FX Brief:

- It was another volatile session courtesy of the Antipodeans, with Australian employment missing the mark and sending AUD broadly lower. Whilst unemployment rose to 5.3% as expected, it was employment growth contracting for the first time since September 2016 (with fulltime employment also falling) which made its presence known.

- And that was before weak Chinese data. Retail sales fell to 7.2% YoY (7.8% prior and 7.9% expected), industrial output fell to 4.7% YoY (5.8% prior, 5.4% expected) and investments fell to 5.2% (5.4% prior and expected).

- RBNZ’s deputy governor spoke earlier in the session, stating they made a call to “bide our time for now” on interest rates, but RBNZ could move rates in February if they needed to.

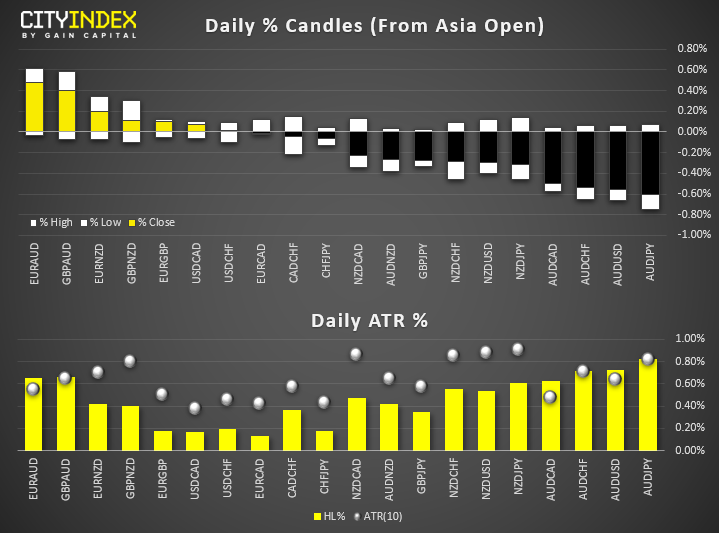

- AUD and NZD are the weakest majors (in that order) and the yen was slightly bid on further trade doubts. NZD/CAD has retreated from yesterday’s high but we’re keeping a close eye on 0.8500 for a potential trend reversal. AUD/USD is below 68c after breaking out of its corrective channel, AUD/NZD fell to a 10-weel low.

- Volatility was higher than usual in Asia today, with the average daily rage to ATR sitting at 69%. Yet six AUD pairs exceeded their AR following weak employment and Chinese data.

Equity Brief:

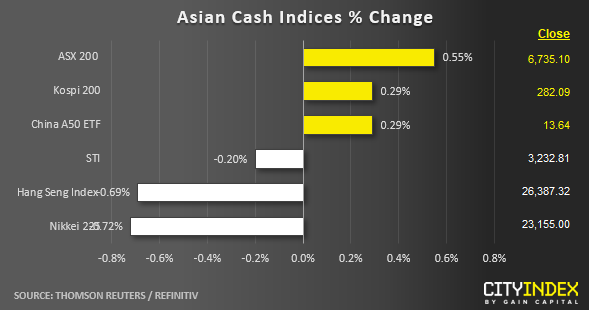

- Cautious trading mood continue to reign in today’s Asian session where traders continue to monitor the on-going anti- government demonstrations in Hong Kong that are not showing at signs of abating at this juncture. Also, key economic data releases out from China, Japan and Australia have remined traders that the global economy remains fragile.

- China’s retail sales and industrial output growth for Oct has slowed down more than expected (retail sales; 7.2% y/y vs consensus of 7.9% y/y & industrial output; 4.7% y/y vs consensus of 5.4% y/y) which indicates that the current piecemeal stimulus programmes from Chinese policy makers are not gaining much traction to boast economic activities.

- Japan’s preliminary Q3 GDP came in at 0.2% y/y below consensus of 0.8% y/y, down sharply from a revised Q2 reading of 1.8% y/y. Meanwhile, Australia’s jobs data for Oct painted a sombre picture as it shed jobs for the first time in 17 months with employment change at -19K versus consensus of +15K.

- Hong Kong’s Hang Seng Index has continued to be the worst performer for the 4th consecutive session where it has dropped by around -0.70% so far reinforced by a plunge of -2.10% seen in Tencent Holdings, the 2nd largest component stock in the HSI after its Q3 earnings missed estimates with a -13% y/y decline in net profits (CNY 20.4 billion vs consensus of CNY 23.5 billion).

- Australia’s ASX 200 has managed to shrug off the negative sentiment arising from the weak AU employment data to record a gain of 0.55% led by technology and healthcare related stocks where Afterpay Touch has soared by 7.5% after an announcement of A$200 million subscription by U.S. based Coatue Management and a 110% increase in its global sales for 4 months ended 31 Oct. Another tech stock, Nearmap also posted a stellar gain of 14% after an upbeat outlook for 2020.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."