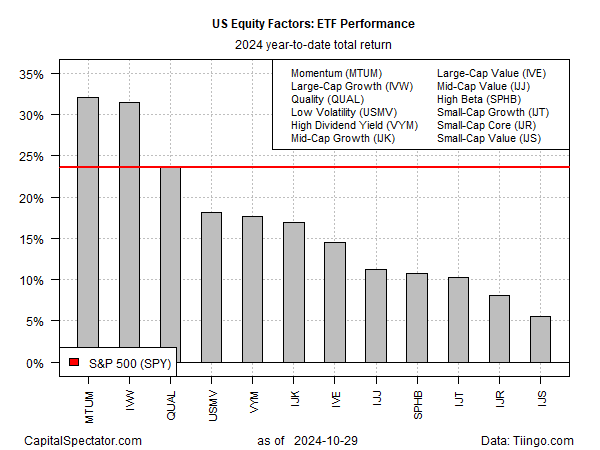

In the competition for 2024 calendar performance, there’s no competition. Momentum and large-cap growth factors continue to outperform the rest of the field by a wide margin, based on a set of ETFs through Tuesday’s close (Oct. 29).

The iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) and iShares S&P 500 Growth ETF (NYSE:IVW) are nearly tied for first place this year with sizzling 32.0% and 31.5% year-to-date gains, respectively. In both cases, the gains are well ahead of the broad market’s 23.6% rise so far in 2024, based on SPDR S&P 500 ETF (NYSE:SPY).

Note that all of the main risk factors for the US equities market are posting advances this year, but the range of results varies dramatically. At the low end of the spectrum is a relatively weak 5.5% increase for small-cap value (IJS). In fact, all three flavors of small caps (growth, core, and value) are in last place for the 2024 factor horse race.

In recent weeks, there has been renewed optimism that small-caps stocks would finally regain the performance crown after trailing large caps for an extended period. Earlier this month, I asked: “Are Reports Of Small-Cap Stocks’ Revival Prospects Premature?”

Two weeks later, the answer seems to be “yes,” or so the latest market action suggests. The core small-cap ETF (IJR) remains well behind the broad market (SPY) for the trailing 1- and 3-month windows, for instance.

Cliff Asness of AQR Capital Management reaffirmed his long-running view that the size-premium (a.k.a. the small-cap effect) is “dead”. In a post on X yesterday, linking to several research papers his firm has published on the topic, he wrote:

“It’s dead because it always was dead (vs market beta, not quality). People seem to have a very hard time accepting that there never was a size effect (vs market beta) even though it’s as close to proven as statistics will allow.”

The market seems to agree, at least based on this year’s relatively weak small-cap performance.