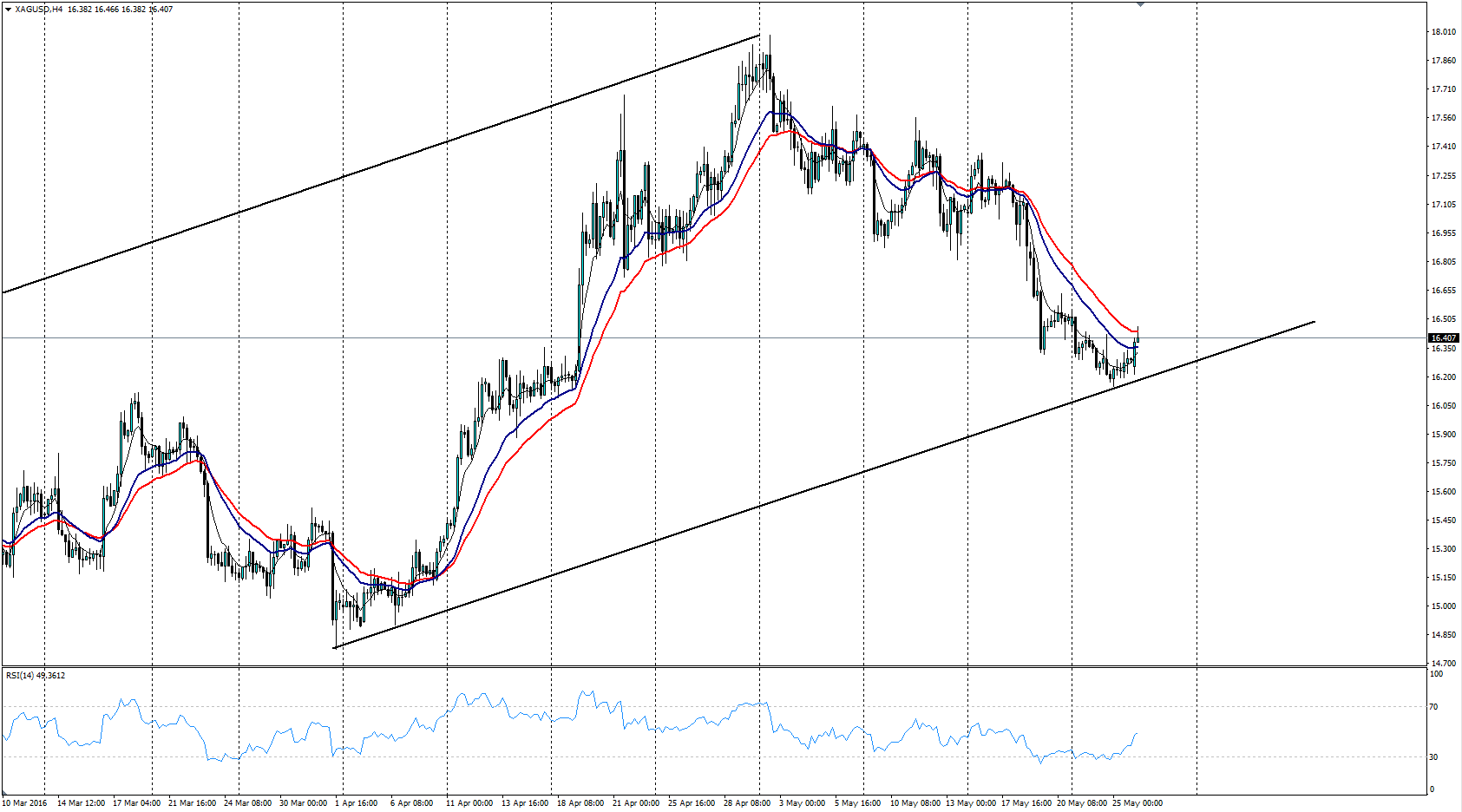

Silver has fallen relatively strongly over the past few weeks as sentiment in the precious metal has continued to swing in line with the Fed’s rate hike rhetoric. However, despite the recent decline, Silver looks to have found a bottom around the $16.13 mark that could just see it rallying in the coming session.

The precious metal currently trades around the $16.41 mark which is also a key Fibonacci retracement level. It would appear that the bearish collapse to this level has stalled at a key convergence level that also includes some relatively strong support. Subsequently, this zone likely provides an excellent base from with a retracement can occur.

Taking a look at the RSI Oscillator further supports the case for a further rally as the indicator was recently strongly oversold and is now trending sharply higher within neutral territory. This would tend to support the contention that a bullish move would have plenty of room to move on the upside.However, the 12 and 30 EMA’s are currently just above price action and the metal will need to convincingly break through those dynamic resistance points to cement a bullish move.

In the near term, silver will need to surmount resistance at $16.63 to confirm a move higher. Any subsequent breach of this level could see the commodity moving sharply to challenge the upside reversal point of $17.30. Subsequently, watch the metal closely for a break of the moving average points as well as resistance.

Either way, a bounce from the 12 and 30 EMA’s is likely to provide plenty in the way of a short term bullish trend to trade into. However, keep a close watch on the Fed’s FOMC rhetoric in the lead-up to next month’s meeting as the expectation setting is likely to be severe.