Uncertainty is as thick as ever for diving into what awaits in the year ahead, but there’s still a growing consensus building that the Federal Reserve will soon start cutting interest rates.

Although some analysts caution that the odds for dovish policy changes aren’t as high as some forecasts suggest, the crowd is nonetheless convinced that the Fed funds target rate is on track to ease in the months ahead.

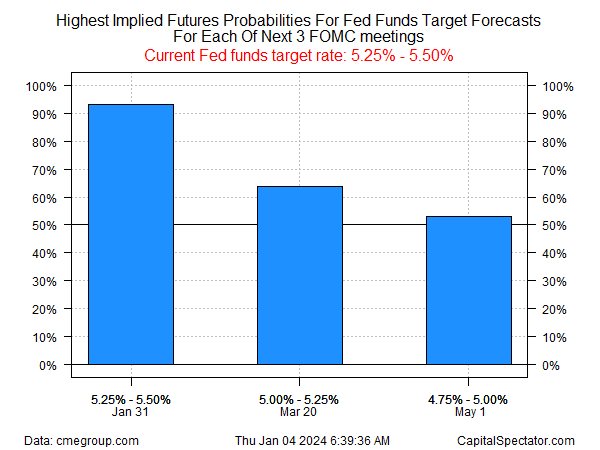

Fed funds futures are currently pricing in high odds for no change in rates for this month’s FOMC meeting (Jan. 31), but a rate cut is seen as moderately likely in March and again in May.

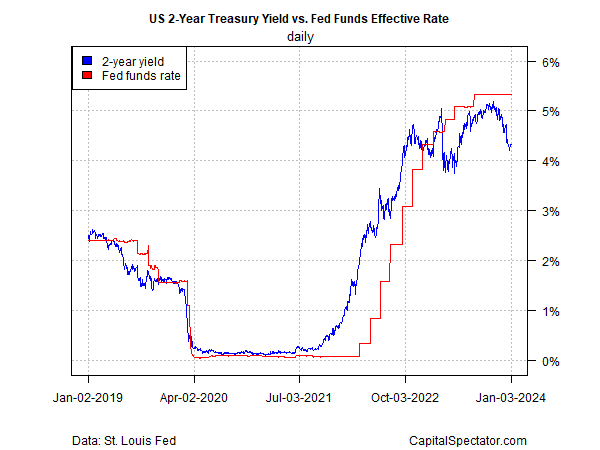

Support for anticipating cuts is also found in the policy-sensitive US 2-year Treasury yield, which remains far below the Fed’s current 5.25%-to-5.50% target range.

The spread is a widely followed market proxy for anticipating that policy easing is near.

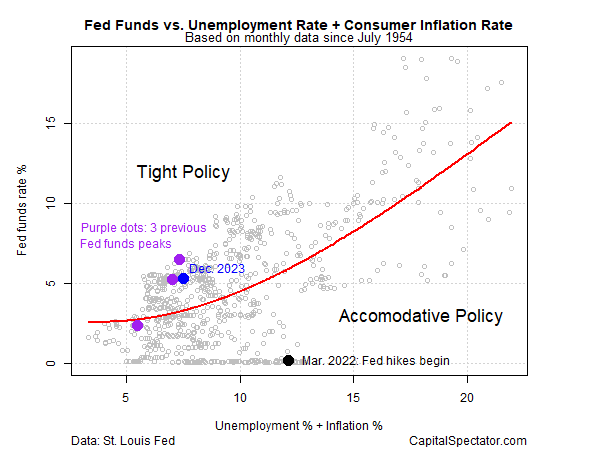

A model that estimates policy conditions based on unemployment and inflation suggests that the Fed has room to cut and still leave a degree of inflation-fighting conditions in place.

As shown in the chart below, the current policy still appears to be moderately tight.

Yesterday’s release of Fed minutes for December provides additional, albeit cautious support for expecting rate cuts.

“In discussing the policy outlook, participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves,” the minutes said.

But while there’s growing confidence that the central bank’s hikes are history, the timing of cuts remains debatable.

As The Wall Street Journal notes:

“While nearly all officials anticipated policy rates would eventually be lowered before the end of this year, the written account of the Dec. 12-13 meeting, released Wednesday, underscored heightened uncertainty over how to navigate the next interval of monetary policy after the most rapid increase in interest rates in four decades.”

Investors will be watching two key economic reports in the days ahead for fresh clues for evaluating the policy outlook, starting with this Friday’s payrolls report for December (Jan. 5).

Economists are looking for a softer rise in hiring that, if correct, will align with the “soft landing” outlook that’s favored by the market.

Next week’s consumer inflation report for December (Jan. 11) may cast a longer shadow over expectations.

A key question that will be in focus: Will core CPI’s year-over-year change, which has stalled at 4%, resume its decline and move closer to the Fed’s 2% inflation target?