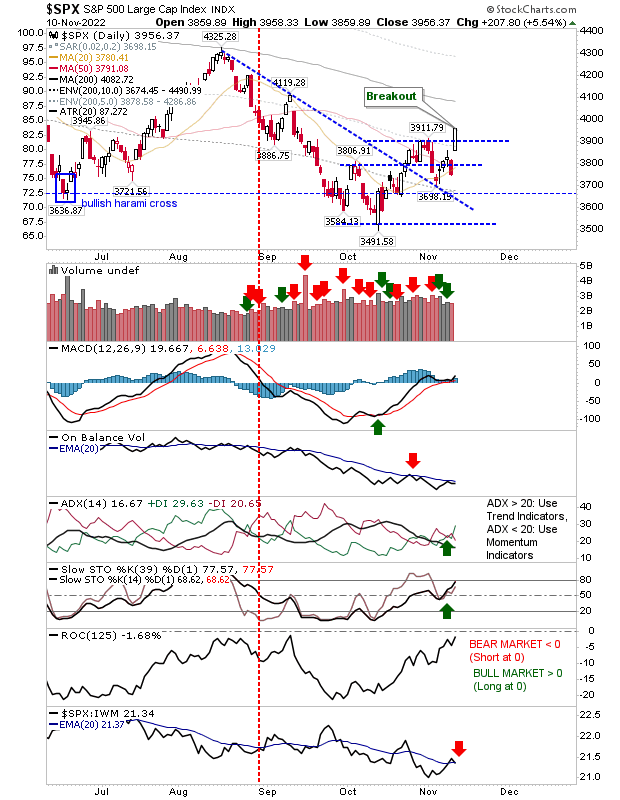

Yesterday's gains reversed what was looking like a new leg lower, and the degree of the advance was no doubt supported by short covering coming off Wednesday's preferred strategy. I wouldn't read too much into the CPI data - news is used to fit the narrative - and many of the indices are still locked inside trading ranges which could go either way.

The S&P managed to make its way past the most recent swing high as it looks to push towards its 200-day MA. Technicals are improving, although On-Balance-Volume retains its 'sell' signal. If this buying is real, the S&P should be the index to benefit.

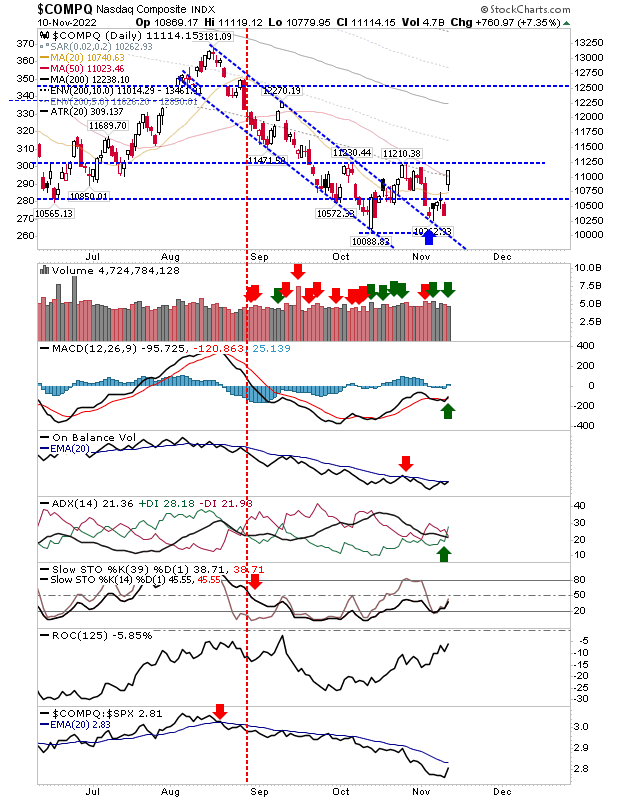

The Nasdaq was not as fortunate as the S&P, although it did enjoy an accumulation day despite remaining below resistance defined by the last swing high. There was a new MACD trigger 'buy' to go with the ADX trigger - although Stochastics and On-Balance-Volume remain bearish. The index has been underperforming the S&P for a long time, but this relationship saw a sharp uptick in the Nasdaq's favor, although it hasn't yet crossed the moving average trigger line.

