The S&P 500 and Nasdaq finished the week lower by around 5 and 6%, respectively. It is tough to find many bright spots in this market, especially with what is taking place in real rates.

Options expiration kept things from getting ugly on Friday; with $390 being the big gamma level on the SPY ETF, put owners were anxious to sell their puts going into days end once it became clear the S&P 500 index wasn’t able to break support at 3,840. So that left the market with a late afternoon rally.

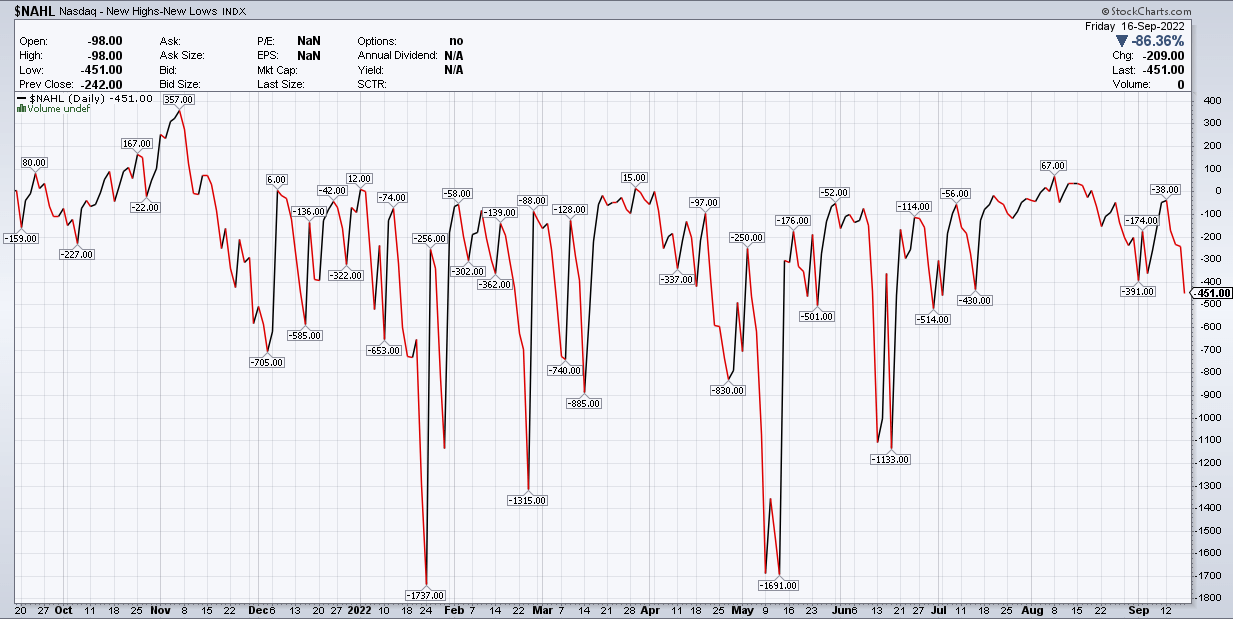

The internals on Friday was pretty bad, though, especially on the Nasdaq, with 451 more new lows on the day than new highs. That was the lowest reading since early July.

