The S&P 500 and the Nasdaq tumbled yesterday, driven by a sharp decline in microchip stocks.

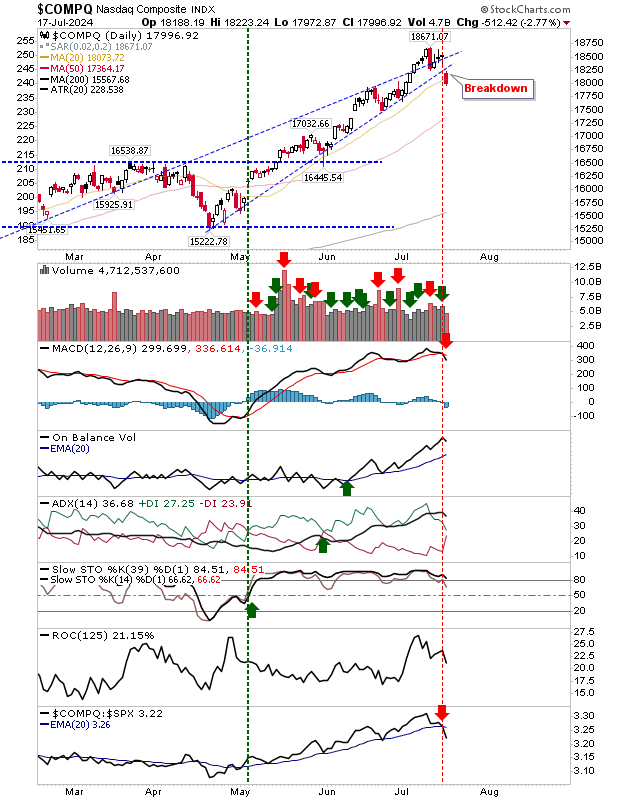

The Nasdaq was the hardest hit on the day breaching the bearish wedge but on a lighter volume.

The index closed below the 20-day MA, but there is a chance for swing traders to trade a move back to 18,500 if we see a bullish doji or hammer today by the close. There is a weak 'sell' trigger in the MACD.

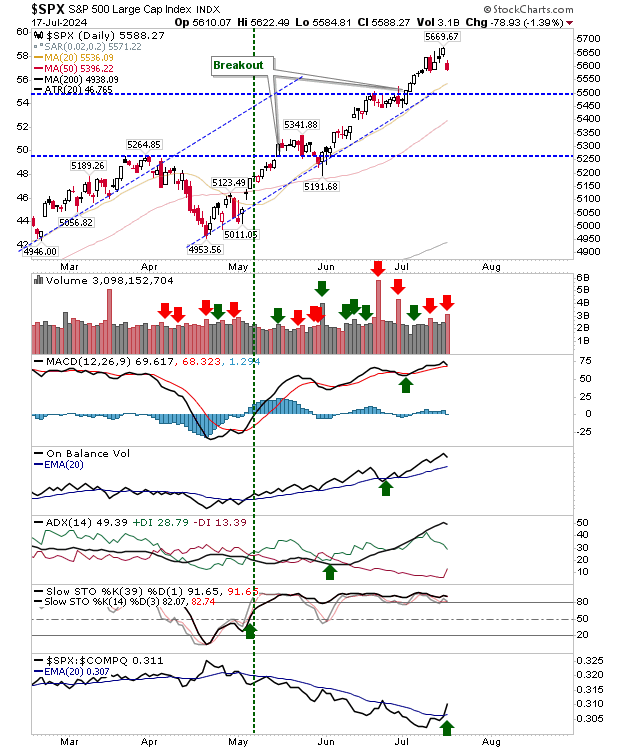

The S&P 500 gapped down like the Nasdaq but it's 50 points away from the 20-day MA which leaves it vulnerable to further selling without an alternative support level to lean on.

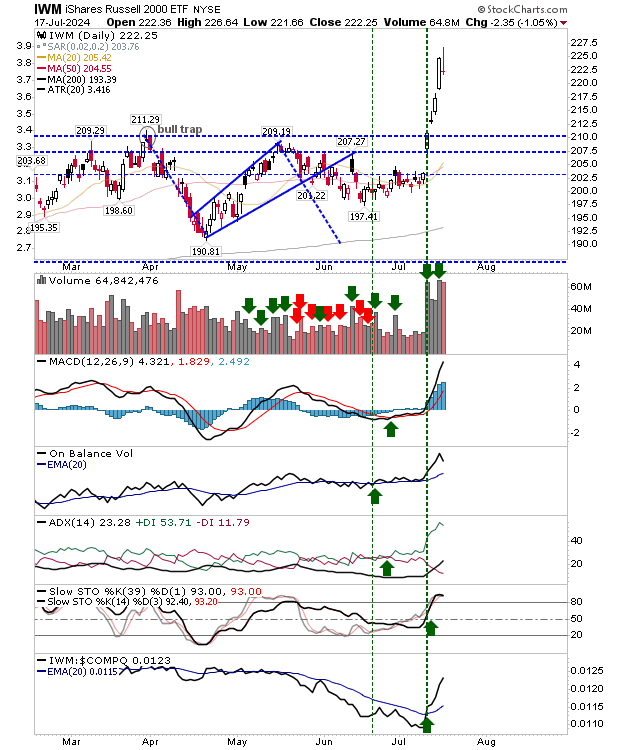

The Russell 2000 (IWM) had attempted an early gain but soon found itself dealing with the selling in the Nasdaq and S&P 500. The inverse doji collectively created a bearish harami cross with yesterday's candlestick, one of the more potent reversal candlestick patterns.

Because of prior gains, supporting technicals remain net bullish and are some way from an immediate reversal, so if we do see a gap down in price today, the resulting decline will likely be short-lived.

For today, look for early weakness in the Russell 2000 ($IWM). If there is no significant follow-through lower, look for a successful hold of the 20-day MA in the Nasdaq by close of business.