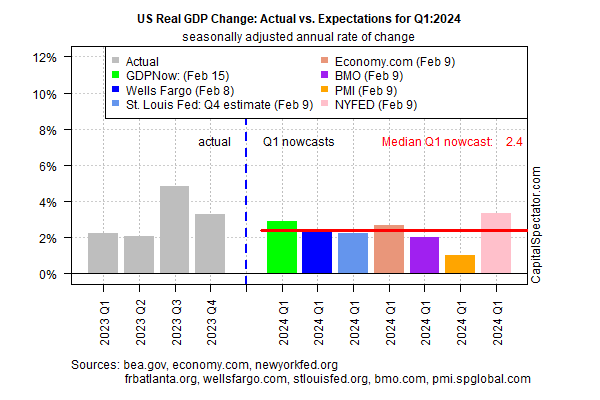

Growth remains on track to soften in the first quarter, based on the median GDP nowcast for a set of estimates compiled by CapitalSpectator.com.

Although recession risk is still low, output looks set to downshift for a second straight quarter.

Q1 growth is currently projected to rise 2.4% (seasonally adjusted annual rate), via today’s median estimate.

The nowcast compares contrasts with Q4’s strong 3.3% rise, which marks a downshift from Q3’s red-hot 4.9% increase, according to data published by the Bureau of Economic Analysis.

Although Q1 output still appears headed for a softer run, the threat of economic contraction remains low for the immediate future, based on several indicators.

For starters, note that today’s nowcast for the first quarter marks a pick up from the previous median estimate.

Additional reasons for expecting that growth will persist include the Philly Fed’s ADS Index, which shows US economic activity expanding at just slightly below average through Feb. 9.

Meanwhile, the Dallas Fed’s Weekly Economic Index through Feb. 9 continues to show a pick-up in economic activity relative to last spring, when many economists mistakenly expected a recession was near.

On both counts, the latest numbers indicate low recession risk.

Yesterday’s weaker-than-expected retail sales report for January triggered new warnings from some analysts that the US outlook is deteriorating.

But by some accounts, there’s still no smoking gun for deciding that the economic expansion has run its course.

“It’s a weak report, but not a fundamental shift in consumer spending,” says Robert Frick, corporate economist for Navy Federal Credit Union.

“December was high due to holiday shopping, and January saw drops in those spending categories, plus frigid weather plus an unfavorable seasonal adjustment.

Consumer spending likely won’t be great this year, but with real wage gains and increasing employment it should be plenty to help keep the economy expanding.”

A similar view prevails at Wells Fargo (NYSE:WFC):

“Even as we expect spending will moderate this year, the January slowdown may overstate the near-term pullback in consumption,” economists at the firm write.

“Households have benefited from a real income tailwind over the past year as inflation is slowing more than wage growth.

While the unique factors of excess liquidity and easy access to cheap credit are tales of the past in the story of consumption, a still-sturdy labor market should lead to only a gradual moderation, rather than collapse in spending this year.”

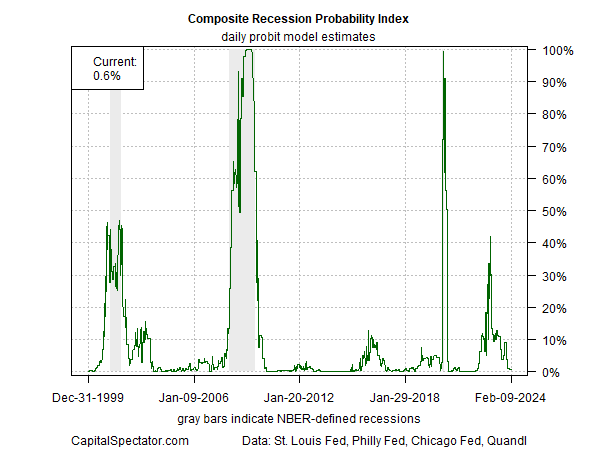

Meanwhile, the recent recession risk estimate published by The US Business Cycle Risk Report (a sister publication of CapitalSpectator.com) remains low, based on data through Feb. 9.

When the Composite Recession Probability Index (CRPI), which aggregates signals from several business cycle benchmarks, rises substantially from current levels it will indicate elevated risk that an NBRE-defined contraction is brewing.

For now, however, the potential for a severe slowdown in economic activity appears low.