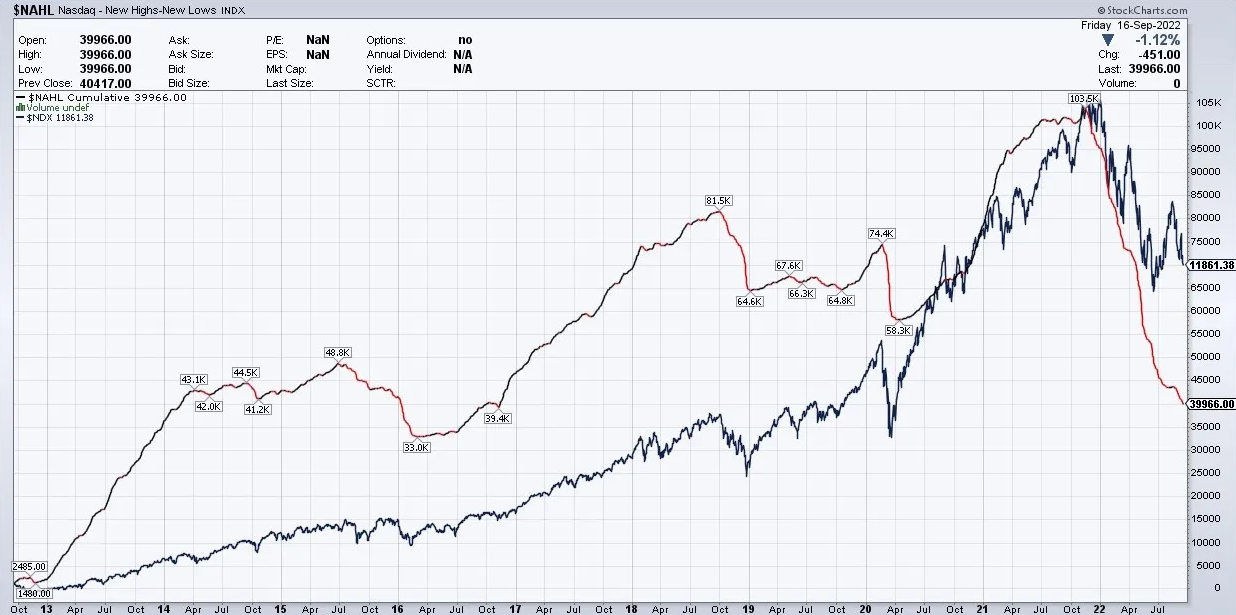

More importantly, the cumulative new high minus new low shows another new low being me on the cumulative count. It is something that I do not view as positive for the market overall and is just another warning sign that new lows are coming to this market sooner than later.

QQQ Vs. TIP

The QQQ runs about 12 days behind the TIP ETF, and the decline in the QQQ is coming on schedule. Based on the TIP, the QQQ isn’t likely to see much of a rebound anytime soon, either.

S&P 500

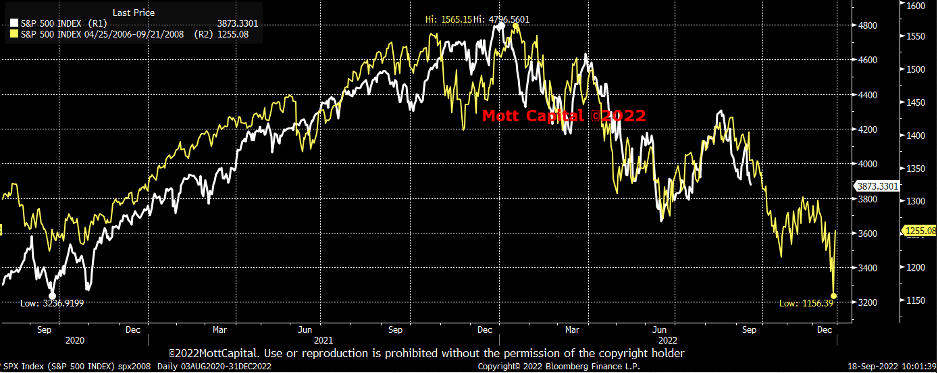

As far as where the market is going this week, I have decided to try and not predict the weekly movements in the market this week because I do not want that to be confused with the conviction I have that market is heading to the June lows, and I believe the high likelihood for them to make new lows. Additionally, the 2008 analog suggests that between now and October 25, the outlook for the S&P 500 and the Nasdaq could be brutally painful.

Zoom

Zoom Video (NASDAQ:ZM) is the poster child for stocks making new lows on the Nasdaq, as Zoom, in my observation, has been one of the greatest leading indicators of where the market is going overall. No surprise then that Zoom just made a new low on Friday. That said, Zoom probably isn’t finished falling either, with the following significant support at $76.45 and then $70.

Emerging Markets

If you want to see the effects a strong dollar is having worldwide, look no further than the EEM ETF, which made a new low on Friday and is probably heading even lower. Support at $38 has broken, and the next support level doesn’t come until $36.45.

DocuSign

DocuSign (NASDAQ:DOCU) jumped after its results, but this stock is no different than Zoom, and those gains are melting quickly. Like Zoom, Docusign will probably be added to the stocks on the Nasdaq making new lows very soon. There is no support until $46.85.

DoorDash

DoorDash (NYSE:DASH) is getting ready to travel up the stairway to heaven with that massive descending triangle and sitting just above support at $56.80. DoorDash will probably be another stock added to the growing list of stocks making new lows.

Anyway, this will be a big week, with the Fed and all; good luck.