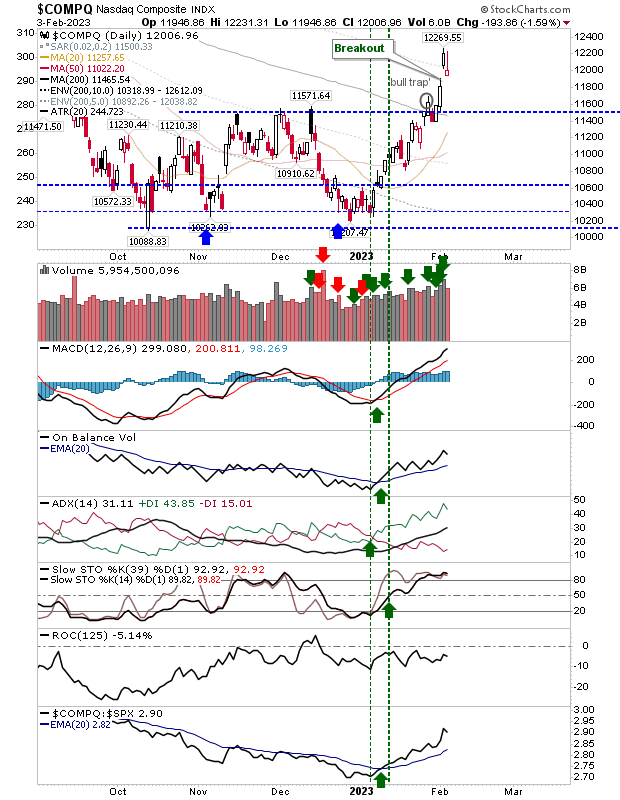

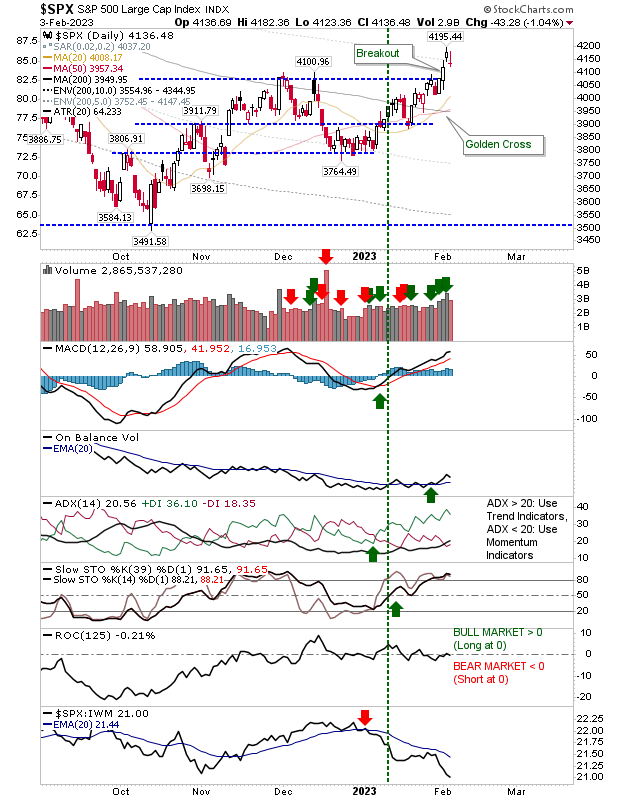

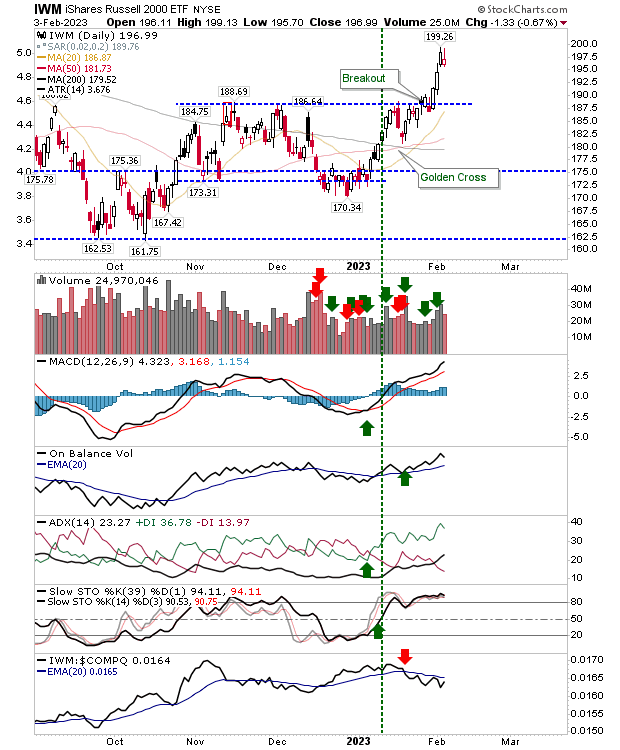

Friday delivered a small riposte to Thursday's big gains, but this rally from December lows needs a larger consolidation to help digest those gains. Breakouts and the moving averages established solid support, so I wouldn't worry if things stall here. If we lose all the moving averages (which would also take out breakout support), a recovery would take longer than just a few weeks.

The Nasdaq is the market leader with net bullish technicals. If Friday's losses were the start of something more, then a retest of 11,500 would be very welcome, and a spike low below 11,500 even better. The 50-day MA would also offer a good test to wash out weak hands.

The S&P 500 has less wiggle room than the Nasdaq. The big win from last week was the 'Golden Cross' between 50-day and 200-day MAs, and I would think a test of these moving averages is likely in the weeks ahead. Key support lurks at 3,800, but if this rally was to get back there, I'm not sure that support would hold.

The Russell 2000 (IWM) hasn't quite managed a "tweezer top" (the Thursday spike high is, perhaps, not long enough), but there is a strong reversal possibility for next week. Good support is to be found at $188.70 and what is a fast-approaching 20-day MA.

For next week, I would like to see some lateral action to consolidate December-February gains. I would not be concerned with losses as long as volume remains below distribution levels.

Current action reflects a move into forming right-hand-bases - bases that date back to 2021 for the S&P 500, Nasdaq, and Russell 2000. Investors should have been buying from June lows, and now is the opportunity for momentum players to jump aboard.