- Meta's upcoming Q2 earnings are highly anticipated, with a focus on its AI progress.

- Despite significant AI investments, Meta still relies heavily on traditional revenue streams, making this earnings report crucial.

- Positive earnings expectations for Meta are tempered by investor concerns over high spending and the long-term viability of its AI strategy.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Tech giants have taken a significant hit recently, with big names like Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA) leading the Nasdaq's recent decline.

This unexpected downturn underscores the market's volatility and the potential for even the most established companies to falter eventually.

All eyes are now on Meta (NASDAQ:META), whose second-quarter earnings are due after the market closes today. Given the intense focus on artificial intelligence, investors will keenly watch the social media giant's progress in this domain.

Meta has made substantial investments in AI, acquiring around 600,000 H100 GPUs from Nvidia. However, the company's core revenue streams still primarily rely on its traditional platforms like Instagram, Reels, Facebook, and Messenger.

It will be crucial for Meta to demonstrate how its AI endeavors are translating into tangible value and revenue growth.

Does Meta Have an Edge in the AI Race?

Last week, the company behind Facebook, Instagram, and WhatsApp launched the latest update to its flagship AI product, Llama, now available as the free and open-source version 3.1 405B.

This move allows anyone to access and modify the model, potentially accelerating Meta's AI development. Unlike the closed models used by Google, OpenAI, and Anthropic, Meta's open-source approach reflects CEO Mark Zuckerberg's strategic gamble.

Jefferies analysts believe Meta's choice to adopt an open-source model positions the company ahead of its competitors in creating value and reinforcing its AI leadership. They liken Meta’s strategy to the success of Linux, suggesting that Llama could become a foundational element for future AI software.

"In addition to offering a significantly better cost/performance ratio than closed models, the open-source nature of the 405B model will make it the best choice for fine-tuning and distillation of smaller models," Zuckerberg explained during the recent update announcement.

While closed models from other Big Tech companies currently dominate, open source is quickly catching up. According to Zuckerberg, Llama 2 lagged behind state-of-the-art models last year, but Llama 3 now competes with the most advanced models and excels in some areas. He predicts future Llama versions will lead the industry in technology, transparency, modifiability, and cost efficiency.

However, training AI models is expensive and requires substantial electricity, prompting Meta to seek new revenue sources to sustain its open-source approach. Jefferies analysts see several opportunities for Meta to monetize Llama:

- Specialized Business Versions: Offering enhanced support and security features.

- Custom AI Services: Allowing customers to personalize their models, develop AI applications, and train models from scratch.

- Increased Advertising Revenue: Boosting user interaction and engagement.

Meta's innovative approach could redefine its position in the AI landscape, driving both technological advancement and financial growth.

Analysts Predict Positive Q2 Results for Meta Amid High Expectations

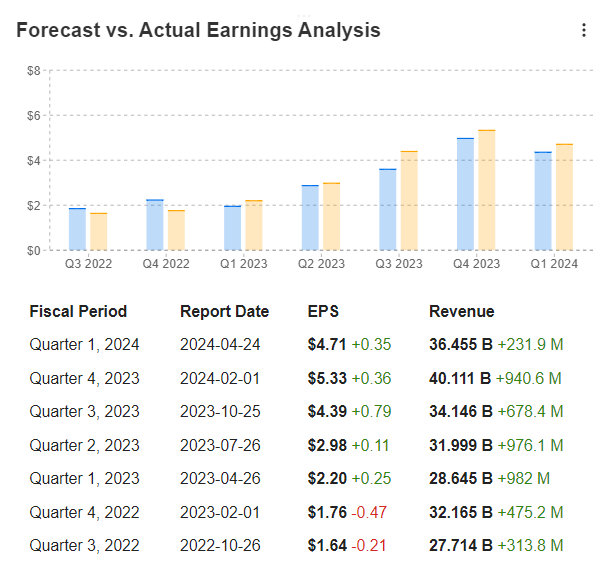

As Meta prepares to release its quarterly earnings after the market closes, analysts anticipate a positive performance. According to InvestingPro, markets expect Meta's earnings per share (EPS) to rise from $4.71 in the previous quarter to $4.78.

Source: InvestingPro

Profits are projected to reach $38.31 billion, marking a 5.1% increase from the $36.445 billion reported in the first quarter and a 19.7% increase compared to the same period in 2023.

Sentiment remains positive, with 11 upward revisions on EPS and only 4 downward ones in the last 90 days.

Understanding when Meta's significant investments will become profitable is crucial for market confidence. Despite turning a corner after its Metaverse bet and exceeding earnings expectations for the past five quarters, Meta's stock slid 15% following the last earnings call.

Source: InvestingPro

Investors were concerned about the high capital expenditures, which are projected to be between $35 billion and $40 billion, with some sectors yet to monetize these investments.

Bottom Line

In today's fast-paced, social media-driven world, there's a heightened demand for instant results. Mark Zuckerberg faces the challenge of meeting these expectations.

However, those who understand the value of patience believe time will reveal whether Meta's substantial AI investments are wise or overly risky.

In the meantime, small investors should diversify their portfolios to prepare for potential market shifts, even as industry giants navigate their ambitious growth strategies.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.