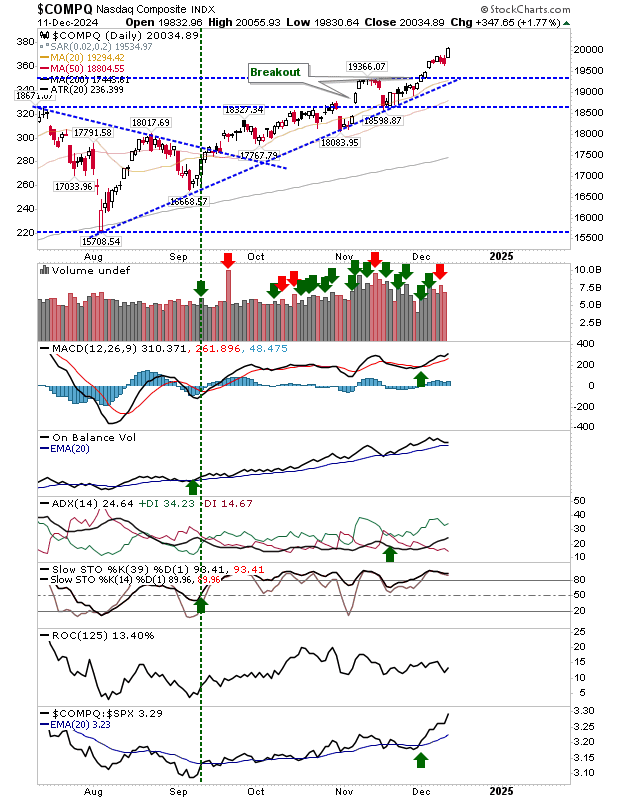

There was only one winner yesterday: the Nasdaq.

Last week's push past resistance has an established breakout gap (yesterday's gain looks to have put to bed any chance of this gap closing, thereby marking it as a "breakout gap"), which in itself, may also be a measuring gap.

If we also have a measuring gap, then look for a push towards 20,500. Technicals are net positive, and there has been a good surge in relative performance against the S&P 500.

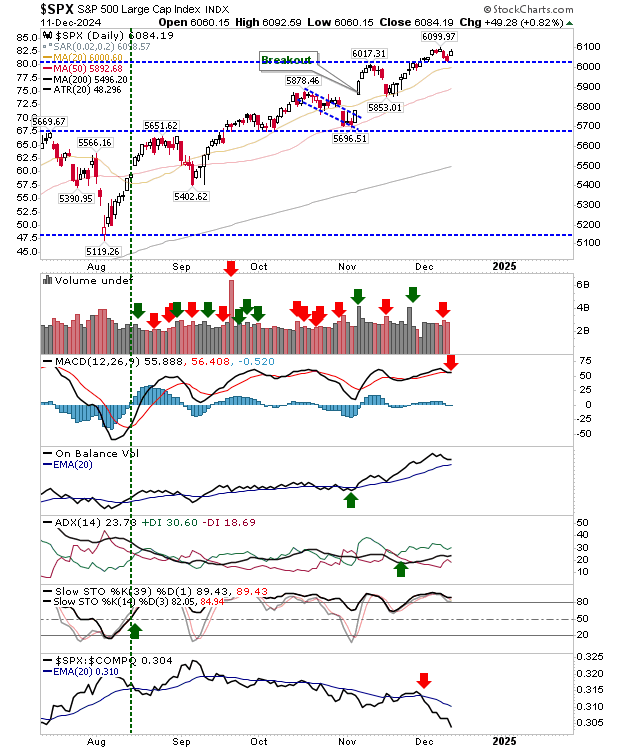

In the middle, we have the S&P 500. It posted a nice gain, but not enough to post a new high. However, yesterday's move in the Nasdaq set a precedent for the index to push on higher, similar to how it performed ein arly October.

Back then, breakout support was retested, but there was no support violation. We can take a repeat here, but an undercut of psychological whole number support at 6,000 will not be tolerated—intraday moves excepted.

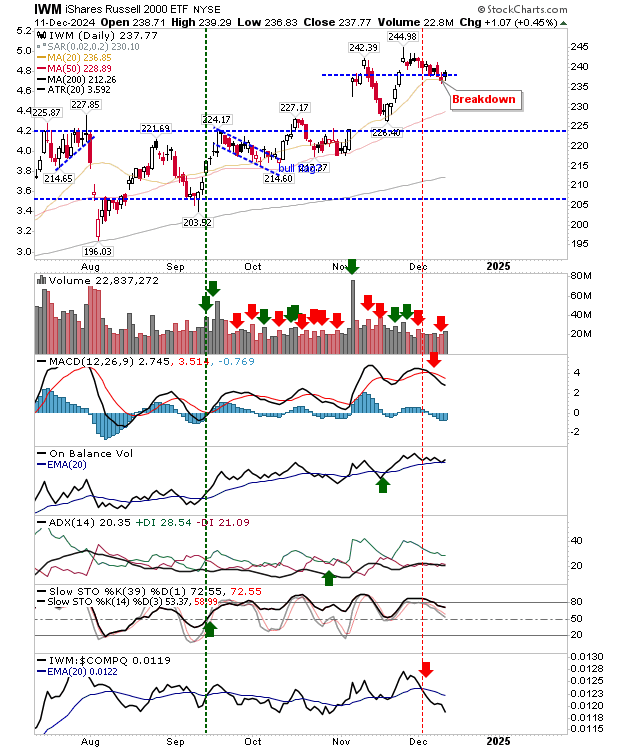

The disappointment was the 170 | Russell 2000 (14202 | IWM). I was looking for a rally off the 20-day MA, but this didn't materialize. Yesterday's candlestick was a 'black' candlestick, but the bearish implications of this only matter at rally peaks, not during a move lower.

today is a new opportunity for bulls, but bulls are running out of room to make their move. Fail the 20-day MA and it's back to challenge the gap at $225. Technicals are mixed, but momentum is still good (for bulls).

For today, it might be too much to ask the Nasdaq to go again, but the Russell 2000 has an opportunity to prove itself. The S&P 500 might be the compromise solution, particularly if it can make a new high and attract new buyers. Santa is coming...