- Meta earnings loom large as big tech attempts to rally again. Can the social media giant deliver strong results and reignite the tech sector?

- Analysts are bullish on Meta but uncertainties around the Metaverse monetization remain.

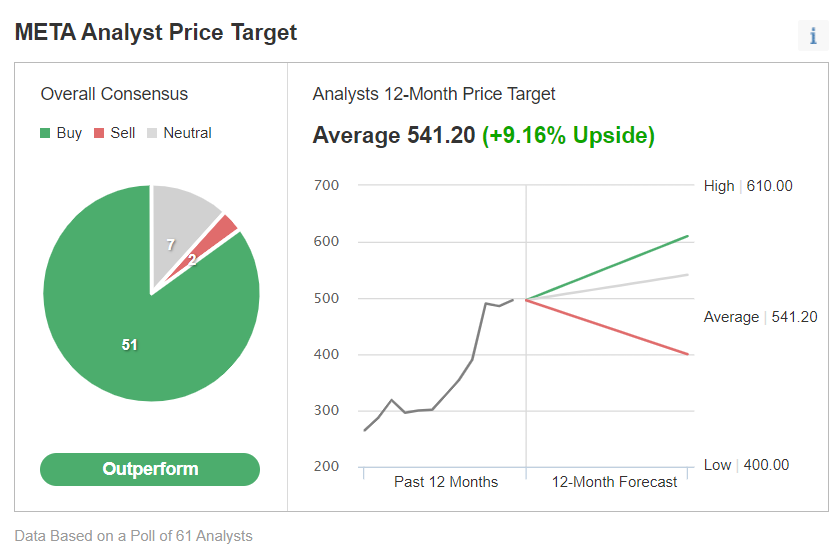

- Wall Street is confident, with most analysts recommending "Buy" and a bullish target price for Meta stock.

Big tech has fueled Wall Street's gains for the past year, with companies like Meta Platforms (NASDAQ:META) leading the US stock market to record highs. However, a recent delay in Fed rate cuts and uncertainty in the chip sector have weighed on the Nasdaq over the past month.

Now, with the start of the quarterly earnings season, the spotlight shines brightly on Meta. The social media giant will face its financial test today after the closing bell. Analysts are anticipating strong results from Mark Zuckerberg's company, with revenue expected to reach $36.223 billion - a 26.5% year-over-year increase, marking the highest growth rate since 2021.

Earnings per share are also projected to nearly double compared to Q1 2023, jumping from $2.20 to $4.36. So, can Meta deliver on these high expectations and reignite the momentum for the tech sector, or will the company fall short and put Nasdaq's recent rebound under pressure?

Meta Earnings: High Hopes, Big Questions

Source: InvestingPro

Analysts are sharply raising their forecasts for Meta Platforms, with InvestingPro's chart showing a 59.8% increase in EPS expectations over the past year. This bullish sentiment has likely been fueled by Meta's:

- Strong Advertising Revenue: New ad formats are driving growth across their platforms.

- AI Advancements: The launch of Meta AI, a new digital assistant, promises to enhance user experiences on Whatsapp and Instagram.

While strengths like advertising revenue growth fueled by new ad formats and advancements in AI with the launch of Meta AI promise a more engaging user experience on WhatsApp and Instagram, uncertainties remain.

The company's ambitious Metaverse project could lead to a second consecutive quarter of hefty losses exceeding $4 billion. Additionally, the upcoming US Presidential election poses a major challenge, potentially damaging Meta's credibility as concerns rise about the spread of misinformation on social media platforms.

Investing.com Analyst Sees Strengths Despite Metaverse Risks

According to Thomas Monteiro, lead analyst at Investing.com:

"Thanks to its leaner margins and substantial free cash flows, Meta's ability to navigate the shifting interest rate narrative should be the key differentiator from its competitors this earnings season. This is particularly reassuring for investors in the current climate, where future guidance is the primary metric of interest, given the expectation of a tougher Q2."

He went on to add:

"The positive trend will likely get further push from the stronger-than-expected economic activity in the US and China for the period, which should once again serve as a solid catalyst for Meta's thriving ad operation. Against this backdrop, Meta's strong balance sheet, undisputed moat, and lean operation should also be perceived as a significant edge in the current war for talent, particularly in the AI space."

However, Monteiro acknowledged that risks still lurk for the company ahead of the earnings report.

"Concurrently, the risk for this report lies in the company's need to show investors it is drawing closer to a scenario in which it will be able to draw substantial AI-generated revenues. Another interesting point is understanding whether a learner Metaverse operation can pay out in the mid-term. I would not be surprised by better-than-expected numbers there, but given the most recent US consumer trends, risks are still high."

He concluded:

"The bonus in the report would be if Zuckerberg could show investors his company is on the way to improving monetization in the WhatsApp business, which still presents significant untapped potential."

Wall Street Remains Bullish

Analysts are showering Meta Platforms with confidence ahead of its earnings release. A survey by InvestingPro of 53 analysts projects an average stock price increase of 9.16% over the next 12 months, setting a bullish target price of $541.20.

This optimism is reflected in analyst ratings, with 51 experts recommending "Buy" for Meta, 7 recommending "Hold," and only 2 suggesting "Sell." The market clearly has high hopes for Meta, following its impressive 140% stock price growth in the past year after a challenging 2022.

However, with great power comes great responsibility. The social media giant now faces the pressure of exceeding expectations and not disappointing the markets and investors who believe in its bullish potential.

***

DISCOUNT CODE

Take advantage of a special discount to subscribe to InvestingPro+ and take advantage of all our tools to optimize your investment strategy. (The link directly calculates and applies the discount of an additional 10%. In case the page does not load, you enter the code proit2024 to activate the offer.)

You will get several exclusive tools that will enable you to better cope with the market:

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.