying it was that there was little in the way of a pause or a test of buyer resolve over the course of the day.

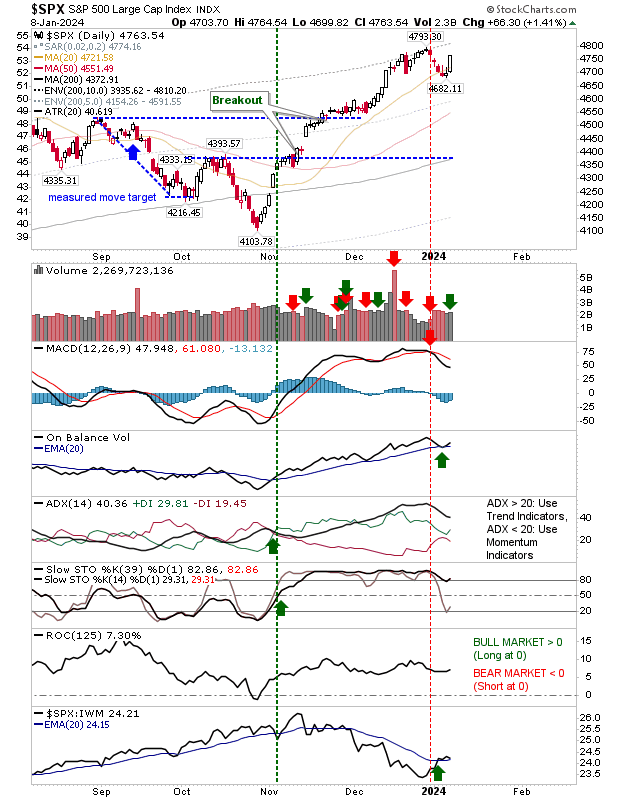

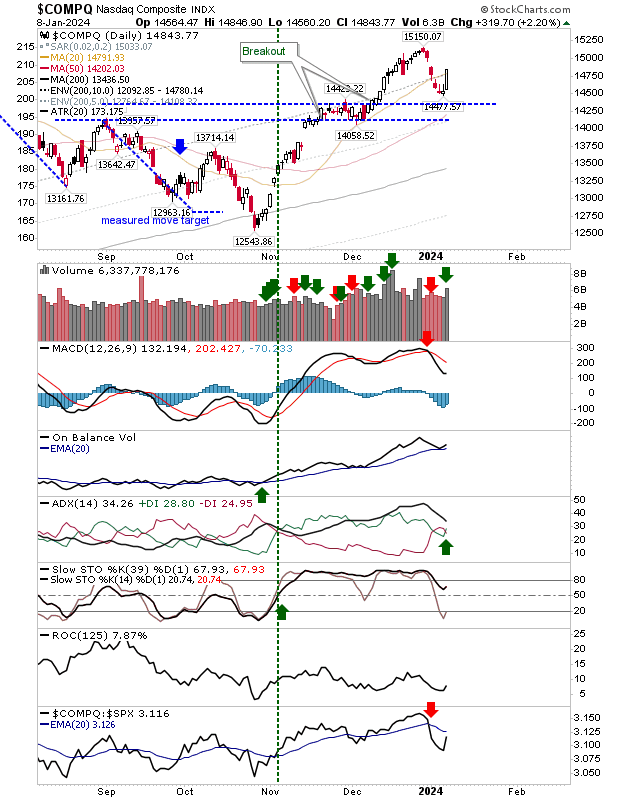

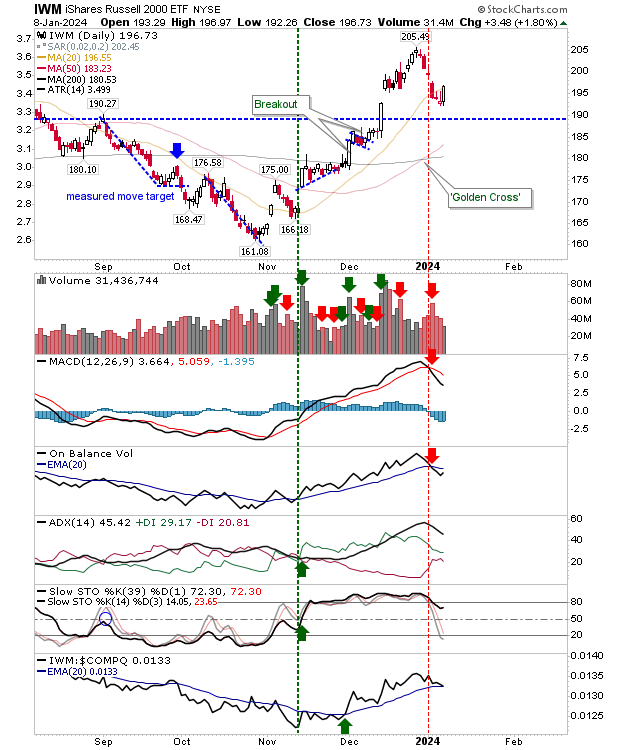

Volume was down for the Russell 2000 (IWM), although the Nasdaq ($COMPQ) and S&P 500 ($SPX) registered as accumulation days.

The S&P 500 ($SPX) recovered its 20-day MA with technicals unchanged, but improving.

The Nasdaq had the most ground to make up against its 20-day MA but it managed to achieve this goal by the close of business today. Technicals continue to improve although the index is still underperforming relative to the S&P 500.

The Russell 2000 ($IWM) also banked a solid day, edging above its 20-day MA, but on lower buying volume.

Technicals remain slightly more bearish than the Nasdaq or S&P 500 with 'sell' triggers in the MACD and On-Balance-Volume, but the index is still outperforming the Nasdaq.

There is probably enough momentum here to see a challenge of $205 highs.

For today, we will want to see indexes start where they closed and continue to build on their nascent rallies. What we don't want is to see a pause or neutral candlestick, like a doji, that could attract sellers later in the week.