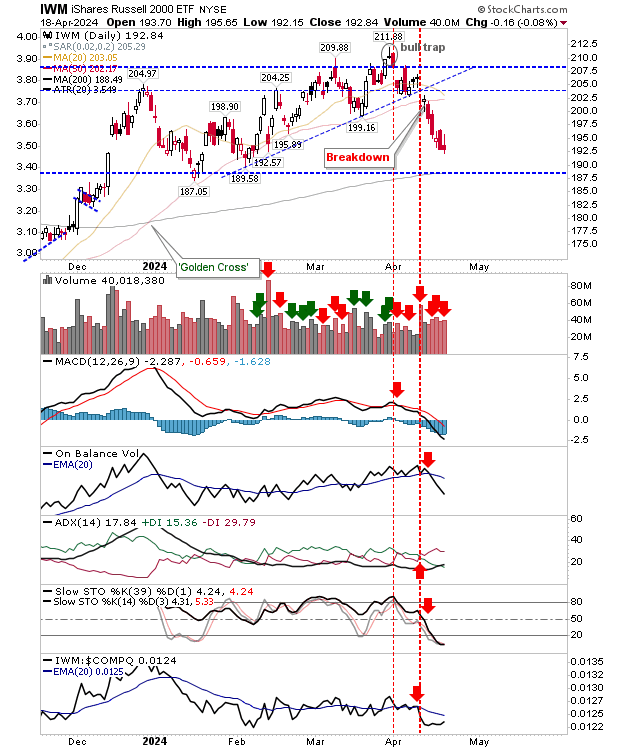

While it wasn't the recovery I would have liked, the Russell 2000 (IWM) managed to resist extending its losses. The index did record a loss, and volume was confirmed as distribution, but I would be a little more optimistic going forward; albeit, a test of the 200-day MA remains favored.

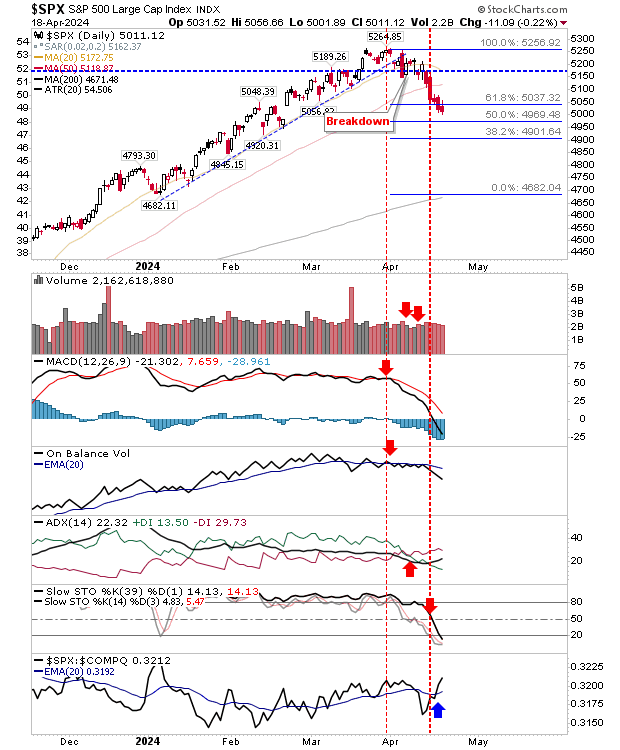

The S&P 500 extended its losses deeper into Fibonacci levels. Volume has dropped a little as momentum reached a confirmed oversold condition. There remains a big void down to the 200-day MA and while a bounce is probably imminent, there is no indication as to what point buyers will step in.

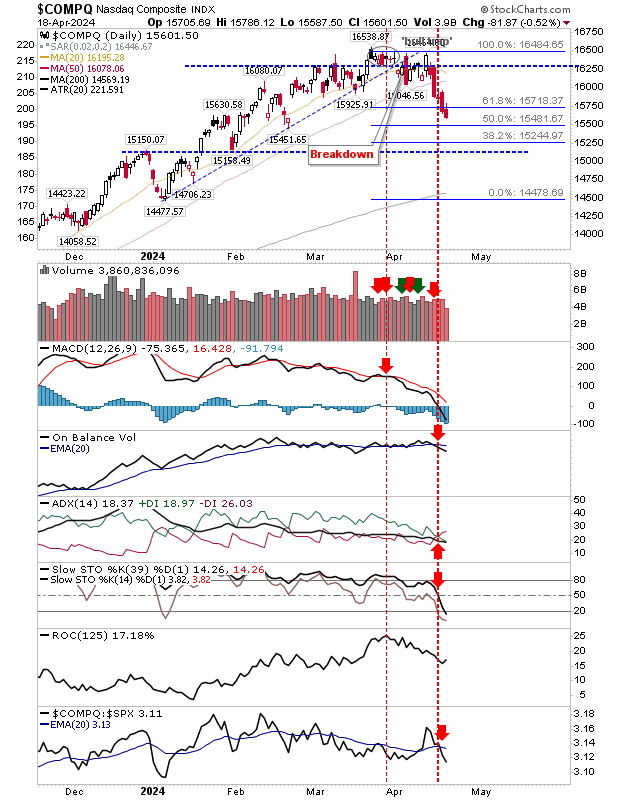

The Nasdaq had the weakest finish of the day and is on course to reach the 50% retracement of the January rally. As with the S&P 500, the decline has reached an oversold momentum state.

While sellers retained control of the markets there is early indication the spate of recent selling is near an endpoint. However, what we do have to be careful about is the risk of a crash. Crashes emerge at an oversold state and we are at this state now.