- Meta is set to report earnings after market close tomorrow

- The stock has zoomed 160% so far this year

- Could the earnings justify the stock's meteoric rise?

In late 2022, I participated in a challenge where I was asked to predict the best-performing stock for 2023. I chose Meta Platforms (NASDAQ:META) due to the substantial discount at which the stock was trading at the time.

It was priced at around $125 per share. I had a position in the stock, although I later closed my position.

Fast forward almost a year, and the stock has zoomed 160% YTD as traders bought into Zuckerberg's year of efficiency narrative.

While it remains uncertain whether my pick will win the challenge, it's clear that the stock made sense at those prices, just like many other stocks back then. The main issues driving the negative sentiment around it were:

- Slow user growth.

- Intense competition from other platforms, with TikTok being the most prominent rival.

As I often emphasize, the market's perception is driven by the prevailing narrative. Interestingly, the same issues that concerned investors at $125 per share seem to have faded into the background as the stock now trades at over $300.

Tomorrow, the quarterly earnings call will take place, and in this piece, we will delve deep into the market expectations using insights from InvestingPro.

What to Expect From Meta's Q3 Earnings?

Earnings for this quarter are anticipated to be $3.61, a significant increase from the $1.64 reported in October 2022 (a period when, incidentally, the stock hit its lowest point).

Revenue is also expected to rebound, reaching $33.4 billion, compared to $27.7 billion in the same period in 2022.

Source: InvestingPro

Key metrics to monitor include:

- Active user growth, which is expected to be one of the main metrics to watch.

- Investments in the Metaverse: The company has been making substantial investments, with significant cash outlays and capital expenditures. The focus is on whether these investments will yield returns.

- Paid social: There is considerable interest in the potential transformation of revenues, not just from advertising but also from users in the form of subscriptions. The question remains whether this will materialize.

Valuations: Is the Stock Still Cheap?

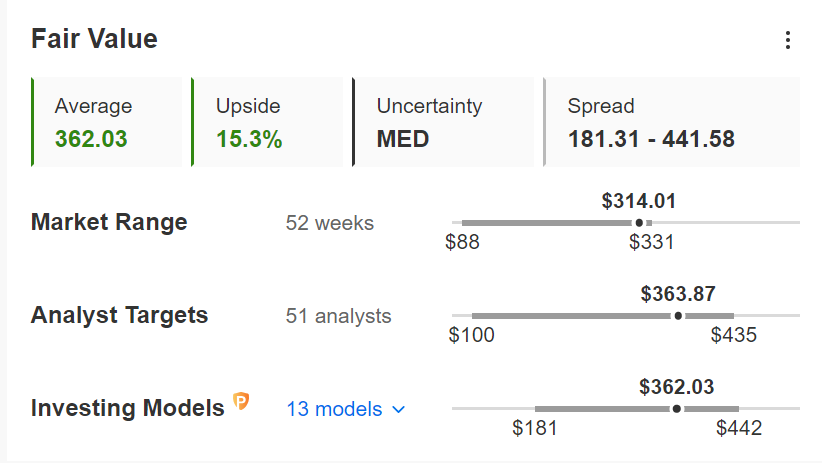

Currently, the fair value appears to be around $360, as per InvestingPro's analysis. This suggests a potential upside of approximately 15%. However, it's worth noting that this leaves little room for significant discounts.

Source: InvestingPro

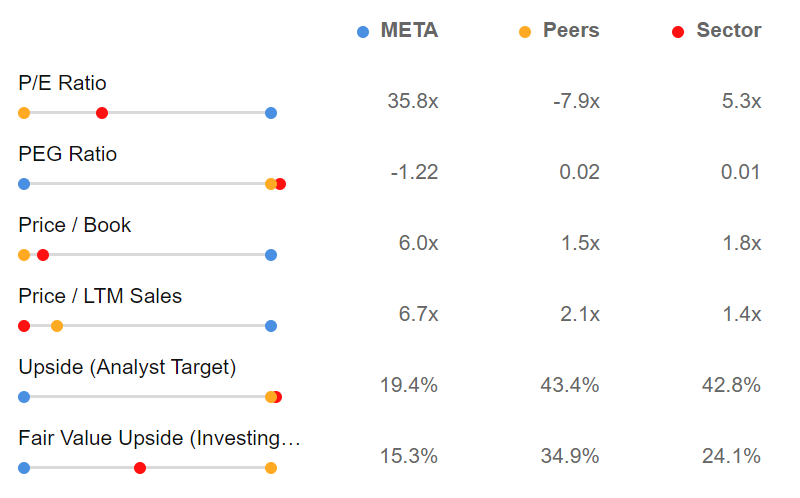

In terms of valuation multiples, according to InvestingPro, the stock is currently trading at significantly higher levels than usual. This suggests that a substantial portion of the price movement for this year has already occurred.

Source: InvestingPro

Conclusion

While the stock's high valuation remains a concern, the company's enduring competitive advantage continues to be a positive factor, and the company possesses numerous opportunities for diversification that could pave the way for fresh revenue streams, potentially fueling future growth.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."