Yesterday was set up to be a low-key day, but come the afternoon, sellers pounced and drove markets down hard after doubts arose about future rate cuts.

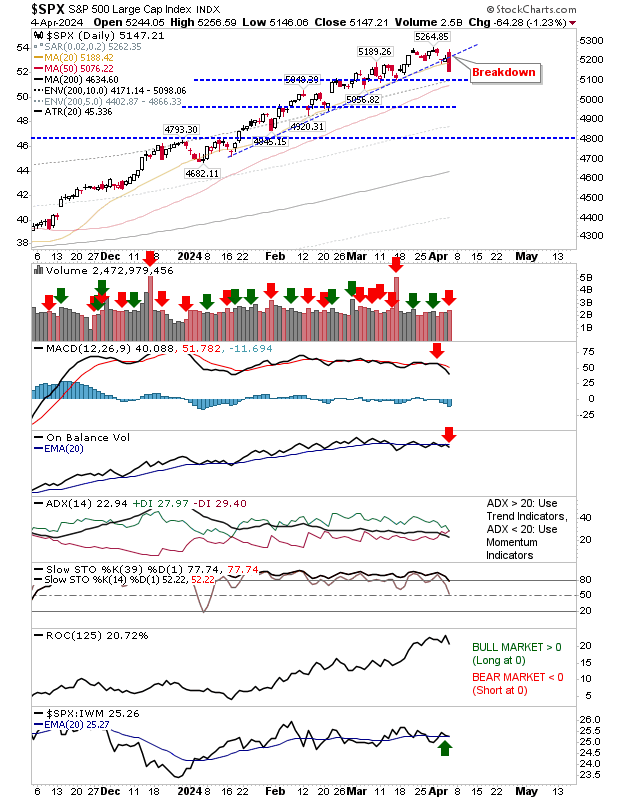

Fed news wasn't the key takeaway, but the loss of support was. The S&P 500 was hardest hit, not because of the percentage loss, but because of the volatility relative to recent trading action.

Yesterday marked a clear breakdown of trendline support. It should be noted that the presence of the 50-day MA offers a point of defense but yesterday's loss does not mean we will see a crash; a time-led consolidation seems more likely.

Technically, the MACD accelerated its losses and there was a fresh 'sell' in On-Balance-Volume.

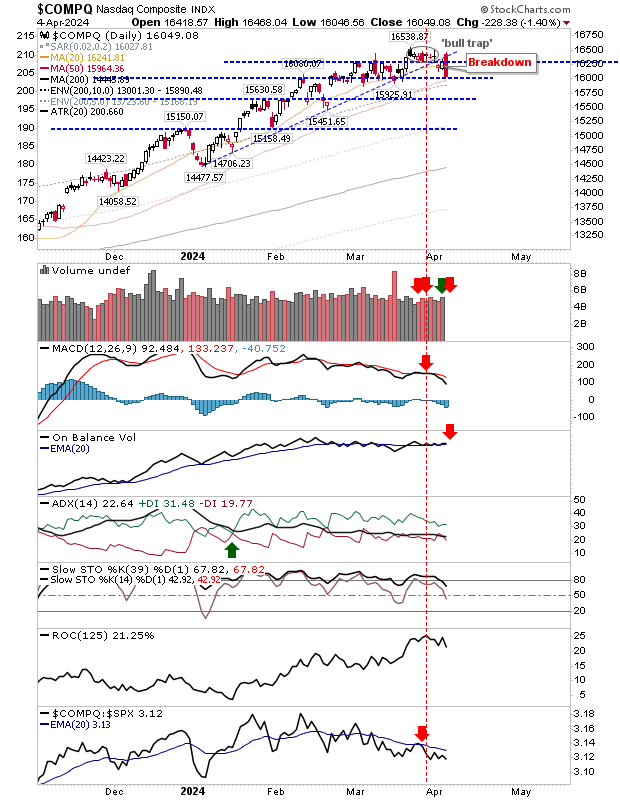

The Nasdaq had started the day with a challenge on the 'bull trap' but it was quickly rebuffed.

The day ended with a large bearish engulfing pattern. The 50-day MA is less than 100 points away from a positive test to attract buyers. However, given the extent of the rally over the last 6 months, a more substantial loss is required.

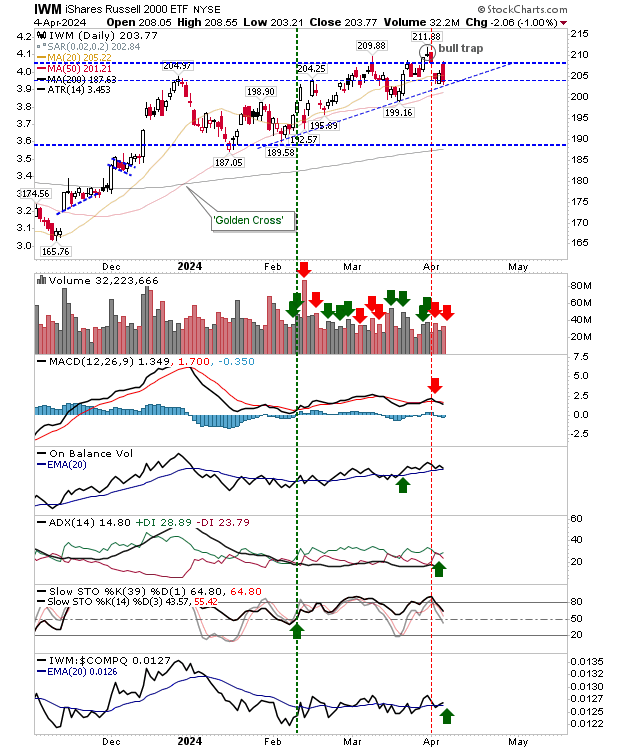

The Russell 2000 (IWM) logged a 1% loss but didn't lose trendline support.

However, the 'bull trap' is still in play and yesterday's action is registered as distribution. Given the action in the other indexes, I would probably favor a trendline break, but an aggressive 'buy' at the open may yield dividends, but use a tight stop if going long.

For today, the Russell 2000 ($IWM) is probably the day trade for a bounce, although the large bearish candlestick is not one to strike confidence. The S&P 500 and Nasdaq may experience a narrow consolidation before the downtrend resumes.