During Covid-19, Queensland’s status as Australia’s population magnet strengthened, with annual net interstate migration reaching its highest level in almost 20 years.

More than 30,939 Aussies made the move to the Sunshine State in the year to June 2021, and the growing pains are expected to increase in the lead-up to the 2032 Olympics.

While the general view is that population growth can expand employment and the economy, an underlying issue remains - enough supply to keep up with demand.

PRD Chief Economist Asti Mardiasmo said the pandemic population shuffle took the state by surprise, leaving supply and demand deeply out of proportion.

“This has resulted in a housing crisis,” Dr Mardiasmo said.

“The Greater Brisbane area is now desperately trying to play catch up, as demand is predicted to outstrip supply for the next 10 years, which will put a constant pressure on house prices.”

The reduced stock is also pushing up rent prices.

PropTrack’s Market Insight report revealed Brisbane rents increased 1.9% over the June quarter and 14.9% year-on-year.

The median dwelling rent price currently sits at $540.

The suburbs set to receive confirmed housing stock

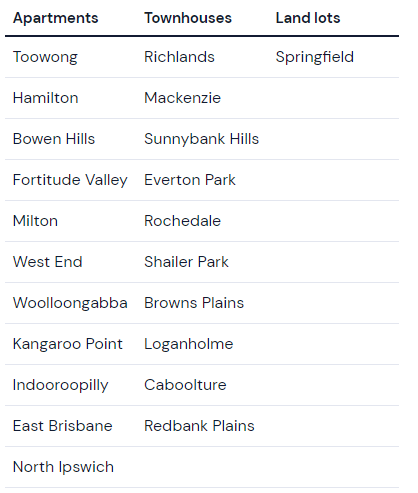

New research by PRD has identified the key suburbs in Greater Brisbane with confirmed housing supply.

In total, the Greater Brisbane region has 749 houses, 2,153 townhouses, 18,259 units, and 10,863 land lots scheduled to commence construction this year.

But according to Dr Mardiasmo, not all projected supply may be built.

“Construction costs and potential challenges such as shortages in material and labour, finance requirements, or local government red tape are all factors that could stop a build or even prevent it from starting," she said.

“The commencement rate [projects not being deferred or abandoned] for dwellings and units is quite low in Greater Brisbane - 56.6% and 59.5% respectively.

“Brisbane has the greatest number of townhouses, dwellings, and units planned, but not always the highest commencement rate.”

The below table displays the suburbs with confirmed supply projects, according to PRD.

Dr Mardiasmo said with the Greater Brisbane region population expected to reach 3.1 million by 2033, the amount of scheduled supply will not be enough to keep up with demand.

“The next step involves developing innovative strategies to introduce more housing options to the market,” she said.

“This may involve embracing a variety of property types, some of which might be unfamiliar to us at present.”

"Lots of new housing stock in the pipeline for Brisbane, but demand still oustripping supply" was originally published on Savings.com.au and was republished with permission.