Street Calls of the Week

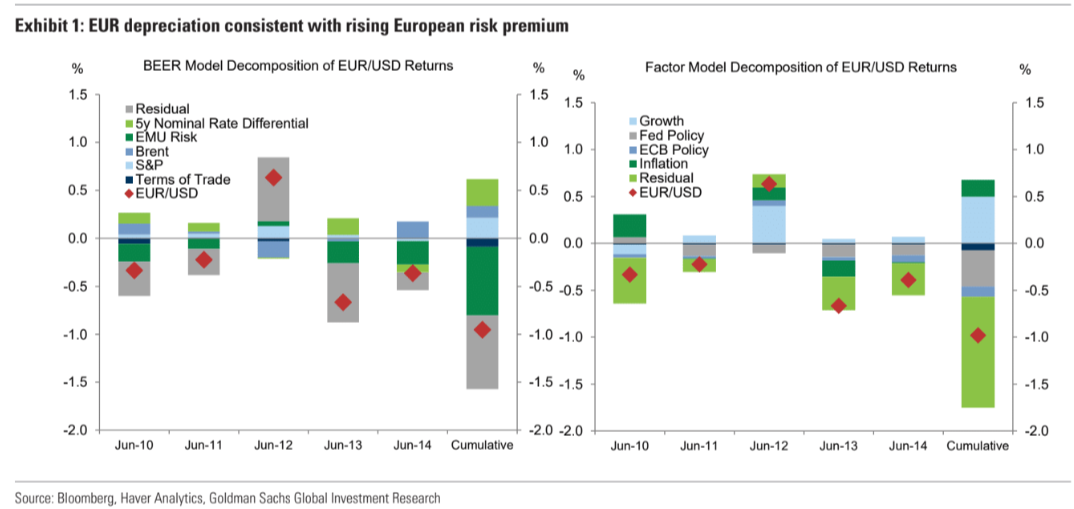

EUR: Election injection, becoming a collection.Moves across European FX markets have been consistent with the sudden injection of fresh political risk premia, reminiscent of some of the risk reverberations of the last decade.

With this in mind, we revisit some of our rules of thumb to explore how currencies could respond to the parameters our economists and rates strategists have laid out.

The Euro tends to weaken by 4-5% on average when peripheral sovereign spreads widen by 100bp.

However, this response is uneven.

The impact on the currency is largest when political risks are top of mind, there are signs of spread contagion, the shock emanates from the “core” of the Euro area, and leads the market to price US-EA divergence.

When this occurs, the Euro tends to fall against CHF even more than it falls against the Dollar—CHF is a European safe haven—but strengthen against the CE3 and Scandis (SEK is most sensitive in times of stress).

Each of these elements was apparent to some degree this week (Exhibit 1).

In the current context, the Euro could also weaken further if political uncertainty erodes some of the progress in soft data and thereby invites further policy divergence, since the recovering Euro area activity momentum has been an important impediment to pricing EUR downside (though next week’s flash PMIs will only partially capture the post-election announcement mood).

We also see room for some “intangibles” where French election uncertainty reinforces the “low flow zone” that we expect to characterize the months between now and the US election.

Taken together, we maintain our EUR/USDforecast of 1.05 in 3 and 6 months, while it is also possible that the path to more benign outcomes would include more “disruption” where the market becomes the forcing mechanism.

Given EUR is the major input into the DXY basket, AUD tracks EUR versus the US dollar more or less automatically. There are divergences in degree but not trend.

In addition, when EUR spreads affect its banking system that tends to pressure Australian banks.