Two very different things going on in the market at the moment.

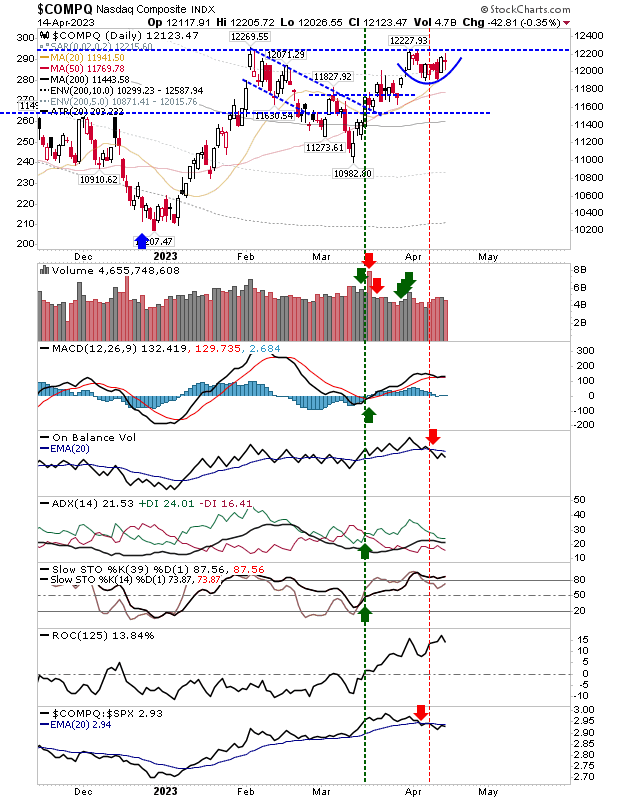

Nasdaq continues to prepare for a breakout. This time forming a mini-handle just below resistance. Aside from On-Balance-Volume, we have bullish technicals - although I would like to see a relative outperformance against the S&P 500, which is not the case currently.

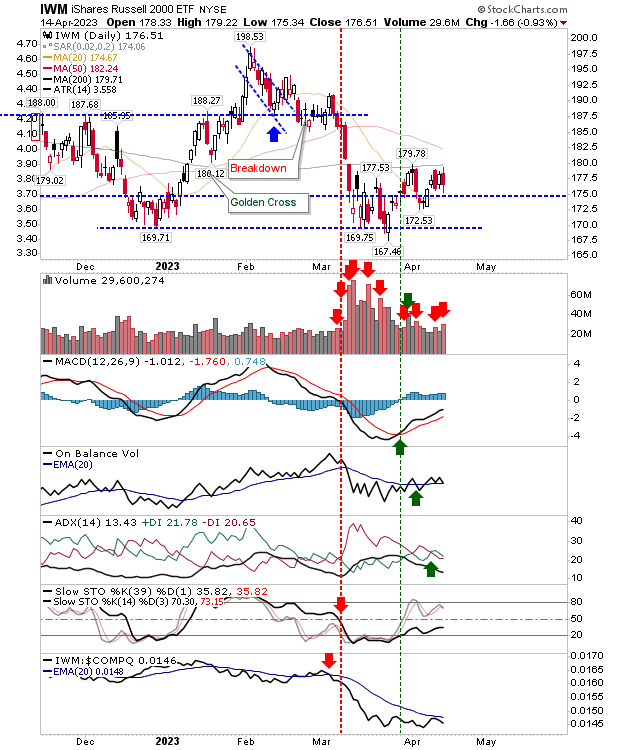

On the other side, we have the Russell 2000 (IWM), which is struggling to build off its March swing low. This is a major concern, as the 200-day MA is now proving significant resistance.

Cyclical and secular bull markets depend on growth stock leadership, and we are not seeing this here. Technicals are okay, in so far as only stochastics are bearish, but the relative performance against the Nasdaq is shocking.

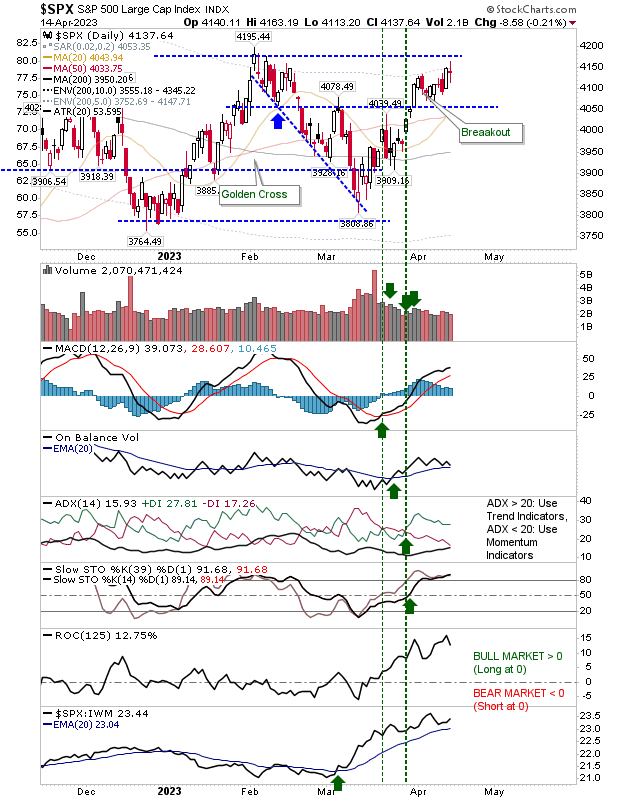

The S&P 500 is siding more with the Nasdaq. While it hasn't shaped a 'handle' below resistance, it has managed to hold above 4,060 support while challenging 4,190 resistance. Technicals are net bullish, and it is significantly outperforming the Russell 2000.

Going forward, there is a long-side opportunity in the Nasdaq. However, if the Russell 2000 continues to weaken - even if the Nasdaq manages to breakout - I would err on the side of caution and tighten stops on any tech breakout traded; double so should $IWM break below $169