Geert Rouwenhorst, the Yale professor who shares responsibility for the idea that commodities are an asset class, got plenty of laughs when he told a trade conference 12 years ago that most people didn’t know the correlation between pork belly futures and natural gas till they began barbecuing. Many traders would admit to Rouwenhorst later that the bets they placed on hogs were more directional than based on an acute understanding of fundamentals. Even today that doesn't seem to have changed.

Lean hogs futures, the most common source for pork meat in the US, have settled lower in 12 of the past 15 sessions on the Chicago Mercantile Exchange.

Down 25 percent since the beginning of the year, lean hogs are the third worst performer among 60 global commodity and currency futures tracked by Barchart for 2018. The collapse, which occurred over the past two months from the combined weight of Mexican and Chinese levies on US pork products, is in response to the Trump Administration’s trade tariffs on the two countries.

Analysts, however, say the selling has been overdone, setting the market up for what could be an intense comeback once the United States seals a North American Free Trade Free Agreement (NAFTA) with Mexico and also resolves outstanding tariff issues with China to avoid a full-blown trade war.

Whopping Tariffs Sink Export Demand

Since early June, Mexico, the largest buyer of US pork, has imposed levies of up to 20 percent. China, the number 2 importer of US hog products, began charging an additional 25 percent tariff in July that, when added to previous taxes, has brought the total amount of duties applied to a whopping 70 percent.

“With NAFTA trade talk optimism rising for a deal later this month, the hog market is in a very strong smart money buy signal and a significant price spike potential exists,” Shawn Hackett of Hackett Financial Advisors in Boca Raton, Florida, wrote to the firm’s clients this week.

“The first thing that’s going to happen is the Mexicans are going to sign a deal and we’re going to get a big jump in US hogs demand and a big price pop,” Hackett told Investing.com on Wednesday. “The China trade war, of course, is also going to be resolved at some point and that’s going to be your next pop. At the end of the day, hogs at current prices are just not a place to be bearish.”

At Wednesday’s bottom of 51.25 per pound, CME’s October futures hit its lowest for a front-month in US hogs since December 2016. Barring an immediate rebound, daily technicals on Investing.com call for a “Strong Sell”, with Fibonacci patterns indicating strong Level 3 support at 50.67 cents – suggesting the possibility of another half-cent loss drop and new 20-month low for the contract between now and the next session.

Huge Rally Potential In Oversold Futures

John Payne, a hogs specialist at Daniels Trading in Chicago and publisher of the Swine Times market newsletter, said even if a buyback did not occur before the expiry of the October contract, futures for 2019 onward had huge potential for gains from oversold conditions. “Those pushing hog prices down now are directional funds focused on the Mexican and Chinese tariffs,” said Payne.

“But from a commodity perspective, you have to ask what happens to behavior changes caused by tariffs, when the tariffs actually stop? In soybeans' case, it could mean that all of a sudden, China will back in the market for US soybeans, while here in the US, we’d have only planted 80 million acres for the current harvest,” Payne added. “With hogs, we could see a violent knee-jerk reaction the other way as, all of a sudden, the market’s going to feel underprovided.”

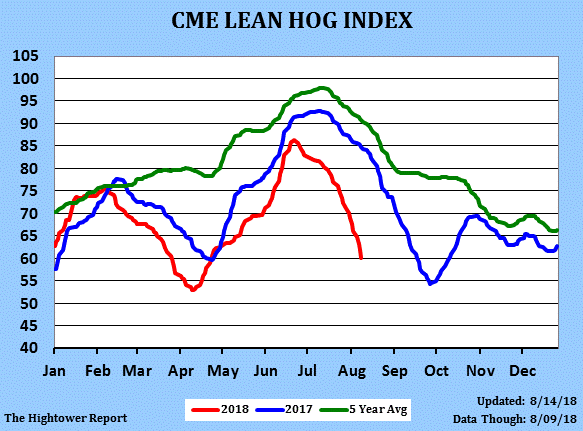

The CME lean hog index shows October futures way below the five-year average.

US Demand Remains Strong; Record High Output

While US hog exports to Mexico and China have been battered by tariffs, data shows domestic demand for pork products is as strong as ever in the United States, as weakness in CME futures filter through to physical meat prices. “US domestic pork prices continue to decline,” ADM Investor Services said, reporting Tuesday’s rate for USDA pork cutout at $69.07 per hundredweights compared with $71.32 the previous week.

Weekly US slaughter numbers for hogs have fallen only once since late May and were up 2 percent above year-ago levels last week. Production rates, measured by kills, remain at record levels in the US, and cumulative 2018 production is up three percent year-over-year.

Payne said the physical hog market was unlikely to rebound till prices for pork bellies, once traded as futures in the Chicago pit until they were discontinued eight years ago, bottomed out. “Seasonally, the bottoming in pork belly happens after October and will likely push the CME lean hogs index this time to the low 50s from the current 60s.”

All this makes hogs a rather different trade compared to most commodities, Payne says. “You can shut copper production down pretty easily by shutting mines. Crude oil too you can stop pumping. With hogs, you have a herd that’s alive and you need to keep killing them as they have just a six-month cycle before they are ready for the butcher, compared with cattle, which have a three-year cycle.”