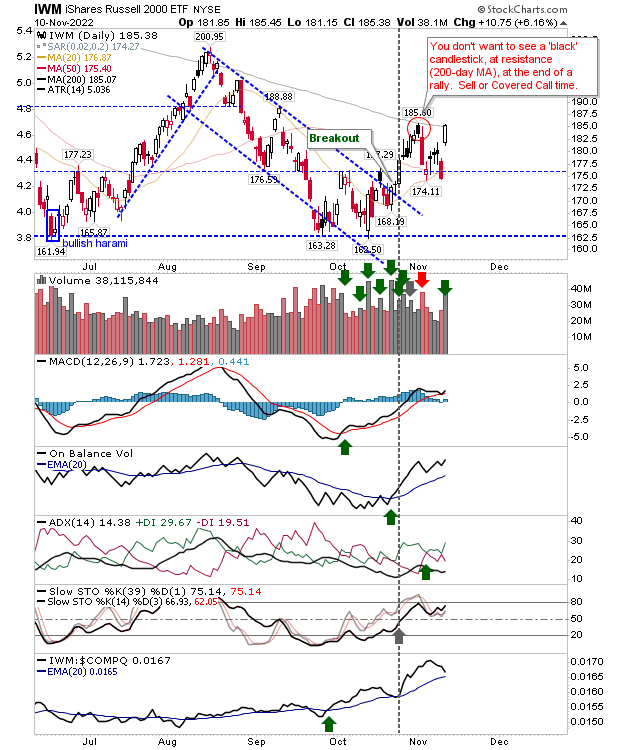

The Russell 2000 made it back to its 200-day MA on higher volume accumulation. While it hasn't cleared the last swing high marked by the black candlestick, it did manage to edge a close above its 200-day MA. Technicals are net positive, although the index is losing some relative ground to peer indices.

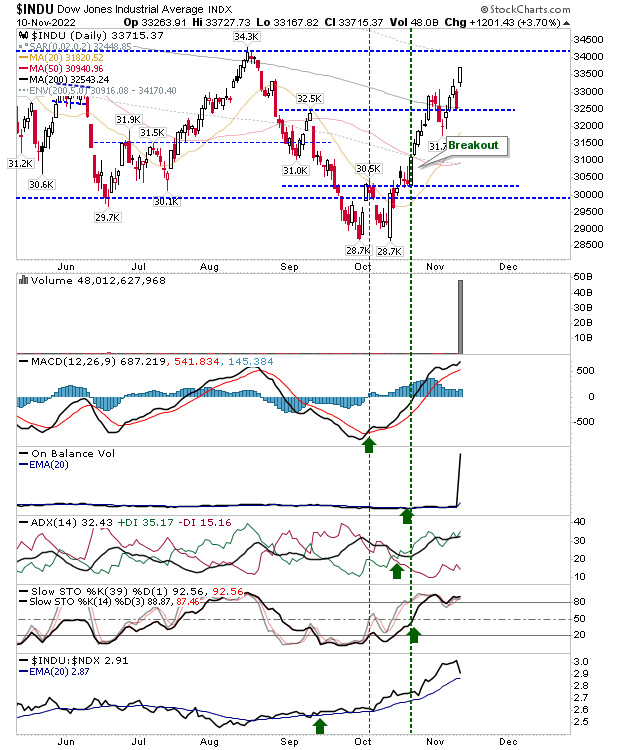

The strongest index is the Dow Jones Industrial Average. It's making its way to the August swing high having pushed past its 200-day MA last week. Technicals are very strong, although it has lost some relative ground against the Nasdaq 100.

For today, it will be about indices holding on to as much of yesterday's gains as possible. Look for large cap indices to hang on to support of their most recent swing highs, and if they can do this then I would be looking for the Nasdaq and Russell 2000 to follow suit.