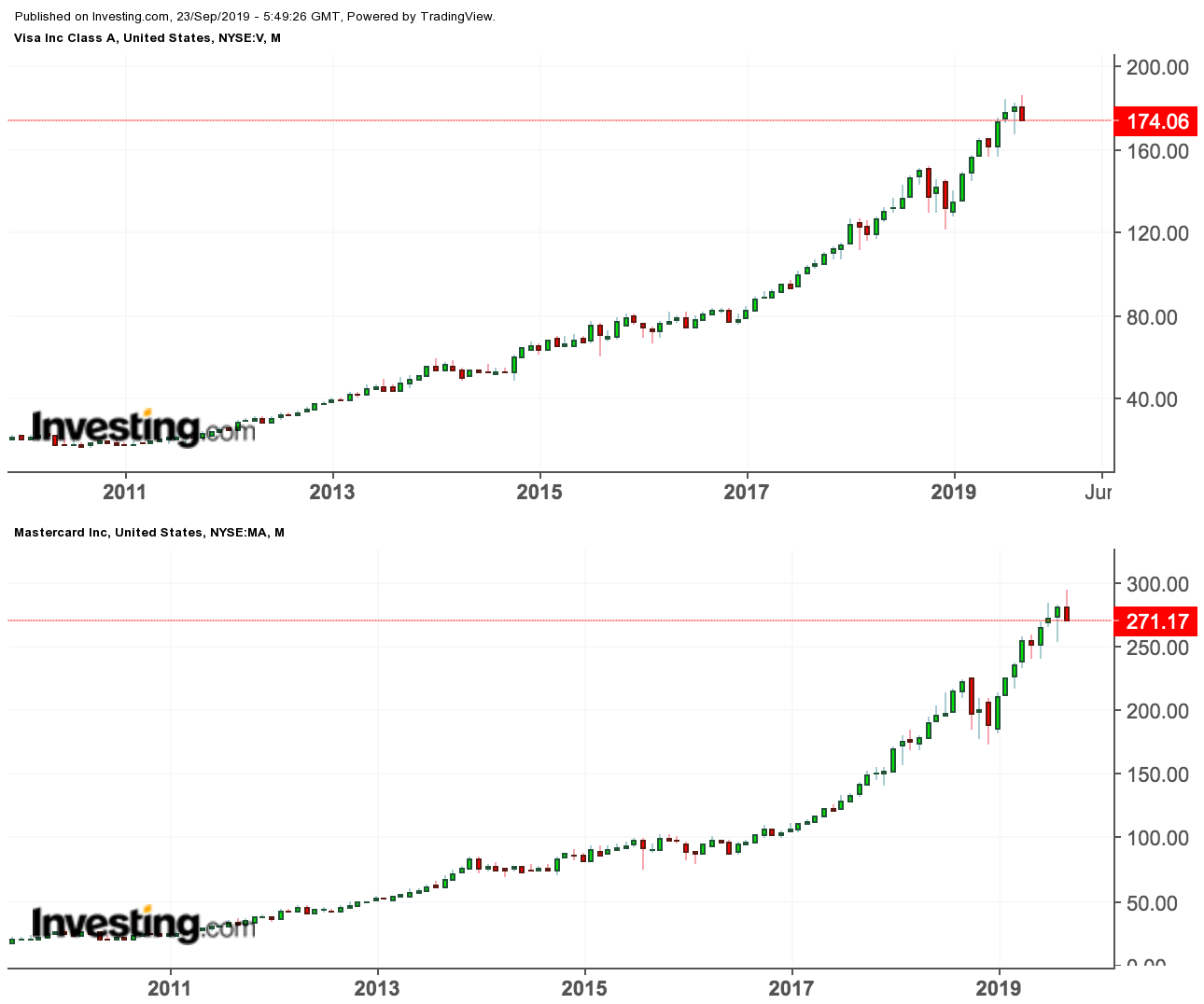

Mastercard Inc (NYSE:MA) and Visa (NYSE:V), the world’s largest payment networks, have proved a great bet for their investors. Despite all the worries about global growth, trade wars, and volatility in the markets, their stocks have continued their upward journey, beating the broader market.

Shares of both companies have surged between 30% to 45% this year, while the S&P 500 Index has gained 19%. If you look at their performances over the longer horizon, the gains have been more stunning. Over the past five years, Mastercard has delivered about 260% return, while Visa has soared 223%.

The growth stories of Visa and Mastercard have been impressive. Thanks to their market dominance and the continuing worldwide shift away from cash, both companies have been ideally positioned to benefit from the strong global economy, solid consumer spending in the U.S. and a favorable credit environment.

For the second-quarter, Mastercard reported a 12% growth in revenue, while Visa delivered a 15% increase compared with a year ago. Mastercard’s revenue has grown more than 17% on average over the past eight quarters, according to FactSet.

With this kind of explosive growth, a logical question in investors' minds should be whether both payment masters will be able to continue with this growth journey? That concern has become more relevant, given growing signs of economic weakness outside the U.S., coupled with the lingering trade war with China.

Bullish Future Expectations

Despite these concerns, the analysts’ community is still quite bullish on the future. Of the 38 Wall Street analysts who cover Mastercard, 35 recommend buying the stock. And for Visa, the number of buy calls is 34 out of 39 in total.

“There are few (if any) other stocks for which you can have a comparable level of conviction that the company will deliver ~20% EPS growth, year-in, year-out, for at least the next five years,” said Moffett Nathanson’s analyst Lisa Ellis in a recent note to clients.

In the case of Mastercard, the sentiment turned more bullish in recent months after the company began spending heavily on acquisitions to unlock future growth and build out its digital capabilities.

Last month, the company agreed to buy a payments platform owned by Denmark-based Nets for $3.19 billion. Earlier this year, the company bought Ethoca, which helps merchants identify fraud, and Vyze, a point-of-sale payment provider. The company also acquired Transactis, which helps with bill payments, and Transfast, a cross-border payments network.

Visa, on the other hand, is consolidating its dominant position in the payment market through a series of acquisitions and partnerships.

Visa was intrinsically poised for success, said David Ritter, a Bloomberg Intelligence analyst in a report last month. The network offered the infrastructure for electronic payments just as digital commerce began to spark, and its middleman role in transactions gives high profit margins with low costs and risks.

“The big tailwind at its back is commerce going electronic,” Ritter said in the report. “They’re just in a great business and very enviable position.”

Bottom Line

Both Visa and Mastercard are benefiting from strong consumer spending, a cyclical shift from cash to credit and a persistent low interest-rate environment which is fuelling consumer spending. That rally may continue if these conditions perist, but both stocks will not remain immune to a sharp slowdown in the economy. Any pullback in their share values should be taken as a buying opportunity by long-term investors.