NZD/USD continues to have a quiet week, as the pair trades at 0.6750 in Wednesday’s North American session. On the release front, New Zealand Trade Surplus surged to NZ$292 million, much higher than expected. US releases were positive, as Goods Trade Balance and the House Price Index both beat their estimates. On Thursday, the US will release unemployment claims and durable goods reports.

New Zealand’s trade surplus was much stronger than expected, posting an excellent reading of NZ$292 million in April. The markets had anticipated a small surplus of NZ$25 million. A strong increase in fruit shipments was a primary factor in the excellent reading. The New Zealand dollar shrugged off the strong reading. New Zealand’s annual trade deficit was NZ$3.66 billion, less than the estimate of NZ$3.94 billion, but much larger than the deficit of NZ$2.66 billion a year ago in the same period.

US housing reports continue to show impressive numbers. New Home Sales surged in April, with an excellent reading of 619 thousand, compared to 511 thousand a month earlier. This figure crushed the estimate of 521 thousand and marked an 8-year high. Last week, Existing Home Sales posted a second straight gain, improving to 5.45 million. This was above the forecast of 5.40 million. The news was not as good from the manufacturing front, as the Richmond Manufacturing Index came in at -1 point, surprising the markets which had expected a strong gain of 9 points. This weak reading follows the Philly Fed Manufacturing Index, which continues to struggle. The indicator posted a decline of 1.8 points, well short of the estimate of a 3.2 point gain. We’ll get another look at key manufacturing data on Thursday, with the release of durable goods reports.

Will the Federal Reserve press the rate trigger in June? Last week’s Federal Reserve’s minutes were more hawkish than expected, and this resulted in strong volatility in the currency markets last week. It has also renewed market speculation about a June rate hike. The Fed is unlikely to make a move if key indicators don’t show improvement, particularly inflation indicators. On Monday, FOMC members James Bullard and John Williams voiced support for further rate hikes. Bullard said that the Fed planned to resume rate hikes if the US economy strengthened, while Williams reiterated that he expected the Fed to raise rates two or three times in 2016. However, there appears to be a gap between what Fed members are saying and market sentiment, as many analysts are projecting only one rate hike this year. The guessing game as to what the Fed has in mind is likely to continue into June, but it’s safe to say that another rate move will be data-dependent, so stronger US numbers will increase the likelihood of a quarter-point hike at the June policy meeting.

NZD/USD Fundamentals

Tuesday (May 24)

- 18:45 New Zealand Trade Balance. Estimate 40M. Actual 292M

Wednesday (May 25)

- 8:30 US Goods Trade Balance. Estimate -60.1B. Actual -57.5B

- 9:00 US HPI. Estimate 0.4%. Actual 0.7%

- 9:45 US Flash Services PMI. Estimate 53.1

- 10:30 US Crude Oil Inventories. Estimate -1.7M

- 10:00 New Zealand Annual Budget Release

Thursday (May 26)

- 8:30 US Core Durable Goods Orders. Estimate 0.3%

- 8:30 US Unemployment Claims. Estimate 275K

*Key releases are highlighted in bold

*All release times are EDT

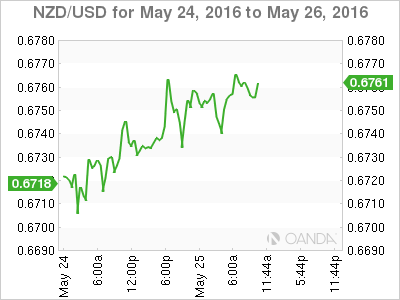

NZD/USD for Wednesday, May 25, 2016

NZD/USD May 25 at 9:45 EDT

Open: 0.6747 Low: 0.6769 High: 0.6733 Close: 0.6755

NZD/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6542 | 0.6621 | 0.6738 | 0.6897 | 0.7011 | 0.7100 |

- NZD/USD has been marked by choppy trading in the Wednesday session

- There is strong resistance at 0.6897

- 0.6739 was tested in support earlier and could break in the North American session

Further levels in both directions:

- Below: 0.6738, 0.6621 and 0.6542

- Above: 0.6897, 0.7011, 0.7100 and 0.7231

- Current Range: 0.6738 to 0.6897

OANDA’s Open Positions Ratio

The NZD/USD ratio is showing slight movement towards short positions. Long positions have a slight majority (52%), indicative of slight trader bias towards NZD/USD breaking out and moving upwards.