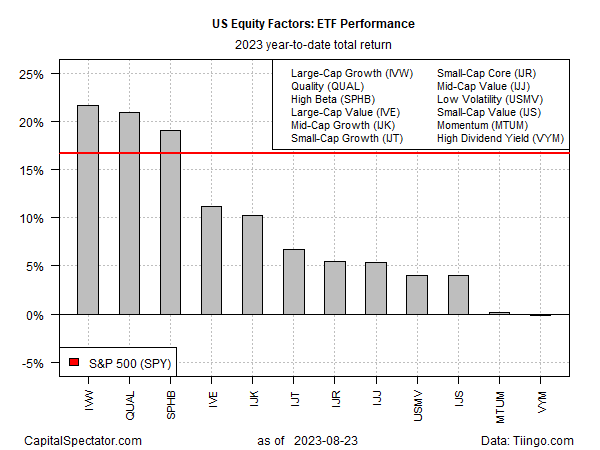

Betting against large-cap stocks and its growth component remains a tough sell so far this year, based on a set of ETF equity risk factor proxies through Wednesday’s close (Aug. 23).

Although most slices of the US equity market’s risk factors are posting gains, the biggest companies that are considered growth stocks are doing the heavy lifting.

The iShares S&P 500 Growth ETF (NYSE:IVW) is the top-performing equity risk fund year to date, posting a 21.7% gain. That’s well ahead of the broad market’s 2023 rise, based on SPDR S&P 500 (NYSE:SPY), which is up 16.7%.

A close second-place performer this year: iShares MSCI USA Quality Factor ETF (NYSE:QUAL), which is up 20.9%. QUAL targets the so-called quality factor with a large-cap focus.

Most equity risk factors are still trailing the broad equity market (SPY) this year by wide margins. The weakest performers: are iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) and Vanguard High Dividend Yield Index Fund ETF Shares (NYSE:VYM), which are essentially flat year to date.

Small-cap and value are doing better, but the much-anticipated recovery in these factors continues to stumble, at least in relative terms so far in 2023, vs. large cap and growth.

A key driver for the leadership in large cap and growth this year: strong gains in the tech sector, which represents the largest sector component for iShares S&P 500 Growth ETF (IVW) with a 36% weight, according to Morningstar.com.

IVW’s third-biggest stock holding is Nvidia (NASDAQ:NVDA), which reported surging earnings yesterday, fueled by rising AI-related demand for the company’s computer chips.

“A new computing era has begun,” writes Nvidia CEO Jensen Huang in a statement. “Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

Some warn that the AI-powered rally in tech is hype, but for the moment, the market disagrees. In any case, as long as the tech/AI drivers stay bullish, the large-cap and growth factors look set to remain the equity market leaders.